- Bitcoin, at press time, was testing its higher channel boundary as inflation cooled down and Trump paused tariff hikes

- Whale exercise and rising giant transactions strengthened a possible breakout above key resistance

Bitcoin [BTC] is regaining investor consideration once more after Trump’s tariff pause and cooling inflation eased macroeconomic stress, probably creating the right set-up for a bullish breakout. These two developments have sparked renewed optimism throughout world markets, lowering the necessity for aggressive financial tightening and inspiring a shift in the direction of threat property.

Due to this fact, Bitcoin—usually favored as each a hedge and a development asset—stands to profit from the bettering backdrop. As institutional urge for food regularly returns, the worth construction and on-chain habits are starting to mirror this renewed momentum.

Is Bitcoin prepared to flee the descending channel?

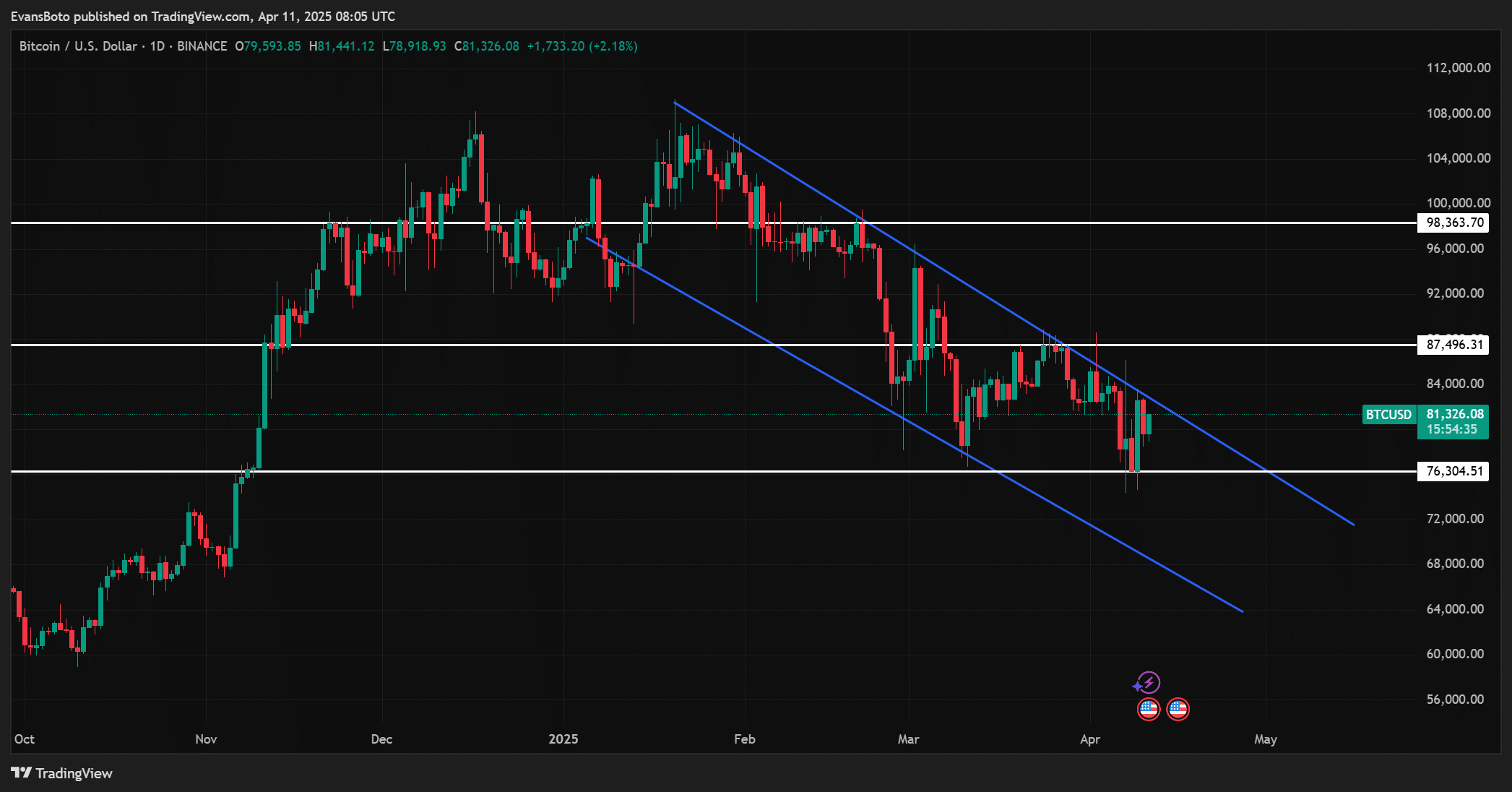

On the time of writing, Bitcoin was buying and selling at $81,614.11, down 0.15% within the final 24 hours. Nonetheless, this slight dip masks an necessary growth on the chart. BTC appeared to be testing the higher boundary of a descending channel after bouncing off the $76,304 help.

A day by day shut above $87,496 might affirm a breakout, probably pushing the worth in the direction of the $98,363 resistance.

Due to this fact, the technical setup may lean bullish, however provided that consumers preserve stress. If BTC fails to clear the channel, the chance of a pullback in the direction of its decrease help ranges will increase. Momentum has been constructing, however affirmation stays key.

What’s the stablecoin provide ratio signaling?

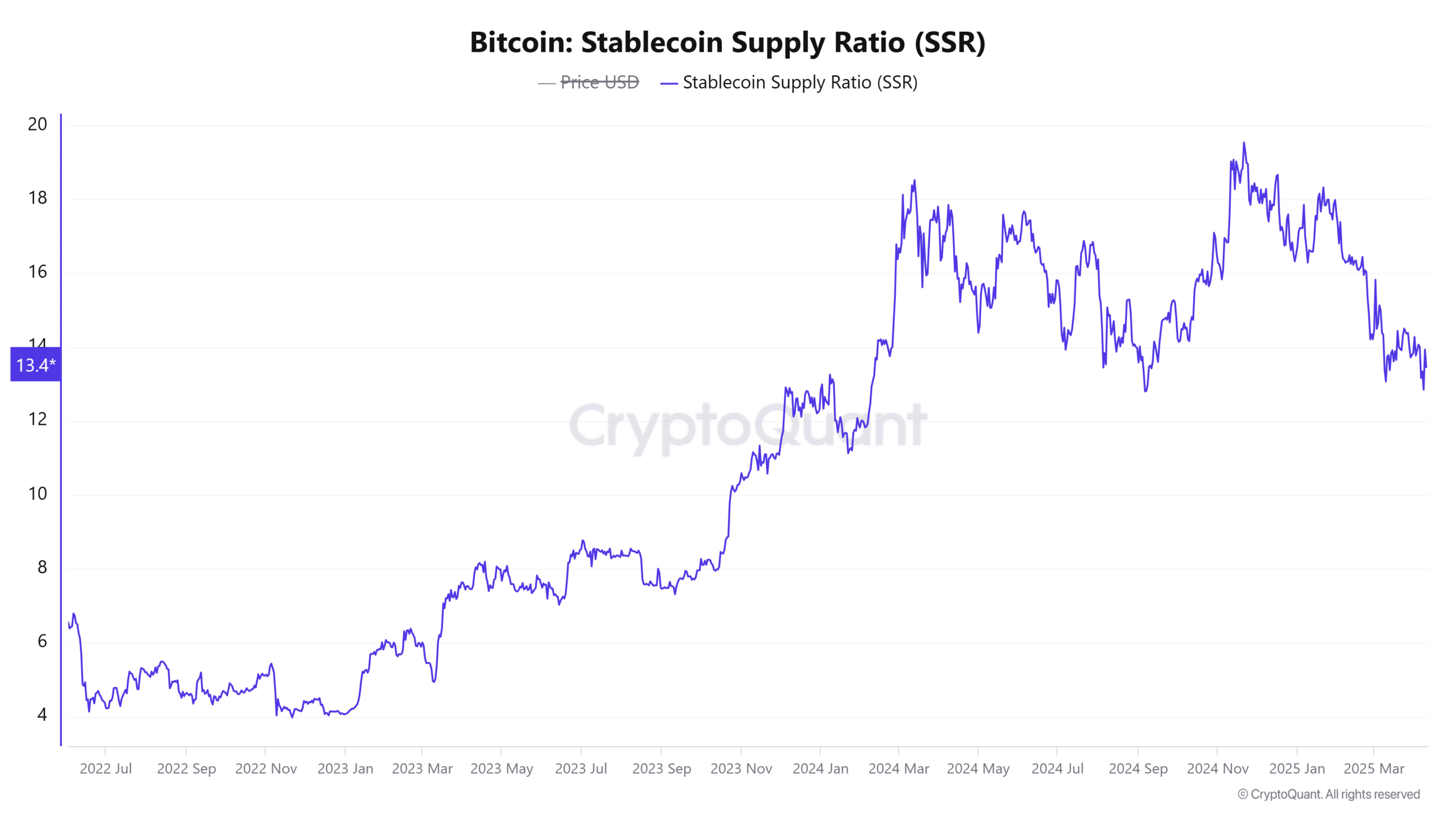

The Stablecoin Provide Ratio (SSR) rose by 0.97% to 13.40, suggesting barely lowered shopping for energy from stablecoins relative to Bitcoin’s market cap. Nonetheless, this hike has been reasonable and doesn’t point out vital promote stress.

As a substitute, it underlined that capital could also be ready for a directional sign.

Moreover, a secure SSR throughout a possible breakout state of affairs helps a more healthy rally. Due to this fact, this metric solely appeared to strengthen the concept traders could also be poised to deploy funds. Particularly as soon as the technical breakout is confirmed.

What are Bitcoin whales and establishments signaling?

Massive BTC transactions had been up 1.28%, suggesting accumulation by whales or establishments. These entities usually act forward of main worth shifts, and the hike in exercise usually precedes rallies.

Due to this fact, this metric appeared to be consistent with the bullish stress forming on Bitcoin’s charts.

Furthermore, good cash tends to re-enter throughout consolidation phases. Such an uptick in high-value transactions additional validated the potential of a near-term breakout.

That’s not all although as Lookonchain reported {that a} whale just lately deposited 1,500 BTC ($120.29M) to Binance. Nonetheless, the whale nonetheless holds 1,486 BTC, signaling retained publicity. This motion displays profit-taking—not a full exit—after beforehand accumulating BTC at $80,449 and promoting some at $87,812.

Due to this fact, the whale’s habits is an indication of confidence in Bitcoin’s longer-term power, regardless of trimming holdings close to its resistance. Strategic exits are regular in sturdy setups.

Conclusion

Bitcoin may be well-positioned for a rebound. The mix of a tariff pause, cooling inflation, hike in whale exercise, and institutional positioning might have created a supportive setting for the crypto.

Whereas the breakout should nonetheless be confirmed on the chart, all indicators appeared to trace at upside potential. Due to this fact, if BTC clears its resistance, a pointy rally shall be more and more doubtless.