- Bitcoin has misplaced 2.5% of its worth during the last 24 hours

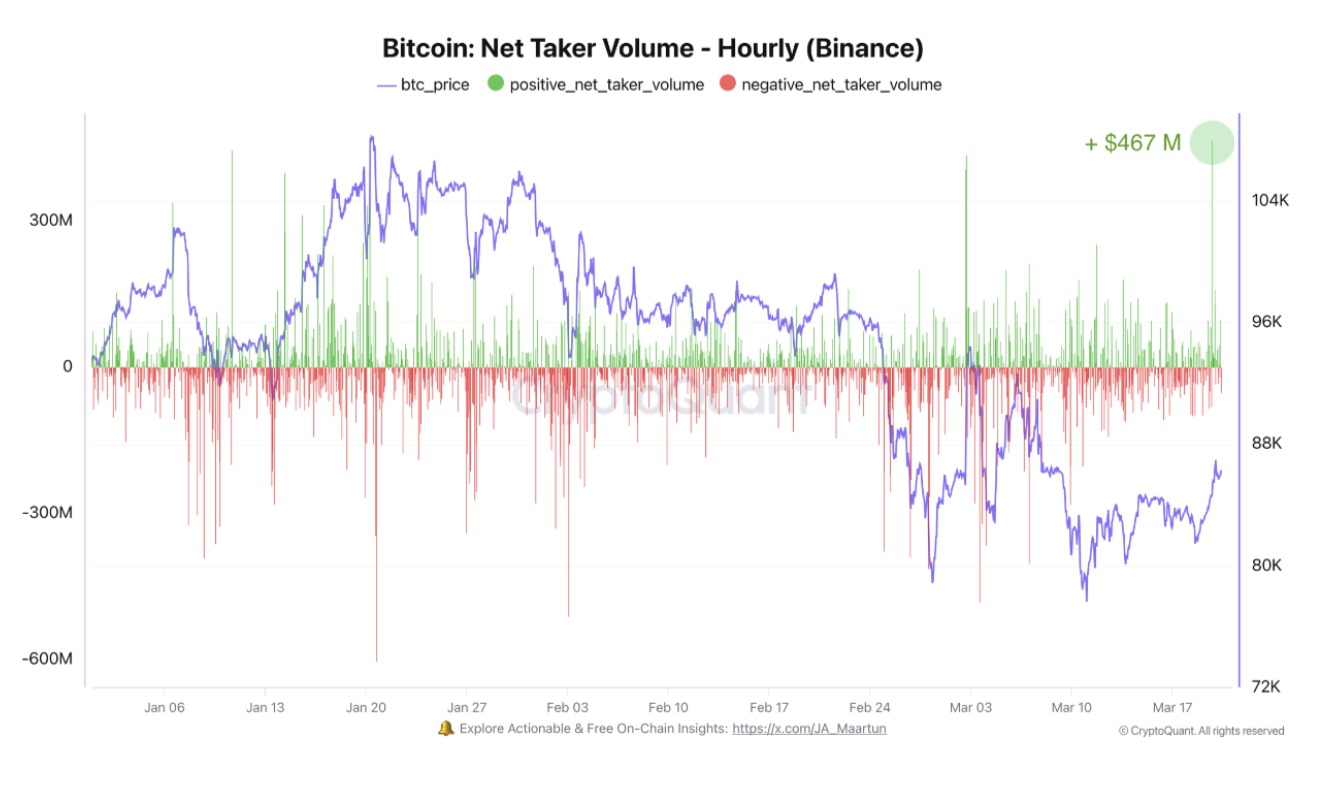

- Bitcoin’s Binance internet taker quantity hit a 2025 excessive of $467 million on the charts

Over the previous week, Bitcoin [BTC] has registered a powerful upswing, with the crypto climbing from a neighborhood low of $76,600 to a excessive of $87,470.

The most recent value pump is an indication of a possible shift in market dynamics, with patrons slowly coming again to the market. In truth, in response to CryptoQuant’s evaluation, Bitcoin is now seeing a possible hike in shopping for stress. Accordingly, the web taker quantity on Binance surged by $467 million – Its highest degree of 2025 – over the previous day.

Such a large quantity spike alludes to stronger shopping for stress than promoting. Since Binance has the best buying and selling quantity, the upswing may imply enhancing sentiment and rising confidence amongst buyers.

The uptick in confidence and shopping for stress may be additional seen in circulating provide, particularly for cash aged ≤1 week. On the time of writing, this cohort had fallen by 50% from 5.9% to 2.8%. Such a dip often means a pointy discount in all of the Bitcoin obtainable to commerce.

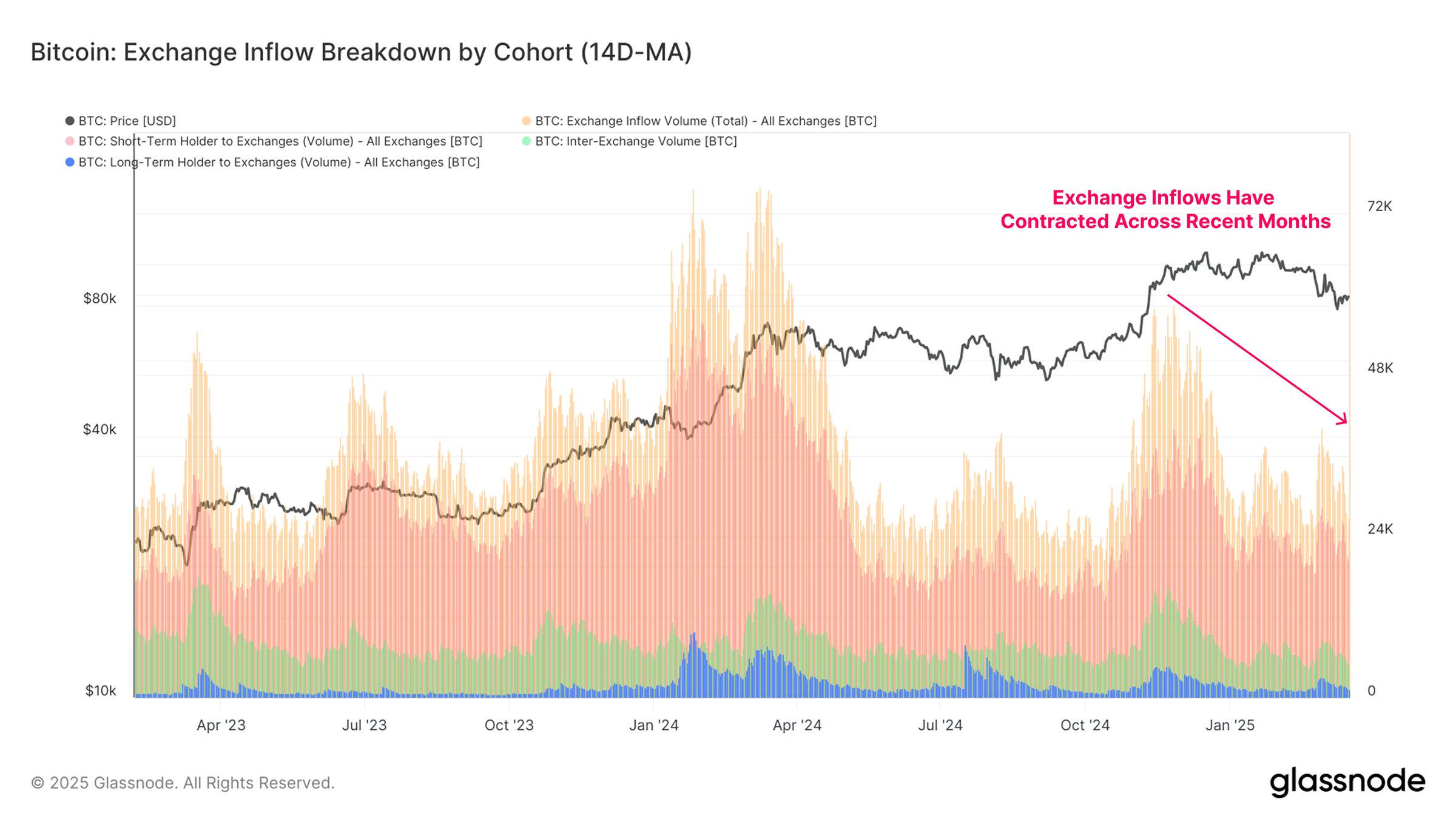

This pattern may also be validated by BTC change inflows, with the identical dropping from 58.6k to 26.9k BTC/day, in response to Glassnode.

This marked a 54% decline – In alignment with capital flows and investor sentiments. Normally, decrease inflows with increased capital flows allude to a fall in sell-side exercise.

What do Bitcoin’s charts say?

Properly, Bitcoin patrons are again available in the market. That’s not all although as BTC can be seeing a excessive accumulation price throughout market contributors.

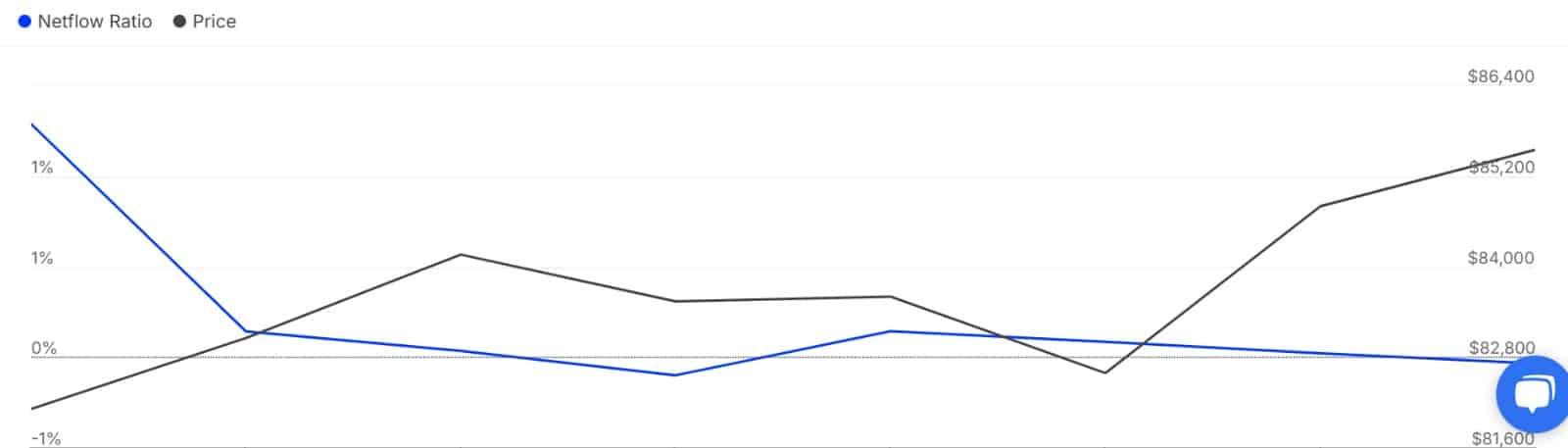

For starters, whales’ habits, we will see that whales are shopping for greater than they’re promoting. As such, Bitcoin’s Giant Holders Netflow to Trade Netflow Ratio declined from 0.17% to -0.04%.

When whale change netflows hit a unfavorable worth, it signifies that whales are withdrawing extra from exchanges than they’re depositing. Such market habits is an indication of robust bullish sentiments from giant holders.

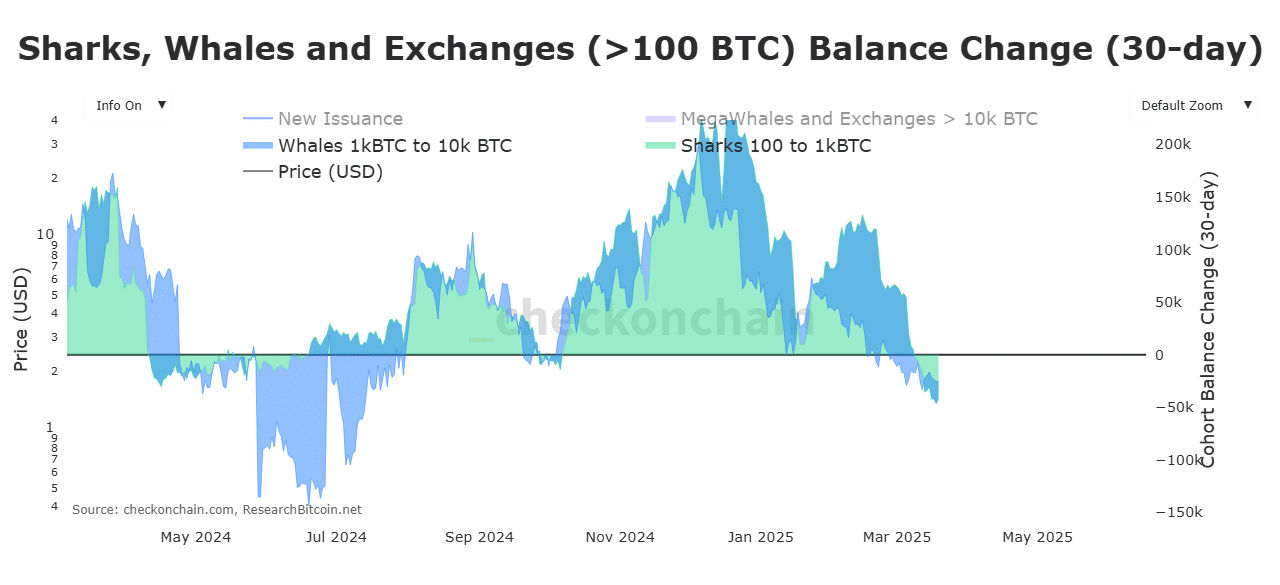

This pattern may be additional evidenced by a declining Shark, Whales, and Trade stability change over the previous 30 days.

In accordance with CheckOnChain, all through March 2025, each sharks and whales recorded a falling change stability. In truth, figures for each sharks and whales fell, alluding to extra withdrawls from exchanges and therefore, a hike in accumulation from each units of holders.

What does this imply for Bitcoin?

Traditionally, a better shopping for stress has meant robust demand for BTC, which often results in increased costs. With patrons making a comeback available in the market, we may see Bitcoin make a sustained restoration on the worth charts.

Due to this fact, if the demand seen over the previous week holds, BTC could reclaim the $86k resistance level. A sustained transfer above this degree will strengthen the crypto to reclaim the $90k-level.

Quite the opposite, if patrons who purchased BTC under $80k promote, a pullback may see Bitcoin drop to $82,000.