- Market sentiment remained optimistic with most Bitcoin addresses in revenue, providing robust assist.

- Bitcoin has efficiently rebounded from key assist ranges, exhibiting indicators of bullish momentum.

Mt. Gox has transferred an enormous 11,502 BTC, valued at $905 million, to an unknown pockets, inflicting ripples all through the crypto area.

Bitcoin [BTC] was buying and selling at $80,324.32, at press time, after briefly dipping to $76K within the earlier week. The crypto group is left questioning the potential penalties of this important transfer.

Might this transaction set off a bigger worth dip, or will the market handle to soak up the influence and proceed on its bullish path? Let’s analyze key market metrics to get a clearer image.

What does Bitcoin’s in/out of the cash information inform us?

Roughly 75.36% of Bitcoin addresses are in revenue, holding 14.96 million BTC at a mean worth increased than the present market worth.

This massive proportion signifies that almost all holders are usually not beneath important promoting stress in the intervening time. Nevertheless, there’s a smaller group, about 22.72%, holding 4.51 million BTC at a loss. This might probably result in sell-offs if market circumstances worsen.

What do BTC’s Alternate Reserves say concerning the market?

Bitcoin’s Alternate Reserves have decreased by 3.13% prior to now 24 hours, indicating fewer cash can be found on exchanges. This implies that buyers are both transferring BTC to non-public wallets or reallocating their funds elsewhere.

A decline in reserves typically alerts diminished promoting stress, which is usually a optimistic signal for the market. Nevertheless, it additionally implies decrease liquidity, which might end in elevated short-term worth volatility.

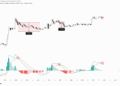

Is BTC’s worth motion stabilizing at key assist ranges?

Bitcoin has efficiently rebounded from the important thing assist stage of $78,258, indicating that the market is discovering stability at this worth level.

The current worth motion reveals that BTC is consolidating and constructing momentum because it holds above this important stage. Moreover, the Stochastic RSI, at present at 36.54, has proven indicators of shifting away from the oversold zone, suggesting a possible bullish reversal.

This means that purchasing stress could also be growing, which might drive Bitcoin towards the subsequent resistance zone at $86,453, as indicated by the 0.618 Fibonacci retracement stage.

What are Bitcoin’s lively addresses and transaction volumes signaling?

Bitcoin’s lively addresses have elevated by 1.15% over the previous 24 hours, reflecting robust curiosity within the cryptocurrency. This rise in lively addresses typically signifies increased consumer engagement, which is usually seen as a bullish market sign.

Moreover, the transaction depend has grown by 1.26%, pointing to elevated buying and selling exercise and motion throughout the Bitcoin community. These metrics recommend that, regardless of current volatility, Bitcoin stays a necessary and dynamic a part of the cryptocurrency ecosystem.

Conclusively, after analyzing the important thing metrics, it seems that Bitcoin can stand up to the influence of Mt. Gox’s huge switch. The big proportion of in-the-money holders, together with wholesome lively tackle progress. This implies that the market has robust assist at present ranges.

Due to this fact, except important exterior components come into play, BTC ought to be capable of soak up the influence and preserve its bullish momentum.