The chart displays a basic divergence: whales are shopping for the dip whereas retail hesitates.

This conduct typically precedes directional shifts in market momentum — both a breakout backed by institutional assist or extended compression if retail stays sidelined.

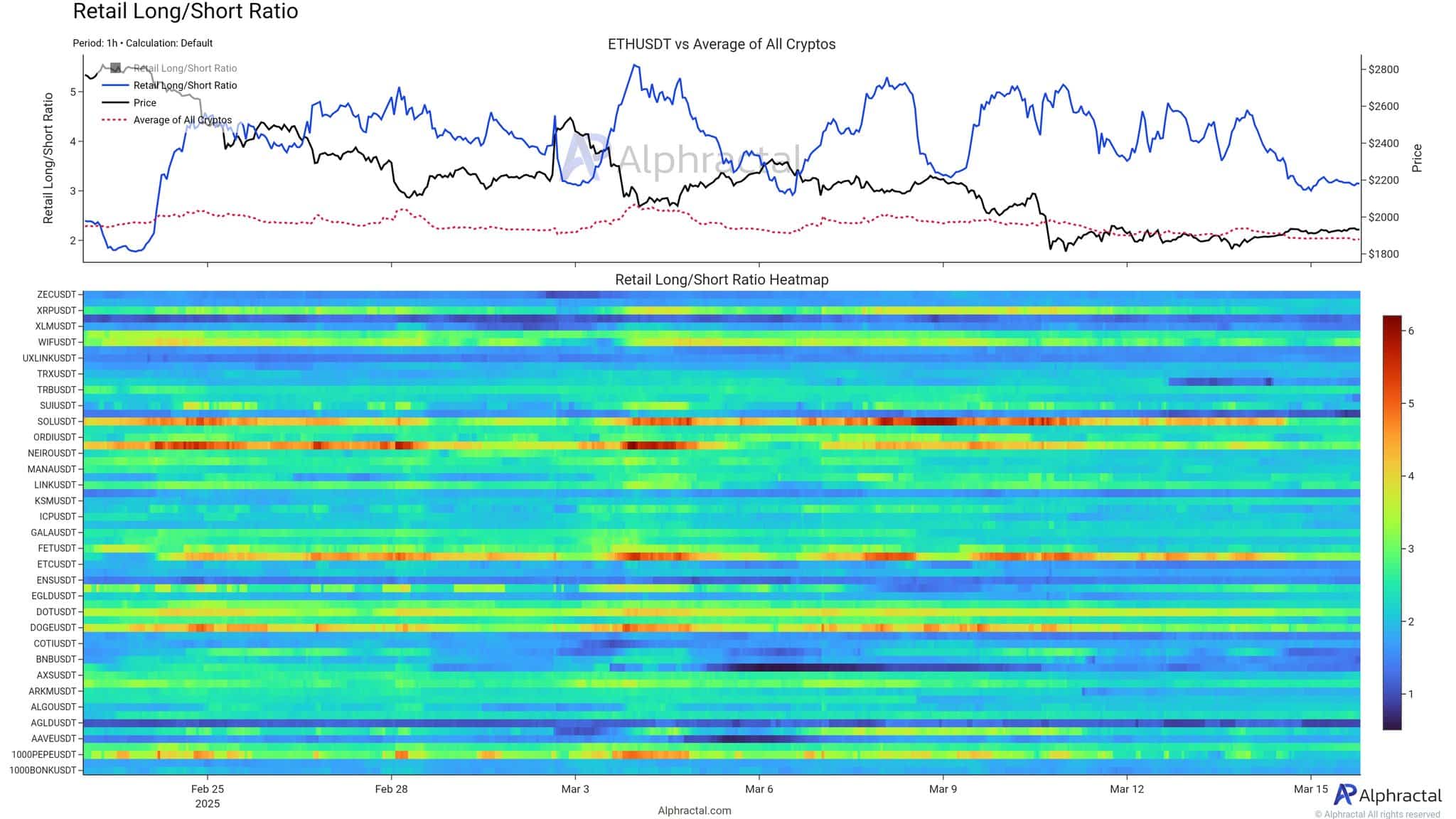

Retail deleveraging and the narrowing lengthy/quick ratio

Retail merchants, as soon as confidently positioned for upside, are retreating.

The retail lengthy/quick ratio for ETHUSDT – which reached highs above 5.5 in early March — has steadily declined to round 3, pointing to clear deleveraging.

As volatility light, so did retail enthusiasm. The ratio’s decline towards 3 means that a good portion of retail merchants are closing positions or adopting a extra impartial stance.

In comparison with late February — when the ratio hovered round 2.5 and climbed with worth momentum — this latest pullback alerts fading conviction amongst smaller holders.

Whereas this reset could also be wholesome, unwinding overly aggressive longs, it additionally highlights the dearth of contemporary demand from retail members.

Market neutrality and dealer fatigue

Taken collectively, these developments paint an image of broad market neutrality. Whales are shopping for — however cautiously. Retail isn’t bearish — simply disengaged.

For a lot of merchants, particularly in perpetual futures markets, this low-action setting is irritating. Circumstances are neither bullish sufficient to justify aggressive longs nor bearish sufficient to warrant significant shorts.

ETH’s worth has mirrored the broader decline throughout crypto property (as seen in each charts’ crimson dotted strains), reinforcing the view that this isn’t an Ethereum-specific lull; it’s a part of a wider market cool-down.

Nonetheless, such neutrality typically precedes volatility enlargement. The market is coiling; the one uncertainty is the path.

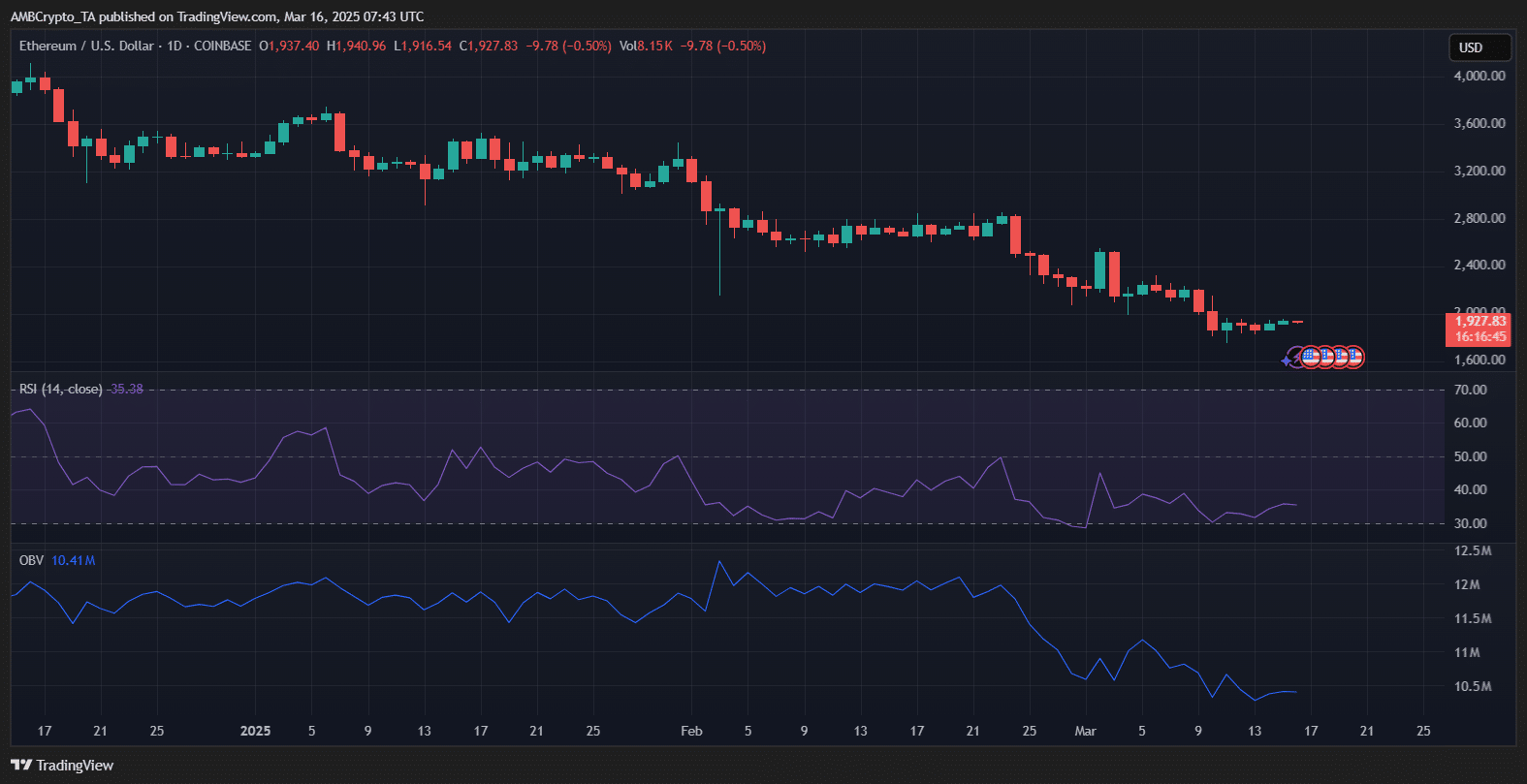

Ethereum worth outlook

Ethereum is displaying indicators of stagnation slightly below $2,000. The RSI hovers at 35, preserving ETH in bearish territory with out being deeply oversold — suggesting restricted upside momentum within the quick time period.

In the meantime, the OBV continues its downward development, signaling weak shopping for stress regardless of latest worth consolidation.

The declining quantity and muted RSI trace at a continued sideways grind or a minor pullback until shopping for exercise picks up. For now, Ethereum lacks the technical energy for a breakout.

With no clear catalyst, ETH is prone to stay range-bound between $1,850 and $2,000.