Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin worth might be headed for more pain, as a crypto analyst has recognized a brand new bear market indicator that implies a crash to $40,000 is imminent. The analyst has predicted when this deep worth decline is ready to happen, warning traders to stay cautious or danger promoting at a loss.

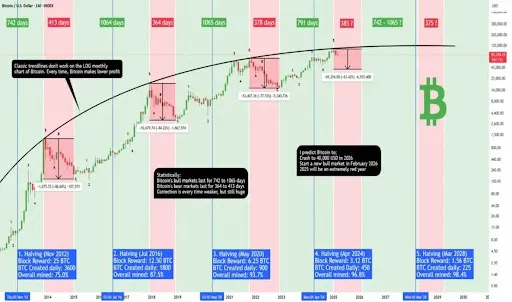

Xanrox, a crypto analyst on TradingView, shared a detailed price analysis of Bitcoin on March 17, predicting that the pioneer cryptocurrency is ready to crash to $40,000 by 2026. The analyst revealed that Bitcoin follows a predictable cycle sample tied to its halving events, which happen each 4 years. Throughout these years, the market alternates between bull markets, the place costs skyrocket, and bear markets, marked by extreme corrections.

Bear Market Indicator Predicts Subsequent Bitcoin Worth Crash

Associated Studying

In each cycle, Bitcoin’s worth crashes after a bull market, in the end experiencing a decline between 77% to 86%. Reflecting on this recurring pattern, Xanrox forecasts a serious Bitcoin price correction, albeit a weaker one than these of earlier cycles. The analyst believes that the cryptocurrency will crash 65% to $40,000, citing its considerably bigger market capitalization and rapidly growing institutional adoption.

He shared a worth chart that highlights the assorted halving cycles and the magnitude of every bull market rally and bear market crash since Bitcoin’s inception. He identified that statistically, predicting Bitcoin’s movements with a easy chart has all the time been correct, suggesting that his 65% crash prediction was inevitable.

At present, Bitcoin’s considerable market capitalization of $1.63 trillion makes it unrealistic to realize the acute development wanted to succeed in a goal of $300,000, $500,000, and even $1 million, as some moon analysts predict. Xanrox means that 2025 may be a bearish year, with the subsequent Bitcoin bull run set to start in 2026, after the bear market.

CryptoQuant Says BTC Bull Cycle Is Over

Sharing the same bearish sentiment concerning the present market, CryptoQuant’s founder and Chief Government Officer (CEO), Ki Younger Ju, has announced the unlucky finish of the Bitcoin bull cycle. Ju revealed that the market ought to anticipate 6 – 12 months of uneven worth motion, indicating the beginning of the bear market.

Associated Studying

He additionally highlights that each on-chain metric for Bitcoin is signaling a bear market, with contemporary liquidity depleting whereas new whales are selling BTC at a considerably lower cost. Furthermore, Bitcoin is buying and selling at $82,549, marking an over 20% price crash since its all-time excessive of greater than $109,000 this 12 months.

Featured picture from Unsplash, chart from Tradingview.com