- Bitcoin’s value targets $90,000 as a triangle sample signaled a possible breakout.

- Whale exercise and miner flows drive market hypothesis and affect value traits.

Bitcoin [BTC] has skilled notable value actions over the previous week, fluctuating between $80,380 and $84,000. Regardless of volatility, BTC maintained an upward development, buying and selling at $83,100, at press time.

Over the previous week, BTC gained 3.5%, although it noticed a minor dip of 0.29% within the final 24 hours. With a market cap of $1.64 trillion, Bitcoin continued to show robust market exercise because it examined key resistance ranges.

Bitcoin’s triangle sample factors to…

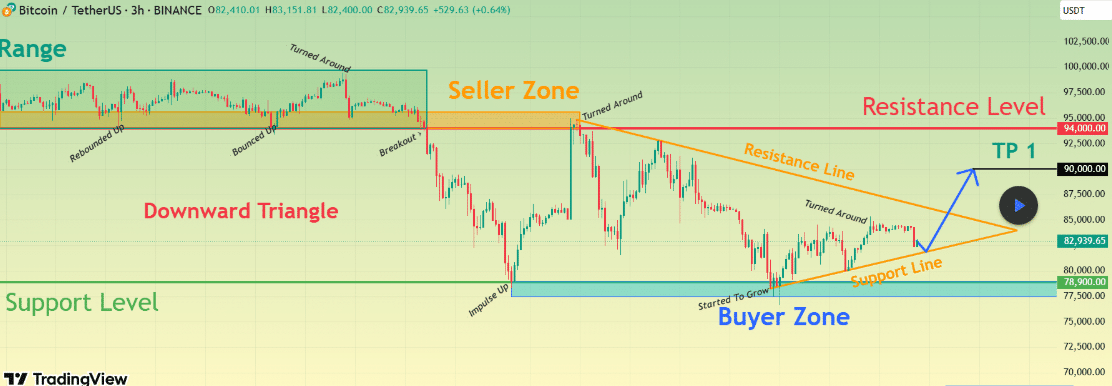

Bitcoin’s 3-hour chart reveals a downward triangle sample with assist at $82,939.65 and resistance close to $94,000.

On the time of writing, BTC was buying and selling inside a purchaser zone, the place earlier value motion confirmed upward motion, marked by “Impulse Up” and “Began to Develop” factors.

Subsequently, Bitcoin’s value is nearing a vital resistance stage. A breakout may drive BTC to a goal of $90,000, signaling sustained bullish momentum.

If this occurs, Bitcoin might obtain additional beneficial properties and probably set new all-time highs.

Affect of huge transactions and miner flows

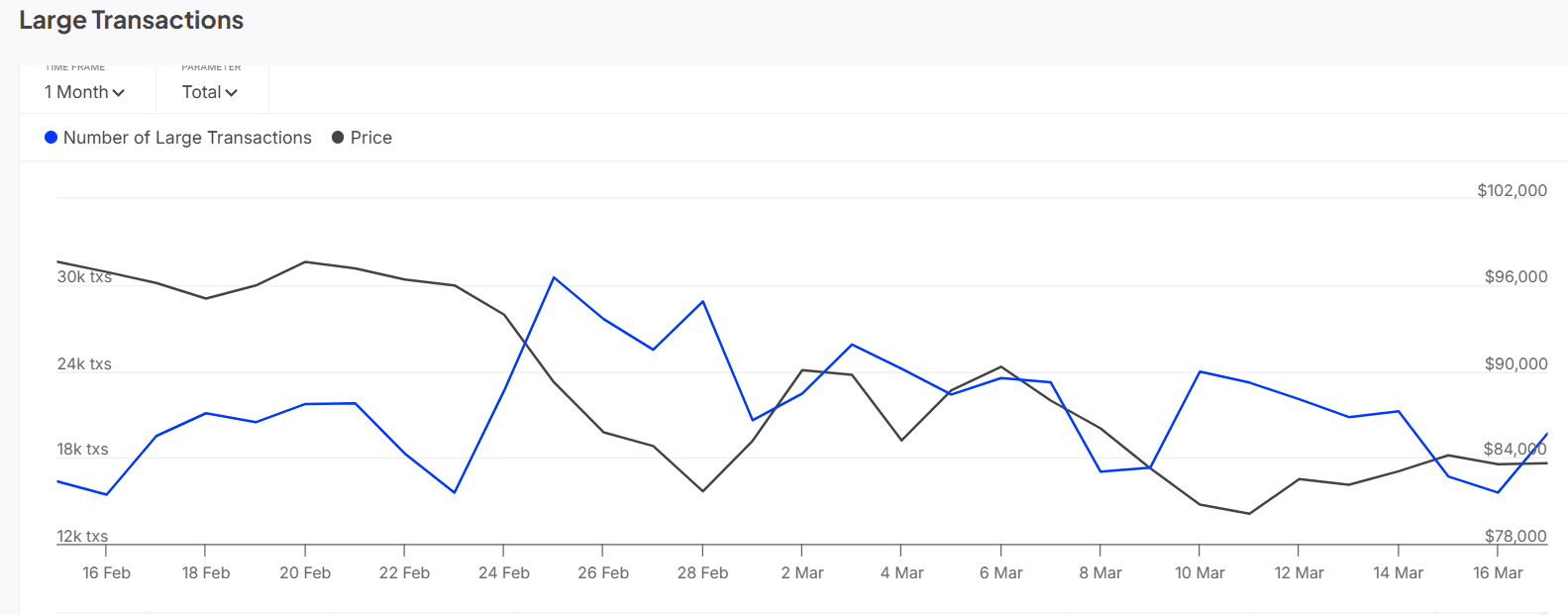

Between the fifteenth of February and the seventeenth of March 2025, Bitcoin’s value ranged from $78,000 to $84,000. Giant transactions elevated throughout value surges however declined throughout dips, significantly on the twenty second of February and the sixth of March.

When Bitcoin hit $84,000 on the sixteenth of March, massive transactions spiked, reflecting rising investor confidence.

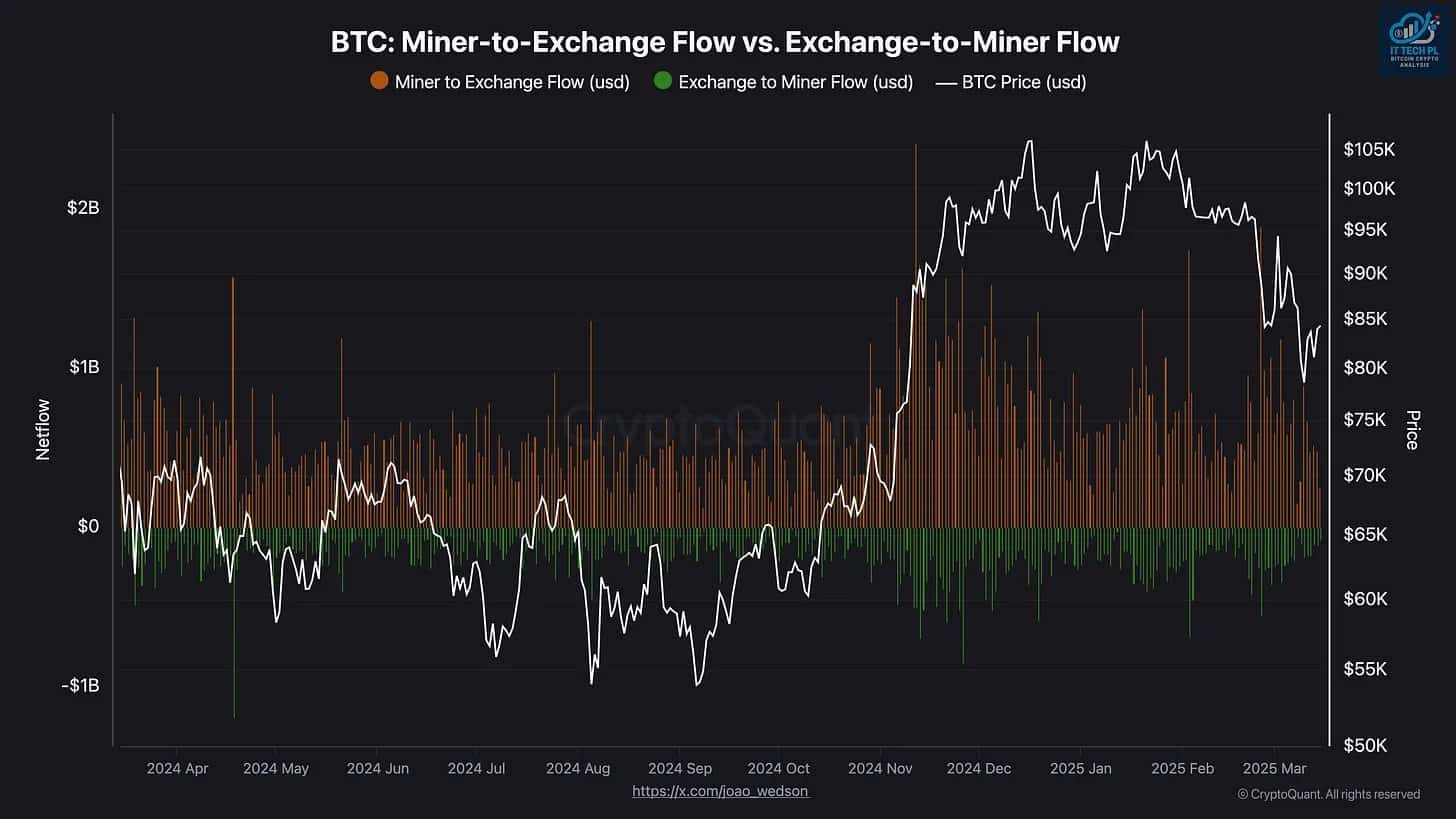

CryptoQuant creator IT Tech pointed out that from April 2024 to March 2025 miner-to-exchange and exchange-to-miner flows instantly affect Bitcoin’s value actions.

Between late February and March 2025, as Bitcoin rose from $80,000 to over $90,000, miner-to-exchange transfers elevated.

This means miners had been promoting Bitcoin, doubtless anticipating greater costs, which impacted market sentiment and potential value actions.

Whale exercise raises market hypothesis

A Bitcoin whale just lately transferred $25.1 million in BTC to FalconX after holding it dormant for 1.5 years. The transaction adopted 300 Bitcoin actions, sparking discussions on its potential market affect.

The whale initially acquired 1,500 BTC for $39.5 million in August 2023, at a mean value of $26,353 per Bitcoin.

Following Bitcoin’s current surge, the whale has achieved an estimated revenue of $85.7 million, reflecting a 219% return. A complete of 1,050 BTC, valued at $87.2 million, was transferred to 2 new wallets, whereas 150 BTC, price $12.5 million, stays untouched.

This important exercise has sparked considerations about its potential affect on Bitcoin’s value traits and market actions.

Bitcoin’s value continues to be closely influenced by massive transactions, miner exercise, and market sentiment, making its subsequent transfer a vital space of focus for merchants and traders.