Dogecoin is again in a well-known posture on a number of timeframes, in keeping with crypto analyst Osemka (@Osemka8), who argues that value motion is monitoring the “OTHERS” index virtually one-for-one and is now deep inside a textbook Wyckoff accumulation. His newest charts—one a decade-long view, the opposite a each day construction map—body the present chop because the basic check part that tends to exhaust either side earlier than development continuation.

Dogecoin’s Excellent Wyckoff Lure

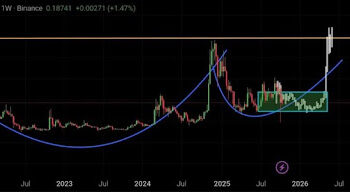

On the long-horizon chart, Dogecoin’s historical past resolves right into a sequence of rounded basing formations that preceded its two vertical advances. The primary arc matured from 2014 into 2017 earlier than the preliminary markup; the second spanned 2018 by 2020 and ended with the 2021 blow-off; and a 3rd, broader arc has been curving beneath value motion from 2022 into 2025.

Whereas DOGE is presently buying and selling beneath $0.20, the rounding contour is once more nonetheless intact—visually rhyming with the 2 prior launch setups that culminated in fast expansions as soon as provide thinned out above vary highs.

The shorter-term each day chart annotates the Wyckoff schematic in granular element. Osemka labels the Preliminary Assist (PS) and Promoting Climax (SC) earlier within the 12 months, adopted by an Computerized Rally (AR) and a Secondary Check (ST) to substantiate the decrease boundary of a gently rising channel.

A pointy downdraft right into a “Spring”—accompanied by conspicuously excessive capitulation quantity—punctured the channel intraday earlier than snapping again, an motion that always features because the terminal shakeout of Part C within the classical mannequin.

Associated Studying

Since then, value has coiled in what the chart calls the “Check part,” compressing roughly between $0.18 and $0.22 as bids and presents probe for residual provide. Overhead, a shaded native provide zone sits within the $0.26 to $0.28 space and features up with the higher half of the channel; the channel’s ceiling runs into the low-$0.30s (~$0.32), the place preliminary provide repeatedly slows advances.

“DOGE coin follows OTHERS index virtually 1:1. An ideal Wyckoff accumulation vary. Check part driving everybody nuts,” Osemka famous by way of X.

Macro Surroundings Nonetheless Not Prepared But

The analyst’s market learn ties the micro to the macro playbook he has tracked earlier than. In an October 7 be aware, Osemka highlighted that DOGE is usually late to the danger rotation: breadth improves first, IWM (small caps: iShares Russell 2000 ETF) breaks out, alts start to rise, and solely when the OTHERS index clears its prior all-time excessive does Dogecoin are likely to speed up.

“Rounded backside on DOGE every time. Since DOGE is that coin that does nothing all the cycle then rips faces off, it’s fascinating to check what occurs after macro setting switches to Threat-on mode. What I can get from that is nothing particular. As soon as IWM breaks out, alts begin to rise and DOGE nonetheless lags behind, however only a bit. Solely as soon as OTHERS breaks it’s ATH is when DOGE begins flying,” the analyst defined.

His most up-to-date alternate with followers retains that conditionality intact; he acknowledges that, by his OTHERS fractal, “one stab decrease” stays attainable earlier than markup, particularly with Bitcoin liquidity just a few p.c decrease on his gauges. In Wyckoff phrases, that might be a remaining check or spring-within-the-spring, designed to validate demand at or simply beneath the $0.18–$0.22 coil earlier than a Signal of Energy (SOS) can assert above $0.32.

Associated Studying

Context throughout the memecoin advanced is blended. Osemka notes that PENGU has been outperforming DOGE on his relative charts “in the meanwhile,” whilst he lists TAO, DOGE, and ONDO because the “best-looking setups” for altcoins, with TAO “by far the strongest” and “different alts” screened as weak. The implication is rotation quite than dispersion: DOGE’s construction is constructive, however affirmation nonetheless hinges on a clear exit from the buildup vary and the broader risk-on ignition he maps by way of IWM and OTHERS.

For merchants mapping ranges off these panels, the near-term battlegrounds are express. The check field at $0.18–$0.22 has to carry its sequence of upper lows to maintain Part D in play; the native provide at $0.26–$0.28 is the primary significant resistance shelf that have to be absorbed; and the rising channel high close to ~$0.32 is the place bulls take management.

Solely sustained acceptance above these bands would improve the construction from accumulation to markup, aligning DOGE with the 2017 and 2021 launch sequences that Osemka’s rounded-bottom study brings into focus. Till then, the “good Wyckoff lure” characterization stays apt: the vary is doing what ranges do—testing endurance and conviction—whereas the intermarket guidelines that has traditionally preceded DOGE’s impulsive legs waits for its remaining tick.

At press time, DOGE traded at $0.194.

Featured picture created with DALL.E, chart from TradingView.com