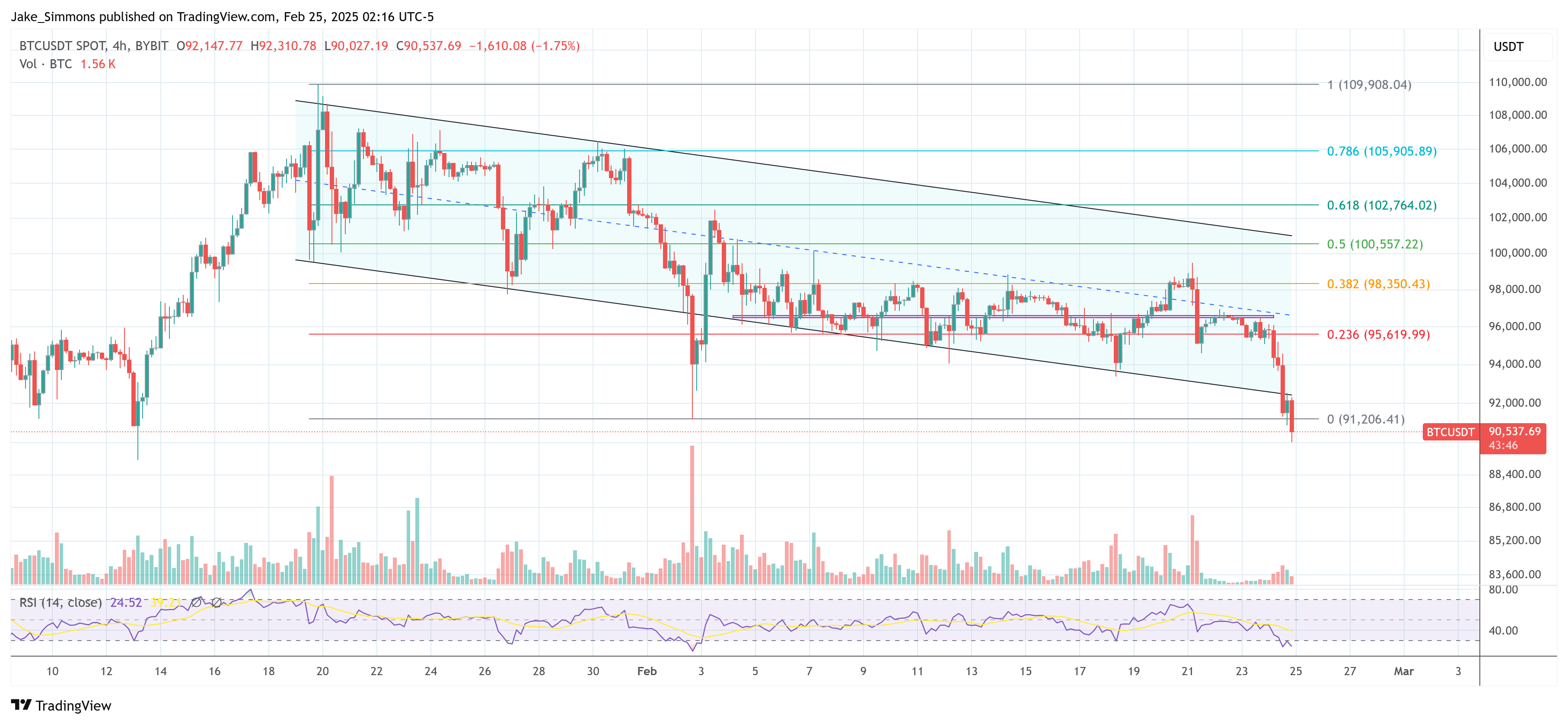

The Bitcoin worth has fallen greater than -8.8% since Friday when Bybit suffered the largest crypto hack in historical past. The flagship digital asset reached a peak of $99,493 late final week, solely to retreat to roughly $91,500 at press time, marking a -5.5% decline since Monday. This downturn not solely shatters Bitcoin’s try to carry above $95,000 but additionally locations it on the verge of shedding its important 97-day buying and selling vary between $91,000 and $102,000. Notably, Bitcoin’s worth has damaged under the descending development channel that has been in play since January 20.

What’s Subsequent For Bitcoin?

Ari Paul, co-founder and Chief Funding Officer of BlockTower Capital, supplied a wide-ranging view on Bitcoin’s trajectory and the broader macroeconomic setting. In a post on X, Paul touched on the potential for continued equity-market weak point and its knock-on impact on digital belongings: “My market take: equities in for 4-15 months of ache (I’ll guess 9 months) tied to deflationary authorities insurance policies (tariffs and mass layoffs largely). Then it’s a political query – does Trump admin ‘capitulate’ and switch severely inflationary? In overwhelming majority of comparable circumstances in historical past the reply was sure, however only a low confidence guess to me at the moment.”

Associated Studying

Shifting focus to crypto, Paul emphasised that whereas cryptocurrencies should show short-term correlations with equities, they’re inherently on completely different cyclical rhythms: “What does that imply for crypto? I proceed to assume crypto and equities are on different cycles rhythms, however that doesn’t negate shorter time period correlation. Alts in all probability observe equities down at the very least at first (however they’re already down a lot, even versus 2021 costs, they might backside nicely earlier than equities.)”

Talking on Bitcoin, Paul predicts that the main cryptocurrency will “act like a mix of gold and S&P 500,” including, “if gold stays sturdy, than that might recommend Bitcoin would outperform shedding equities, however possibly not by a lot. A retrace to ~$73k-$77k appears believable, I’d in all probability add there.”

Regardless of the near-term volatility, Paul stays optimistic: “I stay assured crypto bull market not over, however that is wanting more and more completely different from prior cycles, possibly considerably slower and longer. My base case is that crypto will lead the final macro inflation flip, so possibly crypto bull run resumes in 6 months and equities flip up in 9. The dates given are simply indications of my guesstimates. I place no weight on the precise timeframes.”

BitMEX founder Arthur Hayes additionally took to X to warn of an imminent downward push. He pointed to the mechanics of Bitcoin Alternate-Traded Funds (ETFs) and futures market arbitrage as potential drivers of elevated promoting strain.

“Bitcoin goblin city incoming: A lot of IBIT holders are hedge funds that went lengthy ETF quick CME future to earn a yield larger than the place they fund, quick time period US treasuries. If that foundation drops as BTC falls, then these funds will promote IBIT and purchase again CME futures. These funds are in revenue, and given foundation is near UST yields they’ll unwind throughout US hours and realise their revenue. $70,000 I see you mofo,” he writes.

Associated Studying

Notably, analysis agency 10x Analysis published an evaluation on Monday indicating that whereas Bitcoin ETFs—led by BlackRock’s IBIT product—have garnered $38.6 billion in internet inflows since their January 2024 launch, a lot of this capital might not characterize simple bets on rising BTC costs, aligning with Hayes’ assertion.

“Though Bitcoin ETFs have attracted $38.6 billion in internet inflows since their January 2024 launch, our evaluation means that solely $17.5 billion (44%) represents real long-only shopping for. The bulk—56%—is probably going tied to arbitrage methods, the place quick Bitcoin futures positions offset inflows,” the agency famous.

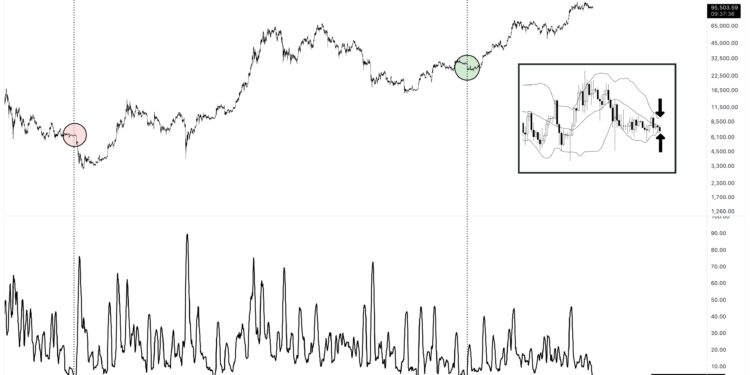

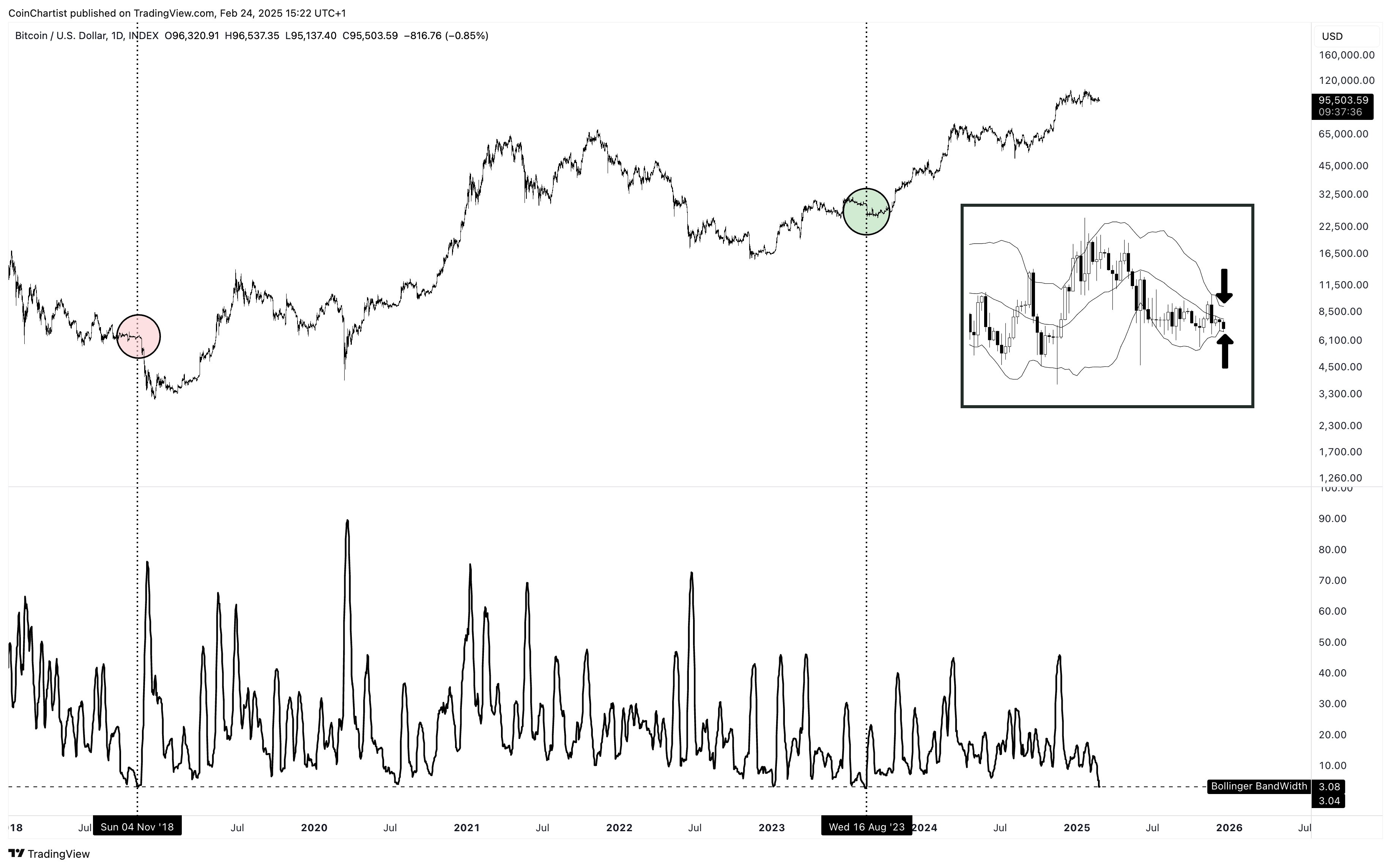

Previous to the continuing worth drop, market technician Tony “The Bull” Severino, warned of looming volatility in Bitcoin, noting that the every day Bollinger Bands have been hitting excessive tightness—a sample typically adopted by a big worth swing: “A call will likely be made quickly in Bitcoin, because the every day Bollinger Bands attain the third-tightest studying since 2018. In late 2018, file tightness led to a 50% decline in simply over a month. In mid 2023, file tightness led to a 200% climb in simply over 200 days. Which route does volatility launch?”

With Bitcoin teetering simply above $91,000 and the market nonetheless reeling from Bybit’s historic hack, the market is at a pivotal juncture. Chart alerts, macroeconomic uncertainties, and the unwinding of complicated buying and selling methods collectively draw a clouded outlook with a attainable extension of this stoop to the $73,000–$77,000 vary within the coming months.

In the meantime, this doesn’t need to herald the start of the bear market. Chris Burniske, associate at Placeholder VC, commented by way of X: “In the midst of 2021:BTC drew down 56%, ETH drew down 61%, SOL drew down 67%, many others 70-80%+. You’ll be able to give you all the explanations for why this cycle is completely different, however the mid-bull reset we’re going by means of isn’t unprecedented. These calling for a full blown bear are misguided.”

At press time, BTC traded at $90,537.

Featured picture created with DALL.E, chart from TradingView.com