- Trump’s govt order requires the creation of a U.S. Bitcoin reserve, using present government-held cryptocurrency belongings.

- Declining alternate reserves sign bullish sentiment however elevate issues over market liquidity.

In a groundbreaking transfer, U.S. President Donald Trump has taken a big step towards integrating cryptocurrencies into the nation’s monetary technique.

Trump’s Bitcoin Reserve plan takes form

On the sixth of March, Trump signed an govt order to determine a strategic reserve of digital belongings, leveraging tokens already in authorities possession relatively than buying new ones—falling in need of market expectations for recent purchases.

Trump hosted an unique White Home summit with prime cryptocurrency leaders, constructing on this initiative, and outlining his imaginative and prescient for a government-backed crypto stockpile.

This unprecedented engagement indicators a shifting regulatory panorama, with potential implications for Bitcoin [BTC] and the broader digital asset market.

Moreover, the potential of the U.S. establishing a Bitcoin reserve has gained momentum, with market predictions shifting from 24% to 32%, based on Polymarket data.

This rising hypothesis has already sparked discussions throughout a number of states, with Utah, Arizona, and Ohio actively discussing the potential implications of a government-backed Bitcoin reserve.

Nevertheless, not all states are on board—South Dakota, Montana, and others have outright rejected associated legislative efforts.

As views proceed to diverge, the anticipation surrounding a U.S. Bitcoin reserve is intensifying.

Why are alternate reserves declining?

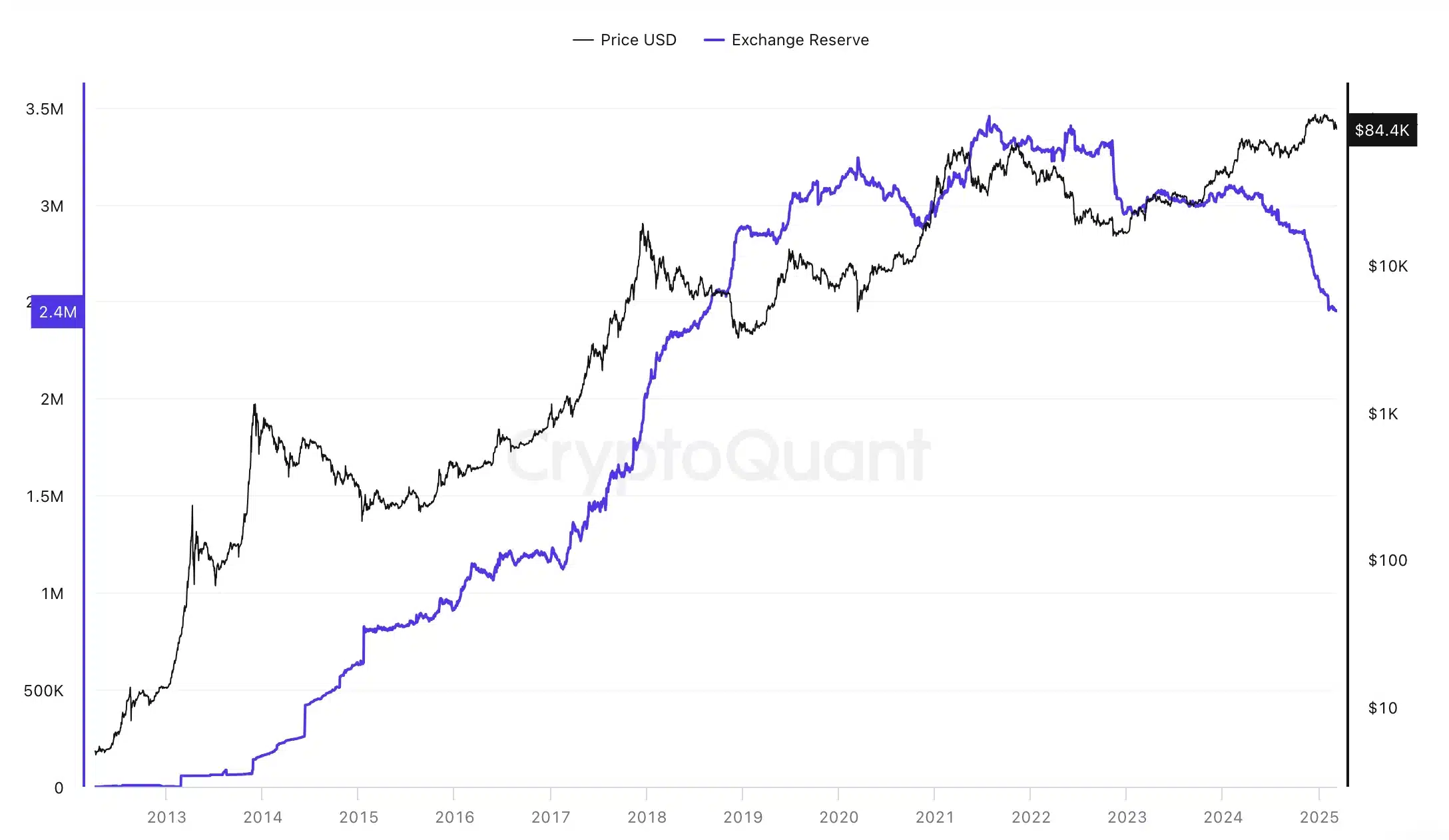

In the meantime, alternate reserves are plummeting, signaling a possible provide squeeze, as highlighted by Moon Whales.

“The US is making a Strategic #Bitcoin Reserve. In the meantime, alternate reserves are in free fall.”

CryptoQuant information additional reinforces this pattern, revealing that alternate reserves proceed to say no.

Buyers are more and more shifting their holdings to personal wallets, displaying a choice for long-term storage over instant promoting.

A shrinking alternate reserve typically signifies bullish sentiment, as lowered provide can create a possible provide squeeze if demand rises.

This pattern additionally displays rising curiosity in DeFi, staking, and chilly storage options for enhanced safety and different yield alternatives.

Whereas decrease reserves can increase costs, they could additionally scale back market liquidity, rising volatility as a consequence of fewer tradable belongings.

What lies forward?

In the meantime, Bitcoin’s value stays beneath stress, buying and selling at $84,557.57, at press time, after a 1.89% drop previously 24 hours, based on CoinMarketCap.

Moreover, some segments of the market proceed to point out bullish optimism, anticipating long-term good points, but total momentum appears fragile.

As anticipated these shifts have stored merchants on edge, with Bitcoin’s subsequent transfer seemingly hinging on broader adoption tendencies and institutional curiosity.