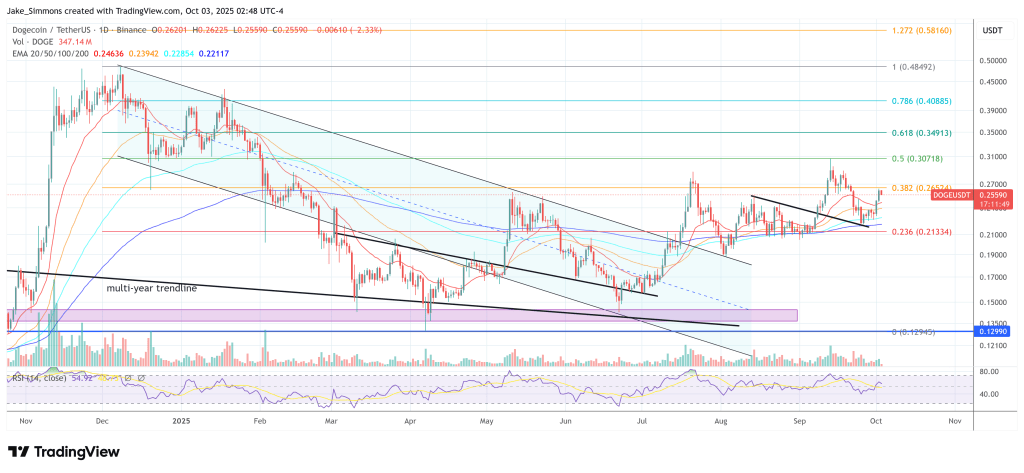

Dogecoin’s every day chart is coiling right into a technically clear inflection, in line with dealer IncomeSharks, who posted a rising channel and an on-balance quantity (OBV) wedge that collectively map a simple path to greater ranges. “DOGE – Not a foul setup. Apparent channel and clear OBV wedge. Ideally OBV will escape earlier than worth,” the analyst wrote, sharing the chart that frames the present advance.

Dogecoin Breakout Watch: $0.33 Set off On Deck

Value has been respecting a well-defined ascending channel that has ruled commerce since early summer time. A number of touches on each boundaries validate the construction: greater lows alongside the decrease trendline from July by means of early October, and lower-high rejections towards the higher rail by means of mid-July, late August, and late September.

After a recent rebound off the rising help space in the beginning of October, DOGE has pushed again into the channel’s mid-range, the place it sometimes pauses earlier than the next impulse. IncomeSharks’ path sketch envisions a short consolidation or shallow pullback contained in the channel, adopted by a drive towards the ceiling.

Associated Studying

The vacation spot is specific on the chart. The higher boundary at present intersects within the low-to-mid $0.30s, and the drawing marks a breakout try between roughly $0.32 and $0.33. That zone represents confluence: it’s the place the rising channel’s resistance comes into play and the place late-September provide capped the prior thrust. A decisive every day shut by means of that band would verify a bullish channel breakout and depart the door open for a run in the direction of the early December 2024 excessive at $0.4843.

Quantity dynamics are the inform to look at. The decrease panel plots OBV, a cumulative measure of purchase/promote stress, compressed right into a symmetrical wedge: a gently rising base since mid-July and a descending lid drawn off the July and September OBV peaks. This sort of narrowing vary in OBV typically precedes a directional growth.

Associated Studying

IncomeSharks’ remark underscores that sequencing: an OBV breakout forward of worth would sign recent accumulation and enhance the chances that worth follows with a push to the channel’s prime. Conversely, failure of OBV at its wedge help would warn that the rebound lacks sponsorship, growing the chance of one other check of the decrease channel line.

Structurally, the setup is simple. So long as DOGE continues to carry the rising help that has outlined the development since July, the trail of least resistance stays up inside the channel. A clear OBV break of its wedge would strengthen that view.

If bulls can then clear overhead provide and convert the $0.32–$0.33 band into help, the chart would verify the breakout roadmap IncomeSharks outlined. If as a substitute worth loses the ascending base, the channel thesis could be invalidated and the market would probably revisit prior higher-low areas alongside the decrease rail earlier than trying one other development leg.

At press time, DOGE traded at $0.2559.

Featured picture created with DALL.E, chartfrom TradingView.com