Newest information on ETFs

Go to our ETF Hub to search out out extra and to discover our in-depth knowledge and comparability instruments

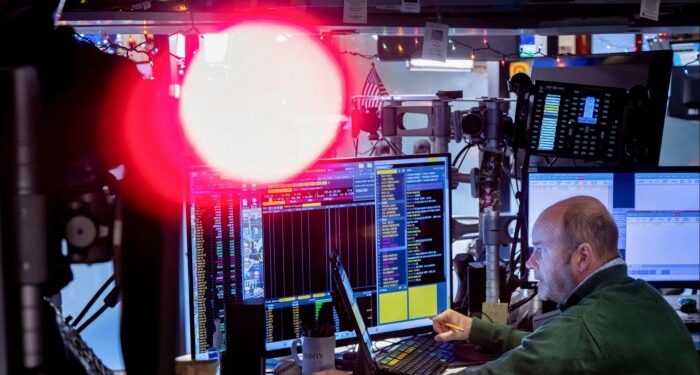

All roads led to Wall Road in November because the US fairness market dominated a file month for the worldwide trade traded fund business.

Internet flows into ETFs globally hit $205bn in final month, based on BlackRock, outstripping the earlier file of $199bn set in July.

But US fairness ETFs accounted for a file $149bn of this — properly forward of the earlier peak of $98.5bn in December 2023 — as nearly each different nook of the funding universe was floor into the mud by the onward march of Wall Road.

Mounted earnings ETFs pulled in an anaemic $35.1bn, comfortably under October’s $49.9bn, whereas commodity ETFs suffered web outflows of $3.6bn as traders pulled cash out for the primary time since April.

Non-US fairness markets had been equally out of favour, with $5.1bn stripped from European fairness ETFs, $2.9bn from Japanese inventory funds and $3.8bn from their rising market friends — the primary time all three markets have recorded concurrent month-to-month outflows since Could 2019, based on BlackRock.

The surge into the US inventory market was pushed by Donald Trump’s clear victory within the US presidential election, which constructed on already robust market momentum.

November was a “historic month”, stated Karim Chedid, head of funding technique for BlackRock’s iShares within the Emea area, with “the large theme rerisking from traders in a month the place we now have had readability across the consequence of the US election”.

Chedid stated this constructed on robust sentiment emanating from the not too long ago concluded earnings season, which delivered 7 per cent year-on-year earnings, comfortably forward of subdued expectations of three per cent, alongside a widening hole in financial knowledge between the US and a weaker Europe.

Matthew Bartolini, head of SPDR Americas analysis at State Road World Advisors, stated this transatlantic gulf was wider nonetheless in fairness markets, with the S&P 500’s post-election bounce of 6 per cent in November taking its year-to-date features to 26 per cent, at the same time as a post-election wobble in European equities amid fears of upper tariffs trimmed year-to-date returns to five per cent.

This 21 proportion level return differential is the best for 15 years, Bartolini stated. This “illustrates how there’s extra to the US’s reign than the current post-election rally narratives,” he added.

“For starters, the US has had stronger basic momentum in 2024. Ahead-looking sentiment is robust too. The US is projected to have stronger earnings progress in every of the following 4 quarters — 6 proportion factors, on common — than the remainder of the world.”

Amid this backdrop, some European traders seem like giving up on their home bourses: web purchases of Europe-listed US fairness ETFs hit a file $23.2bn in November, BlackRock stated.

“Traders abroad jumped on the alternative to extend publicity to the US inventory market,” stated Syl Flood, senior product supervisor at Morningstar, with the Eire-domiciled iShares Core S&P 500 ETF USD (CSSPX) pulling in $4bn, $1bn greater than its earlier month-to-month file, set in January.

Bartolini, whose evaluation solely covers US-listed ETFs, stated that the rolling three-month circulation differential between US and non-US fairness ETFs hit an “eye-popping” $188bn, one other file.

Whereas ETFs monitoring the blue-chip S&P 500 dominated flows, as normal, Chedid famous that extra cyclical areas, reminiscent of small and mid-cap shares and financials, additionally noticed robust shopping for, mirroring the sample within the wake of Trump’s earlier election victory in November 2016.

His undisputed re-election “has eliminated the uncertainty premium for markets,” Chedid stated, whereas additionally doubtlessly ushering in lighter regulation, significantly for monetary shares.

“Traders positioned unusually giant sums with financials-focused ETFs,” stated Flood, with month-to-month flows topping $9.4bn, one more file.

“The Monetary Choose Sector SPDR ETF (XLF), the biggest financials sector fairness ETF at $51bn, noticed file flows of $4.1bn” despite the fact that greater than $1bn of this was withdrawn within the first three days of December, he added.

“Traders made a fair bigger proportional wager on SPDR S&P Regional Banking ETF (KRE); it grew by a 3rd because of November’s flows of $1.4bn”.

Flood additionally famous that Eire, Europe largest ETF domicile, noticed file inflows of $31.5bn (taking belongings to $1.6tn), with everything of this cash being pumped into equities.

And though US-domiciled mounted earnings ETFs did see inflows, Bartolini calculated that fairness minus bond trailing three-month flows hit one more file.

Just about the one different asset that did see a superb month was cryptocurrency. Morningstar’s listing of the highest 10 ETFs by flows in November was dominated by US fairness automobiles with the only real exception being the iShares Bitcoin Belief (IBIT), nestled in fifth with $5.8bn of web new cash as Trump election ushered in a recent wave of enthusiasm for digital belongings.

The large query now could be whether or not Wall Road can keep its excessive ascendancy, or whether or not flows will develop into slightly extra balanced.

“That’s an enormous query that shoppers ask us,” stated Chedid. “In our view there are fundamentals that drive that choice for US equities. We see some selective alternatives coming via in different components of the world, however we do want to emphasize the phrase ‘selective’,” he added, noting that “this yr has been first rate for UK equities”.

And whereas continental Europe “has been considerably weaker when it comes to flows”, amid “a structural decline in manufacturing exercise” a service sector restoration that has “fizzled out” and an unhelpful geopolitical backdrop, Chedid did notice that actively managed European fairness ETFs had seen web shopping for, one thing he attributed to traders in search of out such selective alternatives.