Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After Dogecoin quickly fell by greater than 22% yesterday amid rumors of a “Black Friday”, the worth has since been capable of get better a minimum of a few of its losses. Nonetheless, DOGE continues to be down round 11% for the reason that begin of the week. This has put the worth of Dogecoin in a difficult scenario.

Dogecoin Types Bull Div

Dogecoin breached a essential ascending help line earlier than shortly recovering, a habits that crypto analyst Kevin (@Kev_Capital_TA) describes as testing the “strains within the sand” for this ongoing bull market construction.

Associated Studying: Dogecoin Crashes 20%, But ‘Bull Line’ Signals Hope For HODLers

Kevin’s shared chart signifies that DOGE quickly dipped under a rising pink trendline that has been in place since mid-2023, but managed to shut the each day candle again above this traditionally important help across the $0.138 area—a degree that additionally coincides with the 38.2% Fibonacci retracement degree measured from the $0.049 swing low to the roughly $0.738 peak.

The analyst factors out that, regardless of the intraday break, DOGE’s restoration shaped what he calls a “clear bullish divergence” on the each day time-frame, referencing the Relative Power Index which has begun climbing whilst value made a barely decrease low. He likened this growth to an analogous divergence unfolding on Bitcoin’s chart, suggesting that Dogecoin’s momentum may be stabilizing after a sequence of drawn-out declines from the $0.48 excessive set early December final yr.

DOGE Uptrend Stays Intact

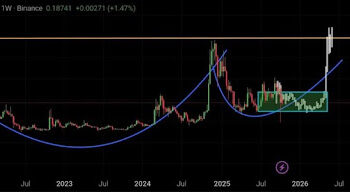

Charting Man (@ChartingGuy) weighed in individually, highlighting that Dogecoin has arrived as soon as extra at its weekly 200 EMA zone—an vital pattern marker hovering within the mid-$0.13 vary—and that its general construction nonetheless exhibits “larger highs, larger lows” when considered on a broader timescale.

His posted chart additionally contains a Fibonacci evaluation which exhibits that DOGE may handle to shut above the 0.382 Fib degree, reinforcing the notion that DOGE’s capacity to carry above $0.15 could possibly be an important gauge of bullish continuation. Failure to maintain this degree, nonetheless, would threat revisiting deeper Fibonacci help ranges, together with the 23.6% retracement close to $0.09 and even the 13.6% degree round $0.07.

Associated Studying

On the upside, merchants could look to potential resistance zones within the mid-$0.20s, which line up with the 61.8% Fibonacci retracement at roughly $0.2671, and the high-$0.30s to low-$0.40s vary tied to deeper retracement zones as much as the 78.6% mark.

The chart watcher additionally notes {that a} retest of the prior swing highs above $0.40 would align with an prolonged push towards the 88.8% Fibonacci close to $0.56, though market contributors stay cautious amid the broader volatility that is dropped at the market by US President Donald Trump’s tariff policies.

At press time, DOGE traded at $0.149.

Featured picture created with DALL.E, chart from TradingView.com