- Ethereum’s threat urge for food drops, indicating warning out there and slower progress forward.

- The Bybit hack appears to have had a comparatively gentle affect, overshadowed by broader market shifts.

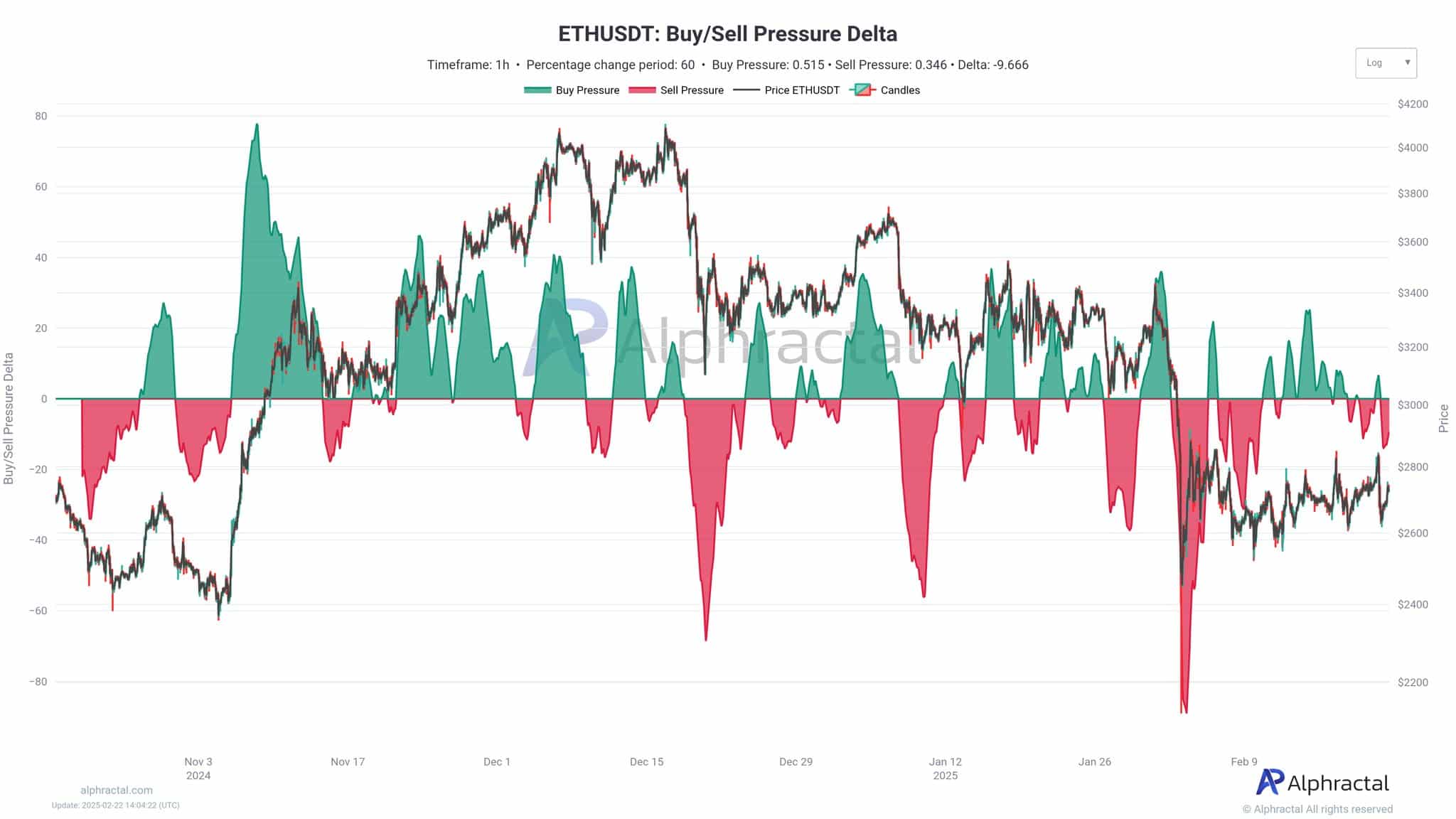

Ethereum’s [ETH] resilience is being examined as latest occasions, together with the rumored Bybit hack, shift market sentiment.

Surprisingly, the sell-off following the potential safety breach had much less affect than the third of February market downturn, which stays extra influential regardless of unclear causes.

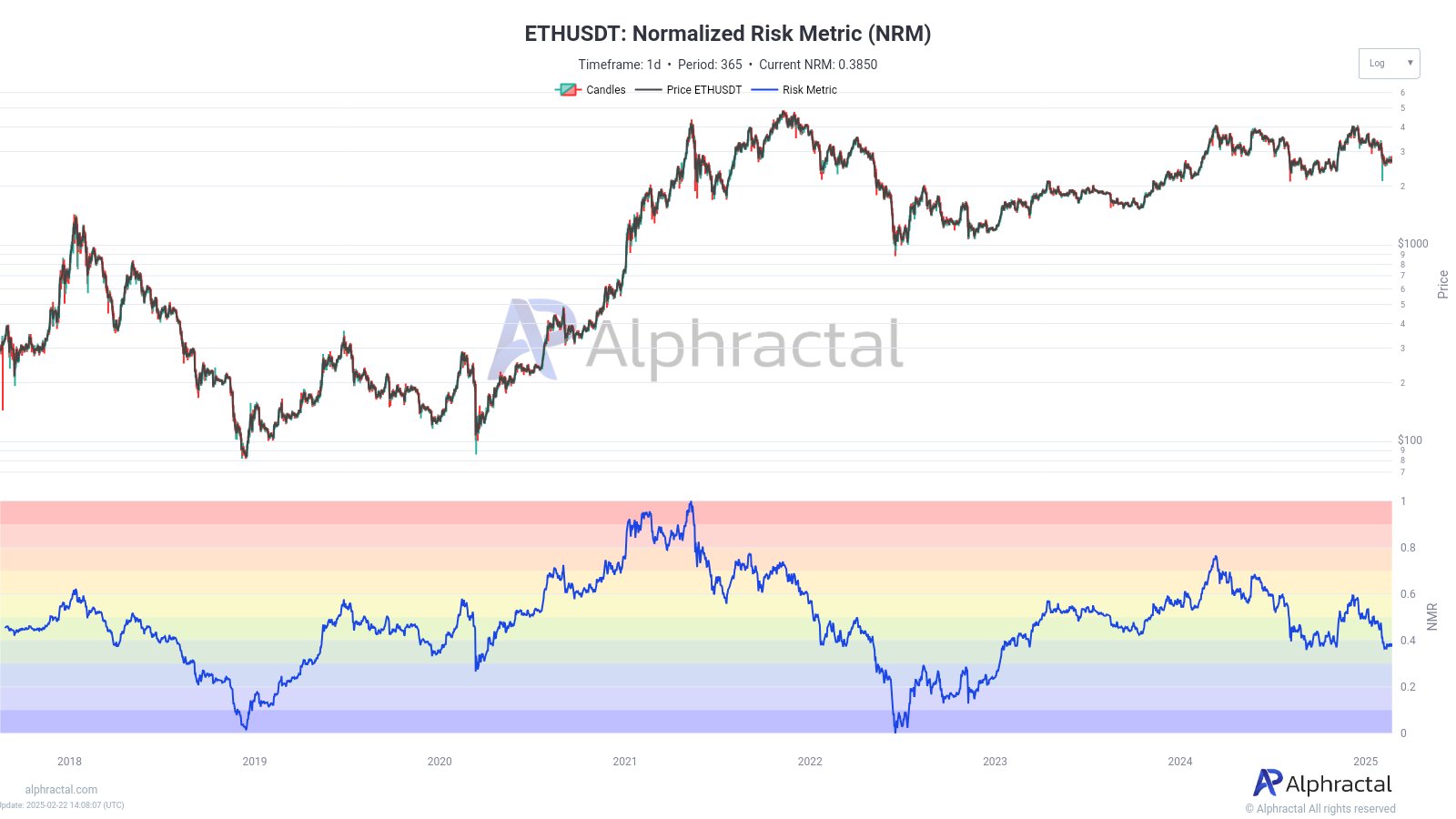

Beneath these short-term fluctuations, a deeper concern emerges: Ethereum’s threat urge for food has been steadily declining since March 2024.

Whereas lowered risk-taking could cut back liquidations and foster accumulation, it additionally indicators a sluggish market. With ETH hovering round key ranges, the query is whether or not it may possibly keep its place or face extended uncertainty.

The Bybit hack: A minor occasion within the bigger image?

Regardless of issues over the potential Bybit hack, information suggests ETH’s sharpest declines in latest months have been tied to broader risk-off strikes, not remoted occasions.

There was a notable worth drop in late January and early February, effectively earlier than information of the hack emerged.

The sell-off on the third of February, which was extra extreme than the hack’s affect, is indicative of deeper liquidity points and shifting sentiment.

With threat urge for food declining since March 2024, Ethereum faces lowered participation from leveraged merchants. Whereas this may increasingly result in fewer liquidations, ETH’s sluggish restoration indicators ongoing market uncertainty.

Ethereum: Is the declining threat a trigger for concern?

Ethereum’s threat urge for food has steadily declined since March 2024, reflecting a broader shift in sentiment. The NRM chart exhibits a transparent downtrend — traders have gotten extra risk-averse.

Traditionally, larger threat urge for food drove speculative surges, however the present market feels extra cautious.

Regulatory uncertainty and lowered leveraged participation have contributed to this development.

Whereas decrease threat metrics cut back volatility and create a extra steady setting, in addition they dampen the potential for explosive worth actions.

Until threat urge for food recovers, Ethereum could proceed to commerce in a extra managed and fewer speculative method.

The chance-reward paradox

As Ethereum’s threat urge for food wanes, the market enters a section of lowered volatility and fewer liquidations.

This stability may encourage long-term accumulation however can also lead to stagnation, as worth appreciation slows with out speculative momentum.

Traditionally, decrease Sharpe Ratios have coincided with sideways motion, requiring endurance from traders.

If Ethereum’s risk-adjusted returns stay subdued, the market may face an prolonged accumulation section as a substitute of an imminent breakout.

Ethereum: The battle of provide and demand

Ethereum’s worth is more and more influenced by institutional inflows, retail sentiment, and regulatory developments.

BlackRock’s latest $3.6 billion funding indicators institutional confidence, doubtlessly stabilizing costs and boosting adoption.

In the meantime, retail sentiment stays divided, with some accumulating on dips and others cautious resulting from market uncertainty.

The attainable approval of Ethereum staking ETFs in 2025 may reignite retail curiosity, whereas bettering regulatory readability within the U.S. could cut back investor uncertainty.

Finally, Ethereum’s future will depend upon balancing institutional backing with sustained retail participation and favorable regulatory situation