- Bitcoin whales cashed out $800 million, signaling a possible shift in market sentiment.

- Key help ranges and declining indicators level to potential Bitcoin value correction.

Bitcoin whales have not too long ago cashed out almost $800 million in earnings, marking a considerable shift in market exercise.

At press time, Bitcoin [BTC] was buying and selling at $96,153.51, reflecting a 2.07% lower within the final 24 hours.

This important revenue realization coincides with a noticeable value improve, prompting hypothesis about market sentiment.

The surge in profit-taking by long-term holders raises vital questions on the potential for a value pullback or the start of a brand new market section.

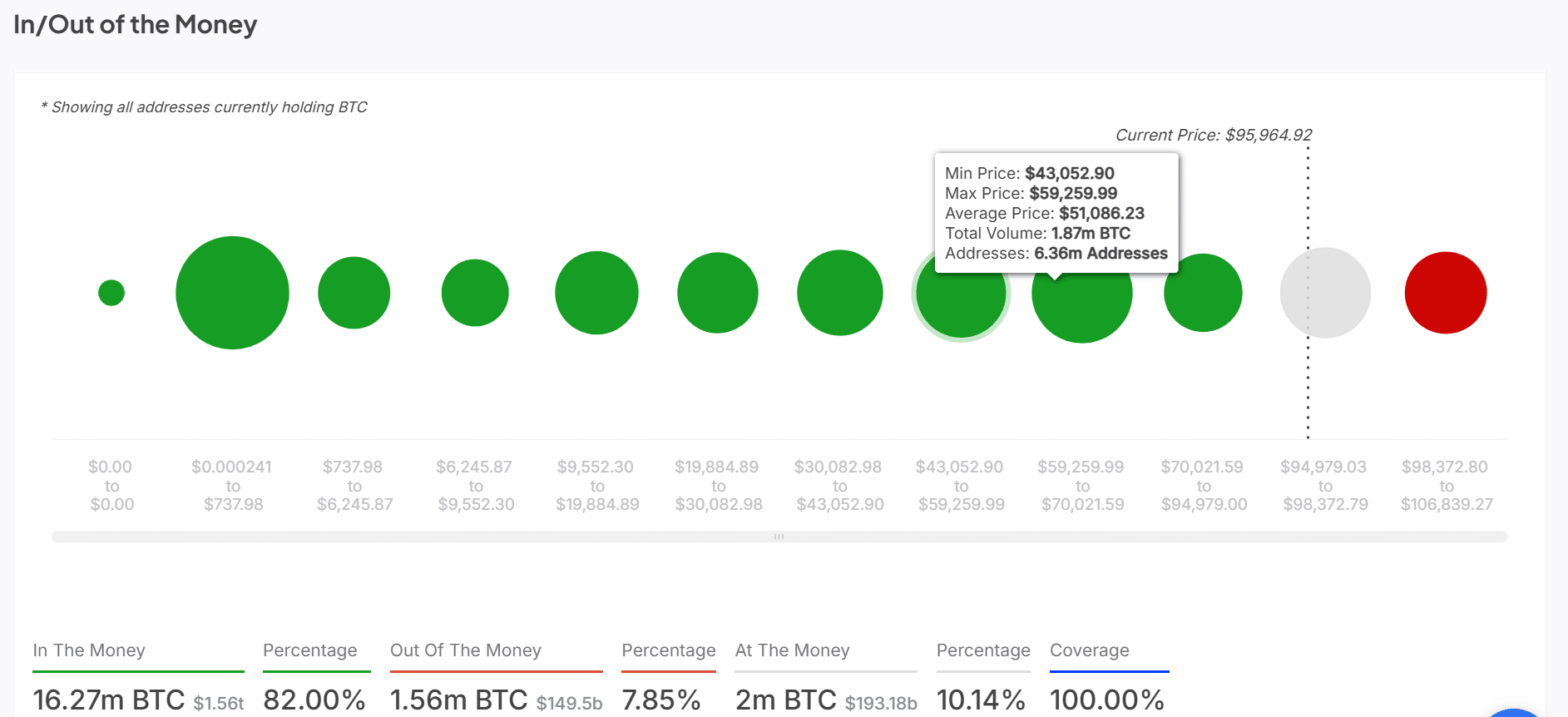

BTC in/out of the cash: Are most holders in revenue?

Bitcoin’s in/out of the cash evaluation reveals that 82% of Bitcoin addresses are at present in revenue, with the common value for these holders at $51,086.23. This huge proportion of worthwhile holders signifies widespread optimism amongst Bitcoin buyers.

Nevertheless, there are nonetheless 7.85% of addresses out of the cash, which means a portion of holders might expertise losses if the worth continues to drop.

As extra addresses develop into worthwhile, the chance of elevated promoting stress grows, probably influencing the general value pattern.

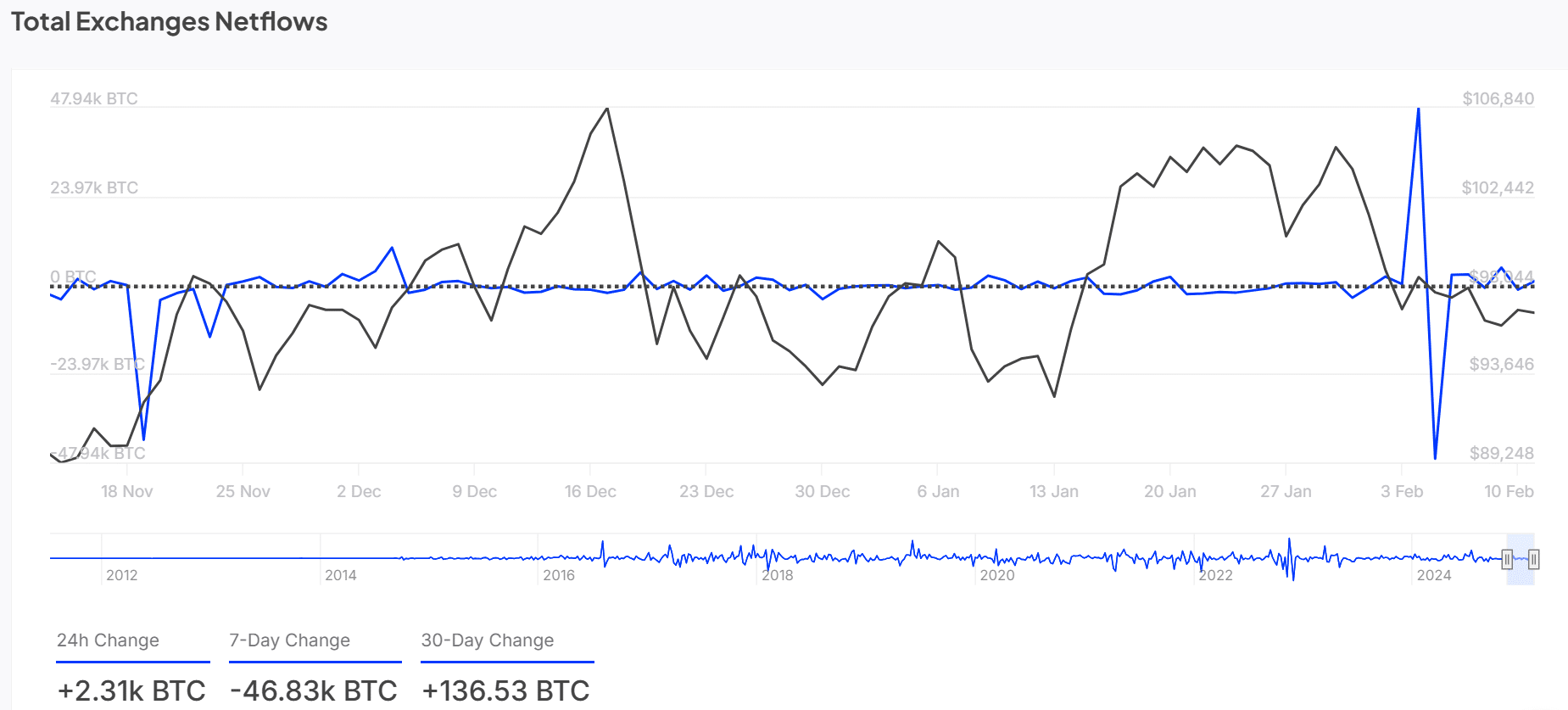

Complete trade netflows: Are merchants getting ready for extra volatility?

Bitcoin has skilled a 24-hour netflow improve of +2.31k BTC, indicating extra Bitcoin getting into exchanges, probably in anticipation of promoting exercise.

Over the past thirty days, netflows have surged by +136.53k BTC, signaling substantial liquidity out there. This influx might recommend merchants are getting ready for potential volatility.

Nevertheless, it might additionally point out a bullish outlook if costs break via key resistance ranges.

Testing key help and resistance ranges

The Bitcoin chart reveals that BTC is consolidating inside a key value vary. Help is discovered at $92,450.82, whereas resistance ranges are seen at $101,441.81 and $109,260.07. These value zones are important for figuring out Bitcoin’s subsequent transfer.

If Bitcoin can break via these resistance ranges, it could proceed its bullish momentum.

Nevertheless, any failure to surpass these key ranges might result in a consolidation section or a possible value correction.

Inventory-to-Circulation ratio and NVT golden cross: Bearish indicators?

Bitcoin’s Inventory-to-Circulation Ratio stood at 1.2686M, reflecting a 20% lower over the previous 24 hours, in accordance with CryptoQuant. This decline suggests a discount in BTC’s shortage, which can affect its long-term worth.

Equally, the NVT Golden Cross has decreased by 29.22% over the previous 24 hours, doubtlessly signaling a market prime or an impending correction.

These components point out that Bitcoin might face stress within the quick time period, because the diminishing shortage and declining transaction quantity recommend a slowdown in demand.

Conclusion: What’s subsequent for BTC?

Bitcoin’s market exercise reveals blended indicators, with whales cashing out. In/out of the cash figures point out potential promoting stress. Key technical indicators level to each bullish and bearish potentialities.

The evaluation means that Bitcoin might face challenges in breaking via resistance ranges, whereas decreased shortage and declining NVT figures increase considerations about value sustainability.

Due to this fact, a pullback in Bitcoin’s value appears probably quickly as market dynamics shift.