The cryptocurrency market has once again stumbled, with Bitcoin, Ethereum, and XRP costs plunging after what appeared like a promising rebound. Regardless of a robust lineup of bullish narratives, starting from interest rate cuts in October to increasing regulatory readability, the momentum has weakened significantly. This brings into question the crypto industry’s outlook earlier than the tip of the 12 months.

Technical Breakdown Weakens Market Confidence

The sharp pullback began with technical cracks that appeared throughout Bitcoin, Ethereum, and XRP charts. The previous 24 hours have seen Bitcoin, which had just lately climbed above $103,000, resuming what appears like one other downtrend that threatens a break under $100,000.

Based on a recent outlook from The DeFi Report, the rally appears good on paper for Bitcoin and different prime cryptocurrencies. Nonetheless, technical evaluation exhibits that the main cryptocurrency is at the moment under a number of key shifting averages, together with the 50, 100, and 200-day indicators. These shifting averages typically act as dynamic help zones, and breaking under them tends to sign that bullish momentum is fading.

Ethereum has additionally adopted this downward pattern, falling again beneath its help at $3,400. XRP’s case has been comparable, with the cryptocurrency slipping again under $2.3.

The technical deterioration throughout these main belongings is relaying a extra cautious stance amongst merchants, lots of whom now see the market’s construction as weak to additional draw back.

Fading Demand And Institutional Outflows

Though there are nonetheless bullish tales, starting from pro-crypto coverage path beneath the Trump administration to tokenization efforts by conventional monetary establishments, the influx of recent capital has slowed down.

Spot Bitcoin ETFs, which had been as soon as the first supply of institutional curiosity, have seen notable outflows, erasing billions of {dollars} in worth since early October. When it comes to web flows and AUM, the Bitcoin ETFs have been among the many most profitable monetary merchandise in historical past. Nonetheless, since October tenth, the ETFs have seen $1.4b of web outflows.

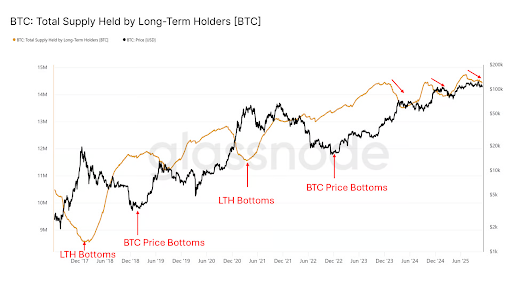

On-chain information additional helps this narrative of cooling demand. Lengthy-term holders are reducing their holdings, and nearly all of these are being absorbed by short-term holders, as evidenced by information from Glassnode.

In the case of market sentiment, optimism is still dominating much of the dialog throughout social media. Michael Nadeau, founding father of The DeFi Report, famous that a big phase of traders are hopeful regardless of the current downturn. Traders appear to be gravitating in direction of bullish stories, in search of one thing to carry on to.

On the time of writing, Bitcoin is buying and selling at $101,720, down by one other 1.3% up to now 24 hours. Ethereum can be down by about 1% in the identical timeframe, buying and selling at $3,330. XRP is feeling the brunt the most, down by 4.5% up to now 24 hours and buying and selling at $2.2

Featured picture created with Dall.E, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.