Ethereum (ETH) has been on an uptrend since September 28, surging from round $3,800 to the mid $4,000 vary on the time of writing. Based on current information from Binance, ETH went via a “reset” in the course of the second half of September and early October, and will now be eyeing the $5,000 worth degree.

Ethereum Reset Over, New Highs Quickly?

Based on a CryptoQuant Quicktake publish by contributor Arab Chain, ETH underwent a wholesome reset over the previous few weeks. Whereas the digital asset initially dropped to $3,800 – $3,900 vary, it’s now buying and selling within the mid $4,000 degree.

Associated Studying

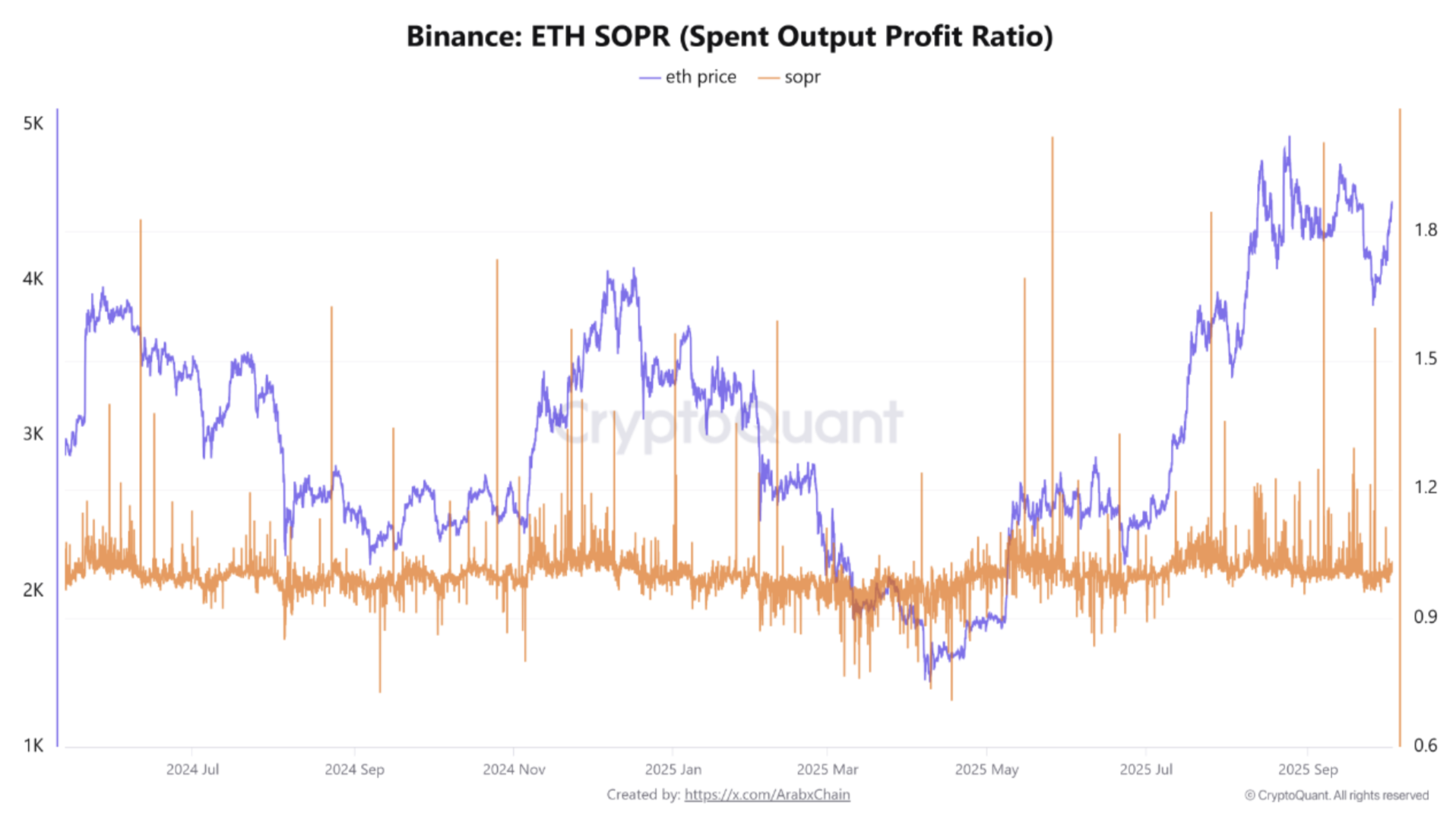

On the similar time, ETH’s Spent Output Revenue Ratio (SOPR) remained unstable round 1.0, with a number of spikes above one and a singular outlier, proven within the chart under. It means that short-term inflows are producing sufficient demand to satisfy the availability.

In easy phrases, any worth decline is shortly reversed so long as the ETH SOPR stays above 1.0. The chart exhibits a neighborhood backside created in late September close to $3,800 – $3,900.

This native backside was quickly adopted by a gradual rebound to $4,500. Nevertheless, the reversal didn’t happen without delay. As an alternative, it occurred in a number of levels, with quick worth corrections that didn’t go under earlier lows.

For many of this era, the SOPR hovered between 0.98 and 1.03, a impartial vary that means a rotation in place as a substitute of a broad market sell-off. Though some flash highs surged above 1.0, these profit-taking bursts had been shortly absorbed by the sturdy demand for ETH.

At present, Ethereum is exhibiting indicators of reaccumulation. So long as any pullback retains the SOPR at or above 1.0 and the assist degree at $4,000 shouldn’t be breached, ETH may gain advantage from a continued upside situation. Arab Chain added:

A sustained break above 4.5K would consolidate demand momentum and open the best way for regularly increased targets, whereas a break under 4.0K with SOPR <1 could be the primary clear signal that sellers have taken management.

ETH Reserves On Alternate Proceed To Dwindle

Apart from ETH’s bullish momentum that will propel it to $5,000, the digital asset’s reserves on crypto exchanges proceed to say no. Current evaluation discovered that an rising variety of new ETH traders are withdrawing ETH for self-custody or staking.

Associated Studying

ETH whale habits additionally factors towards a possible upcoming worth rally for the cryptocurrency. Just lately, ETH whales scooped as a lot as $1.73 billion price of ETH, sending trade balances to a nine-year low.

From a technical standpoint, Ethereum’s Relative Energy Index (RSI) lately gave a uncommon bullish sign, suggesting a possible worth appreciation to $8,000. At press time, ETH trades at $4,471, up 2.6% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com