The October 10 crash had triggered the worst liquidation occasion to this point in crypto historical past, and the Bitcoin value suffered immensely for it. The preliminary wave of downtrend had despatched it towards $102,000 earlier than restoration, however the subsequent waves eventually saw the price break below $100,000 for the primary time in over 4 months. Nevertheless, because the cryptocurrency appears to be like to be discovering its footing available in the market once more, the query of whether or not it’s time to purchase or watch for additional decline has grown louder, and crypto analyst MarcPMarkets has answered.

Why BTC Is A Good Spot To Purchase

To reply the query of whether or not it’s a good time to purchase BTC regardless of the Bitcoin value crashing in current weeks, MarcPMarkets believes that there’s potential for upside to purchasing BTC at round $100,000. The crypto analyst explains that regardless of the bulk nonetheless being bearish as a result of decline, it doesn’t take away the truth that Bitcoin remains to be presenting alternative to purchase, because it sits in an space that has the potential for a bullish reversal.

One main issue that performs into shopping for BTC being favorable is the truth that the macro surroundings proper now remains to be very a lot inflationary. Given Bitcoin’s capped provide, it has emerged to some because the “good” edge to the countless cash printing being carried out by governments. Thus, as extra fiat foreign money floods the market, it turns into much more useful to carry BTC because the Bitcoin price is expected to rise in response.

The crypto analyst additionally explains that the US authorities shutdown has created what is claimed to be an data hole. With the shutdown in place, useful data has not made its option to the general public, and these lacking reviews might have a significant impact on the value.

Moreover, the US Federal Reserve has been shifting towards a extra dovish stance, which is optimistic for threat belongings akin to Bitcoin. Rates of interest have been dropping, and the FedWatch Software shows that expectations for additional drops to three.50%-3.75% are on the rise. The Fed can be anticipated to finish quantitative tightening and transfer into quantitative easing in the beginning of December, creating an enabling environment for the Bitcoin price to recover.

Bitcoin Value Simply Wants To Maintain Help

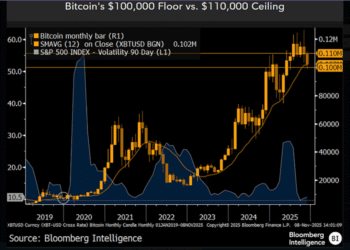

The Bitcoin value remains to be not utterly out of the woods and desires to take care of main help for a restoration to occur. MarcPMarkets factors out that there’s nonetheless help at $98,000, but when the cryptocurrency fails to carry this degree, then the Bitcoin value might be facing the next support at $95,000.

The principle ranges of concern, although, lie round $80,000, as a fall towards this degree might imply the beginning of the subsequent bear market. For one, the analyst explains that $88,000 overlaps with the Wave 1, and failure to bounce from here quickly would imply that the Bitcoin value is in a broader corrective wave.

“I imagine the broader bullish construction (Wave 4) remains to be intact till value overlaps Wave 1 at 88K,” the analyst mentioned. “IF this degree can’t be examined inside this bearish try, it implies a broader Wave 5 is more likely to comply with which theoretically can see a check of the 126K excessive.”

Featured picture from Dall.E, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.