- Bitcoin stays secure as altcoin metrics present steep declines in engagement and efficiency.

- Altcoins present repeated damaging momentum alerts, aligning with historic correction durations.

Current on-chain information alerts diverging tendencies between Bitcoin [BTC] and the remainder of the altcoin sector.

Analysts at CryptoQuant confirmed Bitcoin’s ongoing consolidation above $83,000.

In the meantime, altcoins grapple with heightened volatility, sliding engagement metrics, and depressed valuations.

Momentum tendencies inform the primary a part of the story

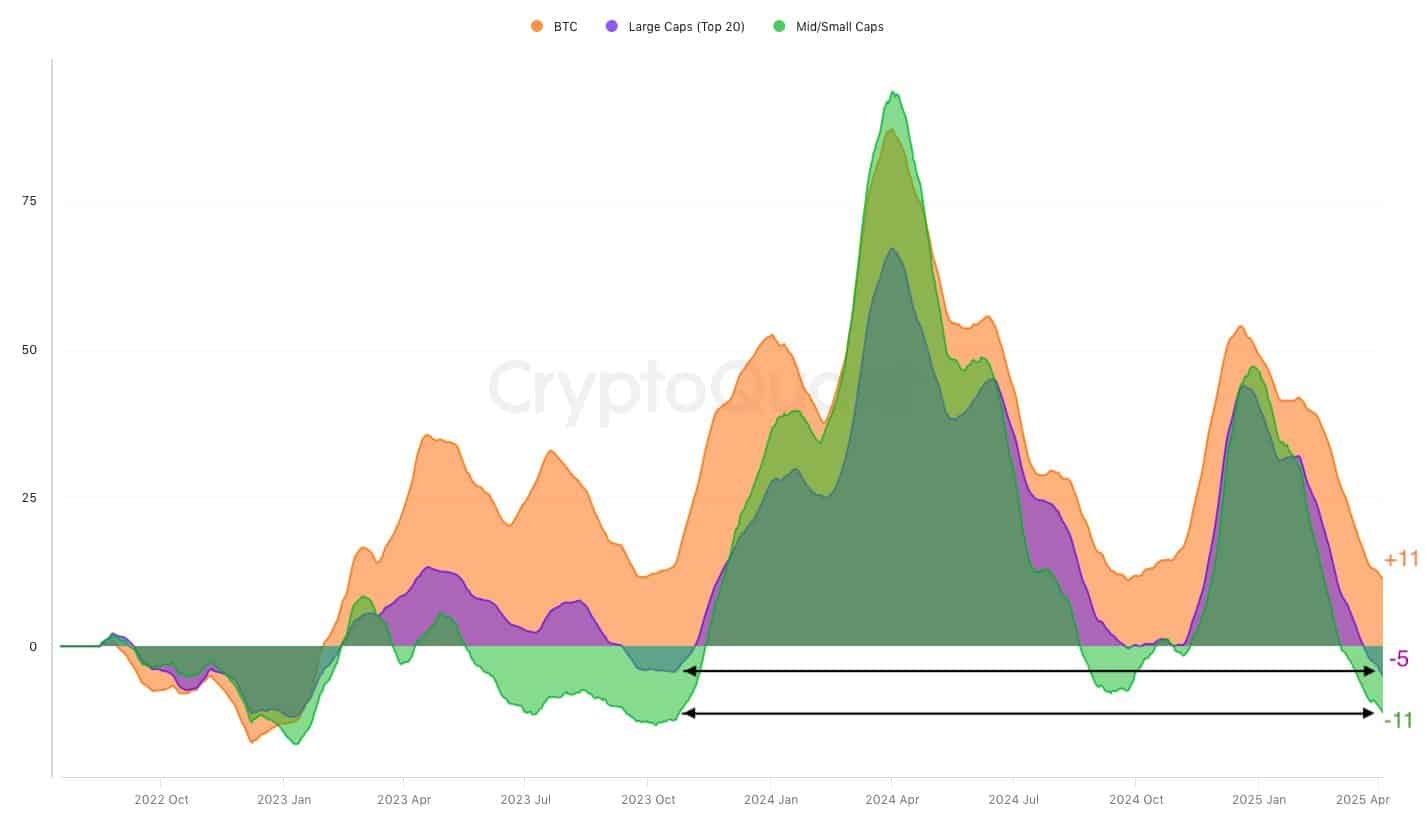

From October 2022 by April 2025, Bitcoin’s 365-Day Transferring Common (DMA) persistently surpassed 30-day averages throughout the market, underscoring its dominant momentum.

Altcoins appear to be shedding steam. As a result of the ratio between 365-day and 30-day averages for non-BTC property stood at -11%, at press time, echoing the downturn witnessed in October 2023.

The truth is, each large-cap and mid-to-small cap altcoins have sunk into repeated damaging territory—reflecting systemic underperformance vis-à-vis Bitcoin.

Transient progress spurts did emerge between April and June 2024. Having mentioned that, these intervals proved fleeting, with altcoins failing to maintain any actual momentum.

Bitcoin, nonetheless, displayed constant resilience by bullish and corrective waves alike, reinforcing its place of dominance.

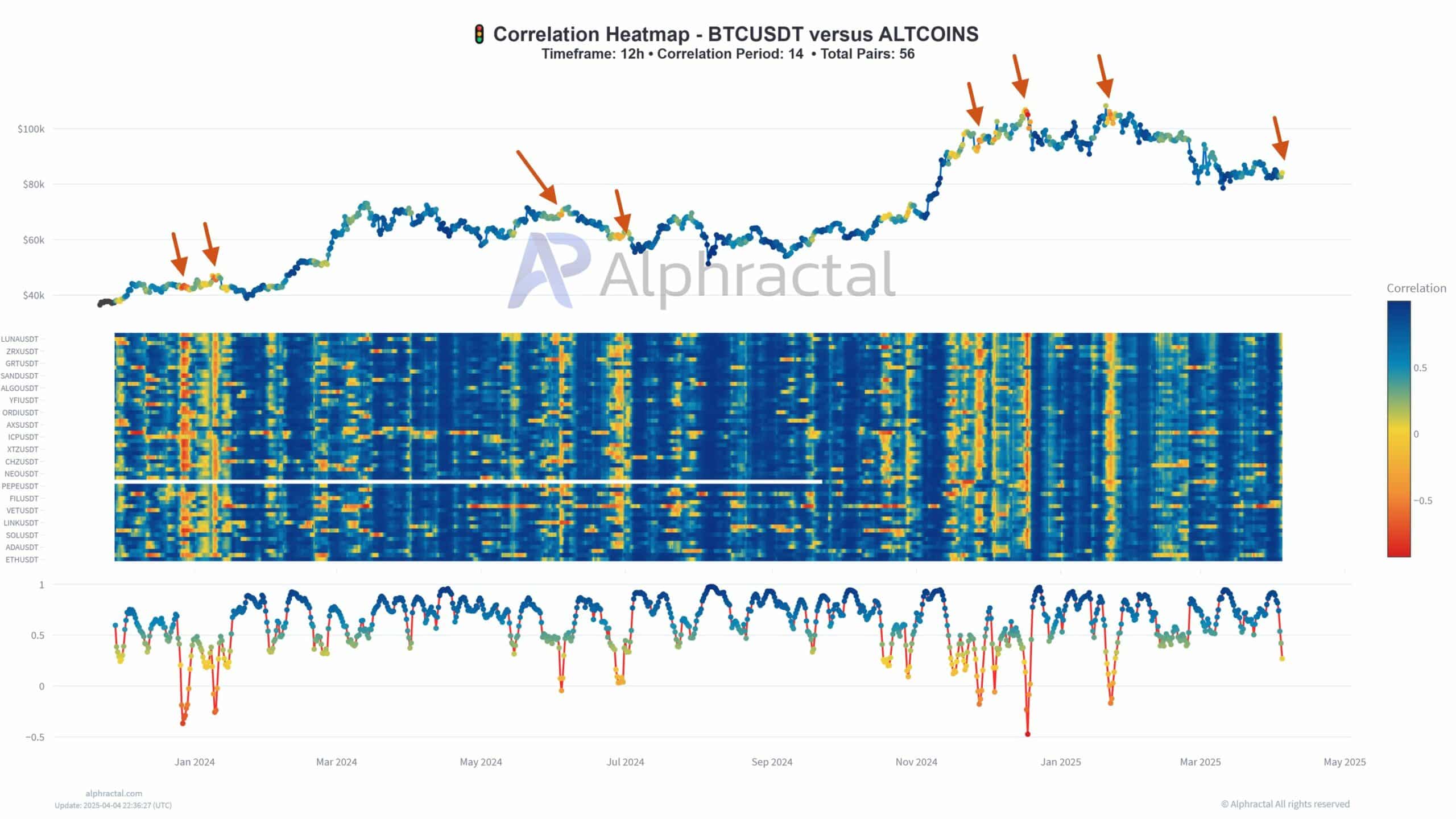

Furthermore, Alphractal’s correlation heatmap reveals this divergence.

BTC, in contrast, stayed resilient

Since early 2024, correlation scores between BTC and 56 altcoins have swung wildly.

On high of that, decrease correlation ranges—usually marked in blue—are likely to precede volatility spikes and value reversals for Bitcoin, whereas additionally aligning with native BTC tops.

On the time of writing, the correlation values oscillated between +1 and -0.5, signifying instability in how altcoins mirror Bitcoin’s value motion.

Efficiency information from main altcoins reveals a somber image.

ETHUSDT plunged -9.9% to 0.749, BNBUSDT slumped -25.1% to 0.4299, LTCUSDT almost vanished with -99.66%, buying and selling close to 0.0006, and LINKUSDT tumbled -33.97%.

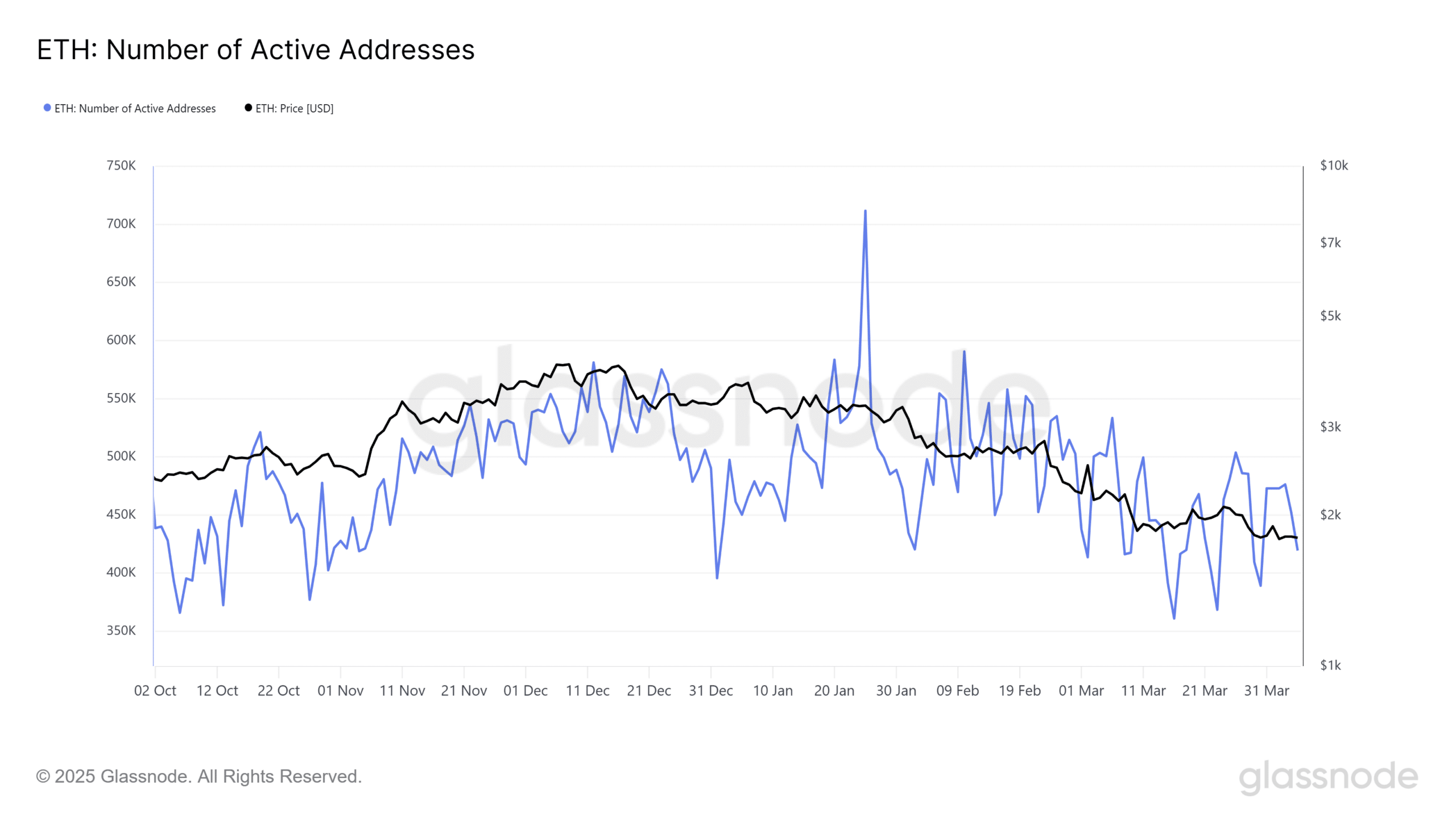

Ethereum’s [ETH] on-chain metrics affirm the frailty.

For instance, from late January to April first week, day by day lively addresses dwindled by 41%, falling from 711,578 to 419,445. Alternatively, ETH itself collapsed from $3,319.97 to $1,805.96—a forty five.6% nosedive.

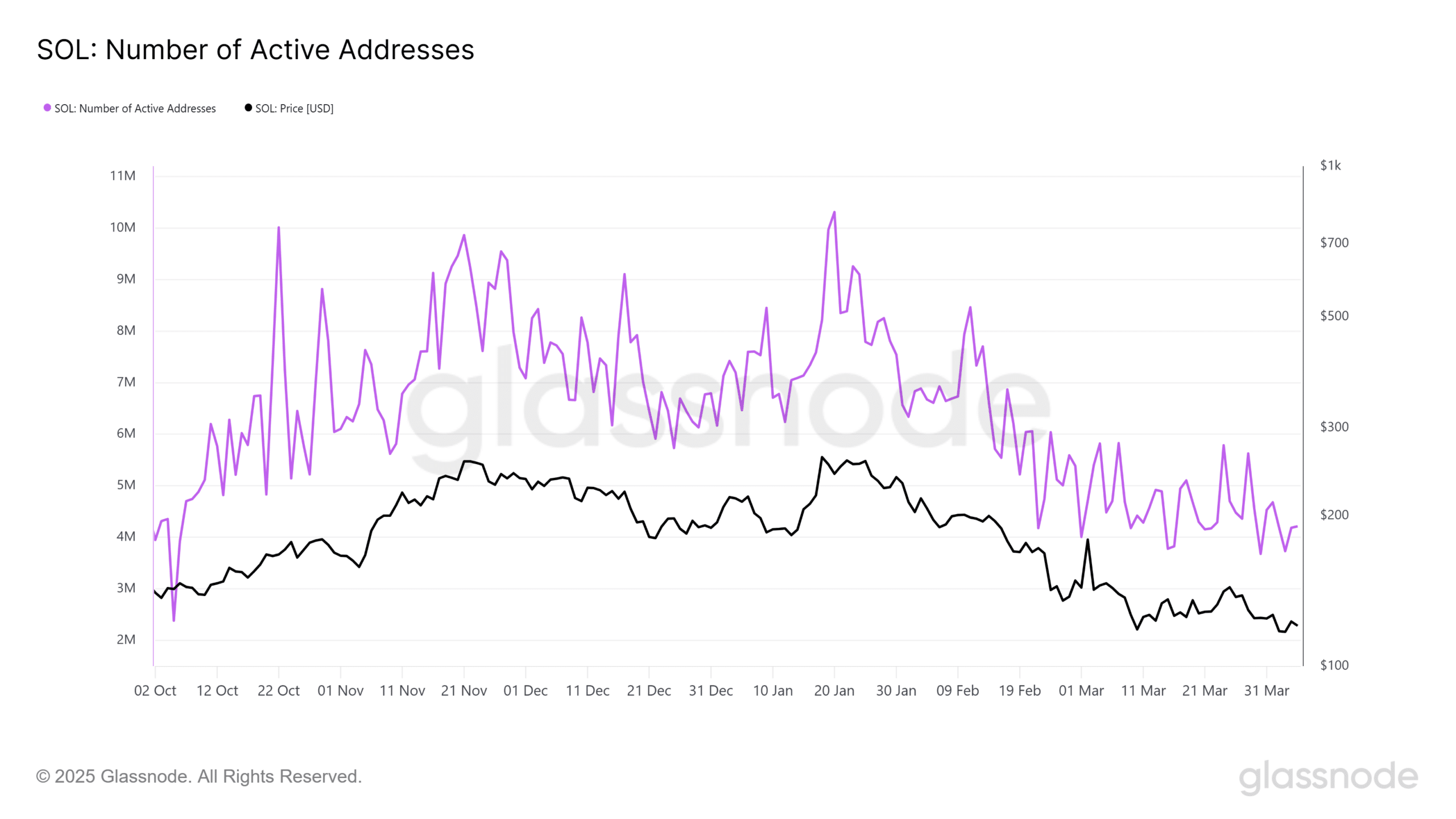

The truth is, an analogous sample is clear in Solana [SOL].

Zooming into Solana reveals a deeper correction

Solana lively addresses slid 59%—from 10.3 million on January 20 to 4.18 million on the 4th of April—whereas value receded 49%, from $242.35 to $122.77.

BTC appears to be like steadier by comparability.

Lively addresses dropped by simply 26%, from over 1.1 million in December 2024 to 809,254 by the fifth of April. On the similar time, value consolidated between $80,000 and $86,000 by March and April.

Transaction quantity on the Bitcoin community dropped by 45%, declining from 533,599 on the twenty third of March to 293,310 by the fifth of April. Regardless of this, Bitcoin’s value solely fell by 4% throughout the identical interval, signaling a part of consolidation moderately than capitulation.

This information highlights a stark distinction between Bitcoin, the crypto market’s main asset, and its alternate options.

Altcoins look like dealing with deeper engagement challenges, which prolong past easy value declines. In the meantime, Bitcoin stays essentially the most resilient possibility, although some view its diminished community exercise as an indication of reducing speculative curiosity.