A crypto market analyst has in contrast XRP to NVIDIA, an American technology company with one of many greatest tech success tales in historical past. The analyst implied that purchasing XRP in the present day might mirror the chance buyers had when buying NVIDIA shares in 2000 at simply $0.35. The comparability emphasizes the long-term potential of the XRP price and highlights the significance of HODLing.

XRP At this time Reveals Progress Potential Like NVIDIA In 2000

A number one market professional, Egrag Crypto, has drawn a hanging parallel between the present XRP worth and the early days of NVIDIA. He suggested that purchasing XRP now may very well be akin to buying NVIDIA shares at simply $0.35, as recorded in 2000. On the time of writing, the shares are priced round $180, representing a staggering 51,329% enhance from over twenty years in the past.

Associated Studying

Egrag Crypto factors out {that a} $10,000 funding in NVIDIA at $0.35 per share in 2000 would have secured roughly 28,571 shares. At in the present day’s costs, these shares could be value over $5,142,780, demonstrating an funding technique targeted extra on maintaining conviction and patience than timing or predicting the market completely. Past this, the analyst’s comparability illustrates the ability of investing long-term in disruptive applied sciences, displaying how early adoption and willingness to carry via volatility may end up in life-changing positive factors.

Making use of this attitude to XRP, Egrag Crypto highlighted that the cryptocurrency has surged from $0.006 to $3.65 over the previous 10 years. By evaluating the altcoin to NVIDIA shares, he suggests the cryptocurrency might have comparable potential for transformative, explosive growth. Consequently, he implied that the present XRP worth of $2.2 might current a possible entry level for buyers keen to decide to a disciplined long-term technique.

Very similar to NVIDIA in its early days round 2000, XRP remains to be within the preliminary phases of its progress trajectory. The cryptocurrency lately emerged from a prolonged legal battle with the US SEC that had constrained its growth and worth appreciation for almost 7 years. With growing utility and ongoing ecosystem developments, XRP is well-positioned to develop over time. Whereas its worth has declined roughly 20% this 12 months, in keeping with CoinMarketCap, analysts stay optimistic about its long-term outlook.

XRP On-Chain Exercise Hits Report Ranges

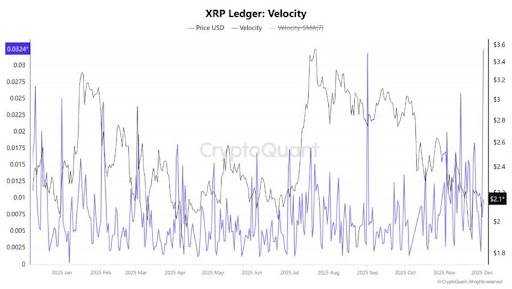

On the technical entrance, XRP has skilled a outstanding surge in on-chain activity, signaling heightened engagement throughout the community. Knowledge from CryptoQuant shows that on December 2, the rate metric for the XRP Ledger (XRPL) spiked to a yearly excessive of $0.0324.

Associated Studying

Analysts from CryptoQuant have revealed that the rise in circulation velocity means that XRP is being actively traded moderately than sitting idle in chilly wallets. The rise factors to excessive liquidity and important participation from whales who seem like shifting massive quantities of tokens.

Moreover, such exercise signifies that the XRP community is experiencing unprecedented ranges of engagement, with extra cash altering arms in a short while than the market has seen to date in 2025.

Featured picture from Freepik, chart from Tradingview.com