- BTC was buying and selling inside a rising wedge, with $86,400 appearing as an important resistance stage.

- A breakout above $86,400 may push BTC towards $90,000, whereas a rejection could result in a drop under $80,000.

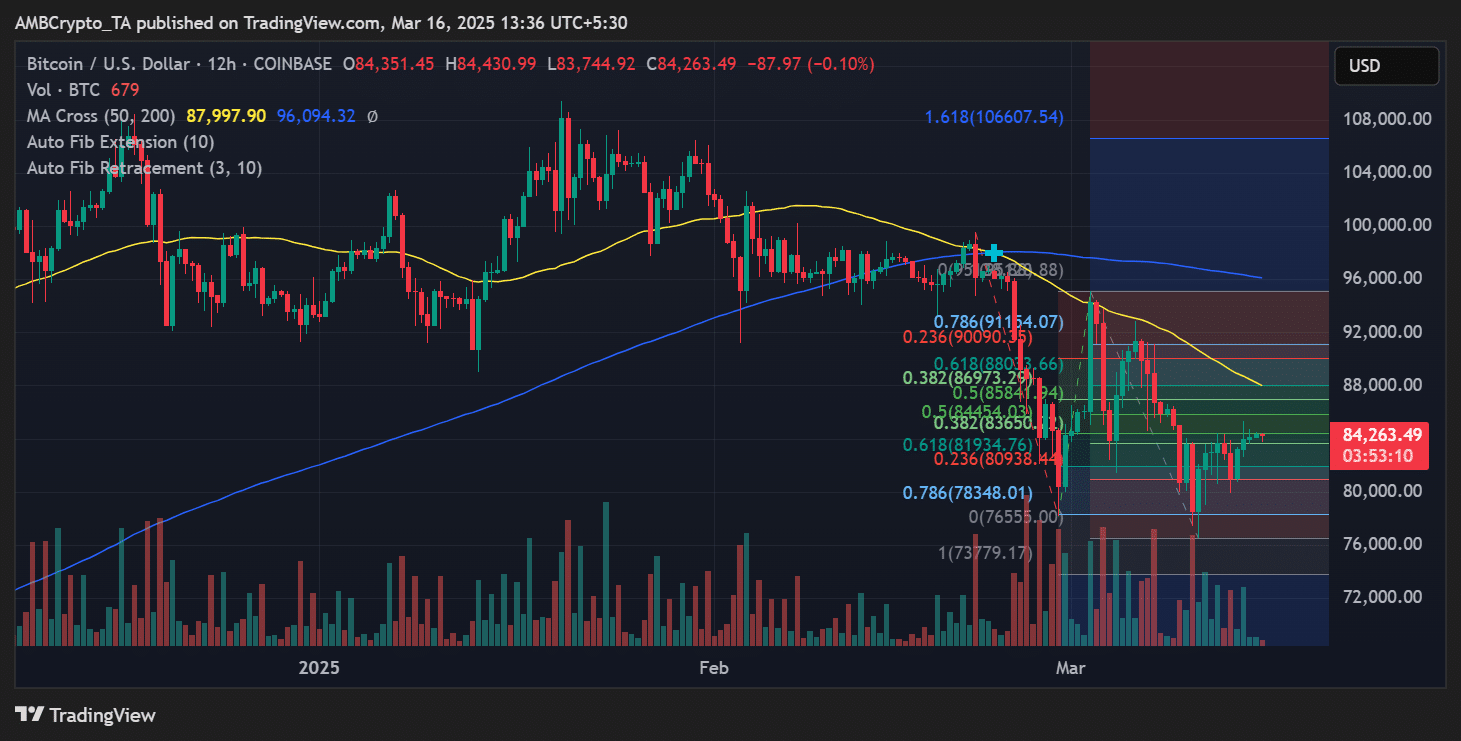

Bitcoin [BTC] has been consolidating inside a rising wedge sample, with a vital resistance zone looming at $86,400. The value lately surpassed the $83,800 resistance stage and efficiently retested it as help.

This stage now serves as a key pivot level for BTC’s subsequent main transfer.

Merchants are intently watching the $86,400 area, which may dictate Bitcoin’s short-term trajectory, both confirming a breakout towards increased worth ranges or triggering a reversal under $80,000.

Bitcoin’s place contained in the rising wedge

The rising wedge sample, seen on the decrease timeframes, exhibits Bitcoin buying and selling inside an ascending construction. Whereas this setup can point out bullish continuation, it usually precedes bearish breakouts.

The press time worth of BTC was $84,263, nonetheless inside the wedge however approaching the higher boundary. Quantity evaluation confirmed declining exercise, suggesting patrons could also be shedding momentum as Bitcoin neared resistance.

Supply: X

The RSI [Relative Strength Index] was hovering round impartial territory, which means there was no sturdy overbought or oversold sign but.

Nonetheless, a rejection may turn into extra possible if BTC pushes towards $86,400 and the RSI strikes into overbought ranges.

Key resistance and help zones

Instant resistance was at $86,400, which stays the important thing hurdle. A profitable break above this stage may see Bitcoin lengthen towards $90,000 and probably $95,000 if momentum sustains.

Main help lay at $83,800, which was lately examined as help and was essential for holding Bitcoin’s bullish construction. If this stage fails, BTC may revisit $81,700 and presumably dip under $80,000.

Fibonacci ranges point out that the 0.618 retracement stage aligns close to $86,900, additional strengthening the resistance zone.

On the draw back, the 0.786 stage at $78,300 may function sturdy help if BTC fails to carry above the wedge.

What occurs if BTC breaks the wedge?

A clear breakout above $86,400 would invalidate bearish issues, resulting in a bullish run towards $90,000 or increased.

Nonetheless, if BTC fails to keep up the wedge construction, it may end in a pointy drop, with preliminary draw back targets close to $81,700 and $78,300.

Market individuals ought to monitor quantity and RSI habits intently to evaluate breakout energy.

In the mean time, Bitcoin is at a pivotal level, with merchants awaiting affirmation on whether or not the resistance will maintain or break. The following few days might be vital in figuring out BTC’s subsequent main worth motion.