The crypto market is coming into a pivotal week as Bloomberg analysts verify that XRP and Dogecoin exchange-traded funds (ETFs) are on observe to launch within the U.S.

The funds, managed by REX-Osprey, have cleared regulatory hurdles underneath the Investment Company Act of 1940, a pathway that has made approval sooner in comparison with Bitcoin ETFs.

Upcoming XRP and Dogecoin ETFs Increase Optimism

The XRP ETF (ticker: XRPR) and Dogecoin ETF (ticker: DOJE) are anticipated to debut inside days, with Dogecoin’s itemizing scheduled for Thursday and XRP’s by Friday.

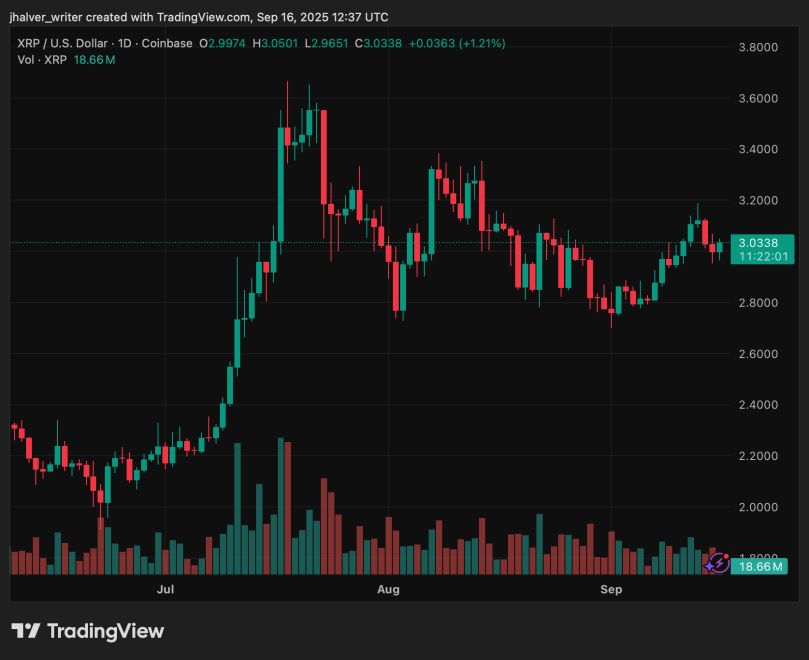

XRP's value traits sideways on the each day chart. Supply: XRPUSD on Tradingview

This would be the first U.S. ETF for Dogecoin, offering conventional buyers with entry to the meme coin with out the necessity for wallets or direct token possession. For XRP, the launch signifies a milestone because it turns into the primary main altcoin ETF after Ethereum to achieve entry into U.S. markets.

Bloomberg’s Eric Balchunas highlighted that the XRP fund will mix direct holdings of the token with publicity to different world spot ETFs. In the meantime, James Seyffart famous that over 90 further crypto ETF purposes are at the moment awaiting SEC overview, together with these tied to Litecoin and Avalanche.

What It Means for Altcoin Buyers

The arrival of XRP and Dogecoin ETFs indicators rising institutional acceptance of altcoins, shifting past Bitcoin and Ethereum. Analysts consider these merchandise might appeal to billions in inflows from retirement funds, brokerage platforms, and conventional funding accounts.

For Dogecoin, the ETF marks a leap from meme tradition into mainstream finance. Already, DOGE has seen value momentum round $0.26–$0.28, with whales accumulating closely forward of the launch.

Some technical analysts argue Dogecoin is finalizing a bullish chart sample that would push its value towards $0.35, $0.45, and even $1 if momentum holds.

XRP, however, is positioned as a utility-driven altcoin with sturdy liquidity. Its ETF might speed up inflows into Ripple’s ecosystem, particularly if paired with dovish world financial insurance policies within the coming weeks.

Broader Market Influence

The timing of those ETF launches coincides with key central financial institution conferences. The U.S. Federal Reserve is anticipated to chop charges by 25 foundation factors, whereas the Financial institution of England and Financial institution of Japan will announce selections inside days.

Analysts recommend that if a number of central banks coordinate easing, the consequence might spark a mega altseason, driving Bitcoin previous $120,000 and Ethereum past resistance ranges.

For buyers, the message is obvious: XRP and Dogecoin ETFs should not simply symbolic victories; they may remodel altcoin adoption in conventional finance. Now we wait and see what could unfold over the subsequent ten days.

Cowl picture from ChatGPT, DOGEUSD chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.