The worth of Bitcoin has not shown any serious momentum to this point in 2025 apart from briefly surpassing the $108,000 degree in mid-January. Quite the opposite, the flagship cryptocurrency has suffered some important corrections over the previous few weeks.

The latest pullback noticed the BTC worth closely stoop towards $92,000 after US President Donald Trump launched new commerce tariffs on Canada, Mexico, and China earlier this week. Whereas the Bitcoin worth shortly recovered above $100,000, it has since struggled to maintain any bullish momentum — at present buying and selling round $96,500.

HTX And BitMEX Customers Load Their Bitcoin Baggage — What We Know

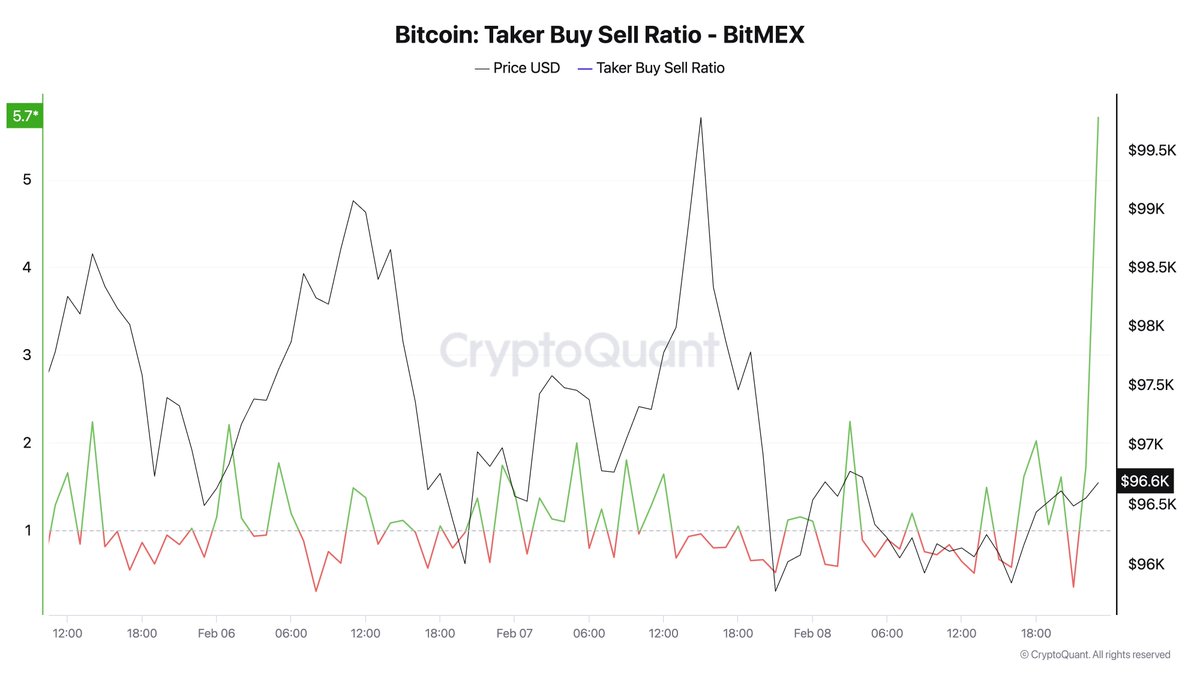

Outstanding crypto analyst Ali Martinez took to the X platform to share that sure centralized exchanges have witnessed elevated shopping for exercise. This on-chain statement is predicated on adjustments within the “taker purchase/promote ratio,” which measures the taker purchase and taker promote volumes for a selected asset (Bitcoin, on this case).

For readability, the taker purchase quantity is greater than the taker promote quantity when the worth of the taker purchase/promote ratio is bigger than one. Usually, this situation is taken into account bullish, because it suggests the willingness of buyers to pay the next worth for a particular cryptocurrency (Bitcoin).

Contrastingly, a less-than-one worth for the taker purchase/promote ratio signifies that extra sellers are prepared to half with their belongings at a cheaper price. This phenomenon implies that the sellers are overtaking the consumers, signaling a bearish investor sentiment in a selected crypto market.

In line with Martinez’s publish on X, the Bitcoin taker buy/sell ratio on the HTX and BitMEX exchanges skilled a notable upswing on Saturday, February 8. CryptoQuant knowledge exhibits that the metric rose to round 5.7 on the BitMEX platform within the late hours of the day.

Equally, the Bitcoin taker purchase/promote ratio climbed to as excessive as 16 on the HTX change on Saturday earlier than later crashing down towards 0.4. Nonetheless, this piece of on-chain knowledge signifies a spike in shopping for exercise on the centralized buying and selling platforms.

Fresh buying activity on crypto exchanges might be bullish for the Bitcoin worth, which has lacked the chew wanted to maintain any upward motion. As of this writing, the premier cryptocurrency is valued at round $96,700, reflecting no important worth change prior to now 24 hours.

Is It Time To Purchase BTC?

In a separate publish on X, Martinez suggested that it may be time for buyers to dabble again into the BTC market. The rationale behind this suggestion is predicated on how the crypto crowd is feeling in the mean time.

Current on-chain knowledge exhibits that the group sentiment towards Bitcoin is damaging proper now. Nonetheless, costs have been identified to maneuver within the crowd’s other way a number of occasions prior to now.