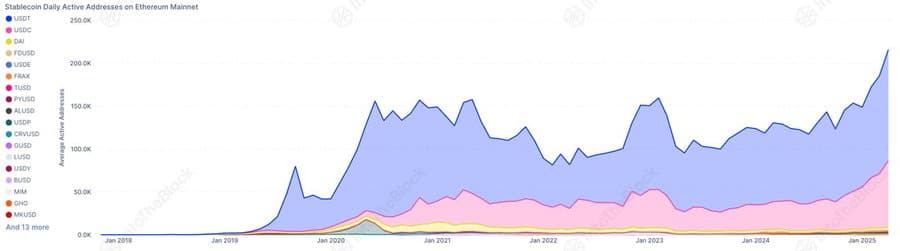

- Ethereum hits over 200,000 distinctive addresses utilizing stablecoins, marking a shift in the direction of sustained utility

- Stablecoins have gotten important to Ethereum’s ecosystem, driving liquidity, and shaping future cross-border finance

One thing’s stirring on the Ethereum mainnet – not seen throughout headlines, however within the knowledge.

Greater than 200,000 distinctive addresses on Ethereum [ETH] at the moment are holding stablecoins, and that quantity simply hit an all-time excessive. It’s a refined sign, however one that claims rather a lot about the place the good cash’s headed… and what it desires from crypto.

A report excessive in stablecoin engagement on Ethereum

USDT has emerged because the dominant stablecoin, whereas USDC and DAI proceed to make regular progress. As soon as seen primarily as buying and selling instruments, stablecoins have now change into important for transactions, worth storage, and interactions inside Ethereum’s ecosystem.

This shift displays the expansion of a utility-focused, mature digital financial system more and more anchored by secure digital currencies.

What this implies for Ethereum and past

The rise in stablecoin exercise on Ethereum indicators elevated market liquidity throughout DeFi and centralized platforms. This development helps quicker, extra environment friendly transactions and unlocks new alternatives in cross-border finance.

Nevertheless, the enlargement has drawn heightened regulatory scrutiny, specializing in reserve transparency, AML compliance, and taxation.

Whereas Ethereum might proceed to guide, competitors from blockchains like Solana and Base is intensifying.

Whether or not by way of multichain development or deeper Ethereum integration, stablecoins have change into the spine of on-chain finance, now not a secondary function.