Knowledge exhibits Bitcoin has misplaced curiosity to Ethereum and altcoins just lately as their mixed futures quantity has damaged previous the 85% mark.

Ethereum & Altcoins Have Seen Their Futures Quantity Rise Just lately

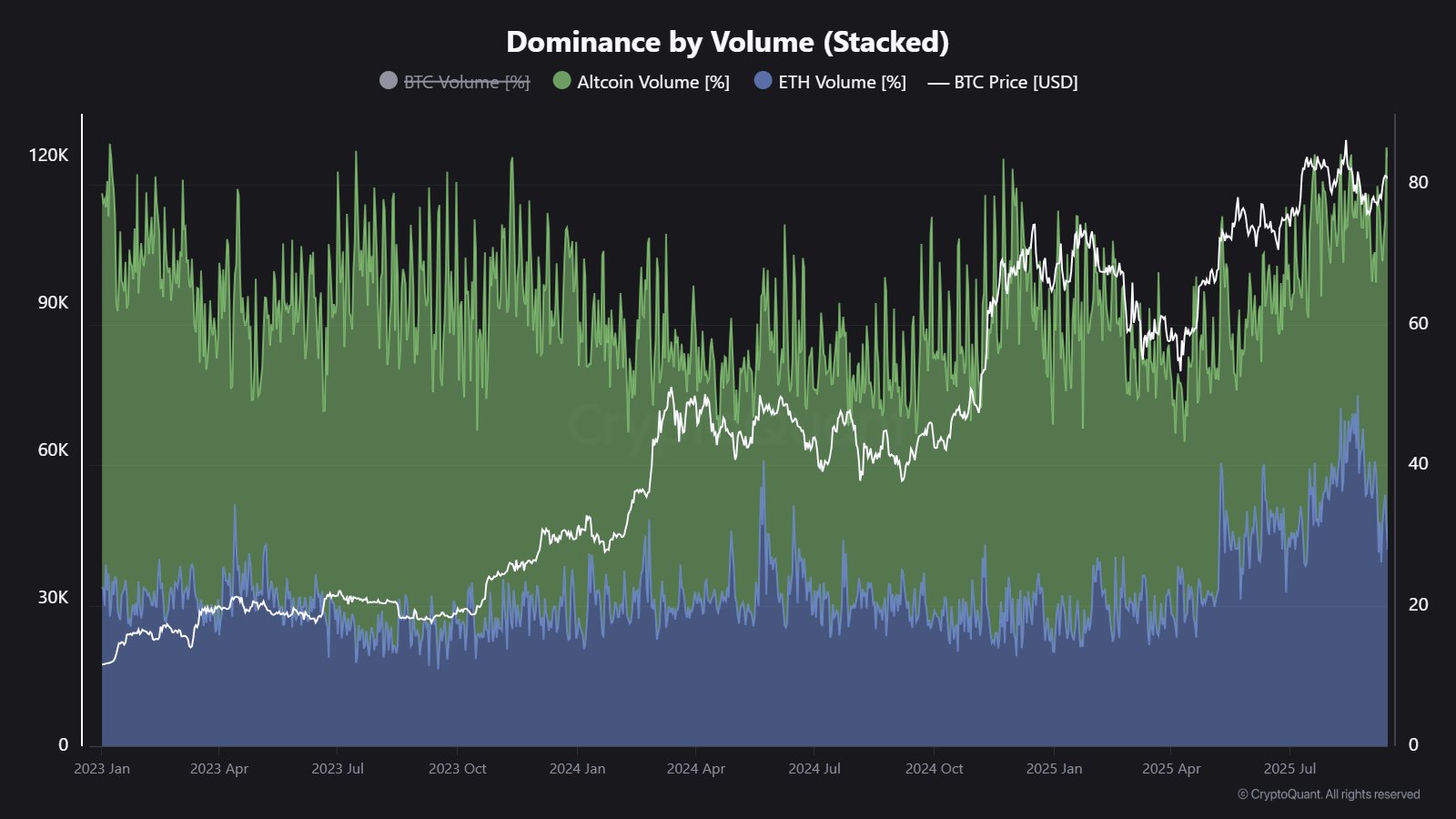

In a brand new post on X, CryptoQuant group analyst Maartunn has talked in regards to the newest pattern within the futures buying and selling quantity share of Ethereum and the altcoins. The futures trading volume right here naturally refers back to the quantity that’s turning into concerned in futures-related trades on the assorted derivatives exchanges.

Beneath is the chart shared by Maartunn that exhibits the pattern within the dominance on this metric for ETH and the alts over the past couple of years:

The worth of the indicator seems to have gone up for each of those property in latest days | Supply: @JA_Maartun on X

As is seen within the graph, the futures buying and selling quantity dominance has seen a pointy enhance for the altcoins just lately, implying that speculative curiosity in these cash has gone up.

The metric continues to be considerably down for Ethereum in comparison with its earlier excessive, but it surely has nonetheless additionally loved an uptick similtaneously the altcoin development.

Mixed, ETH and the alts occupy round 85.2% of the whole cryptocurrency futures buying and selling quantity following the rise. Which means that the remaining portion, Bitcoin, has gone beneath 15% in dominance.

Traditionally, intervals like these have been a foul omen for not simply BTC, however the market as a complete. Examples of those are seen within the chart throughout each the late 2024 and Summer season 2025 value tops.

Thus, contemplating that Ethereum and the altcoins are as soon as once more dominating futures buying and selling exercise, it’s attainable that Bitcoin and different property could also be in for some volatility.

In another information, on-chain analytics agency Santiment has shared in an X post an replace on how the assorted initiatives within the digital asset sector rank up by way of the Development Activity. This indicator measures the whole quantity of labor that the builders of a given mission are doing on its public GitHub repositories.

The metric makes its measurement in items of “occasions,” the place one occasion is any motion taken by the developer on the repository, just like the push of a commit or creation of a fork.

Right here is the desk posted by Santiment that exhibits the rating for cryptocurrency initiatives on the premise of their 30-day Improvement Exercise:

Appears to be like like ICP has maintained its place on the prime | Supply: Santiment on X

As displayed above, Ethereum is simply the tenth largest mission by way of 30-day Improvement Exercise, regardless of its market cap being second solely to Bitcoin. The mission that’s seeing its builders work the toughest proper now could be Web Pc (ICP), which has the metric sitting at a worth practically thrice that of ETH’s.

ETH Value

Ethereum recovered above $4,750 earlier, but it surely appears the asset’s value has as soon as once more confronted a pullback because it’s now again at $4,450.

The pattern within the value of the coin over the past 5 days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.web, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.