Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

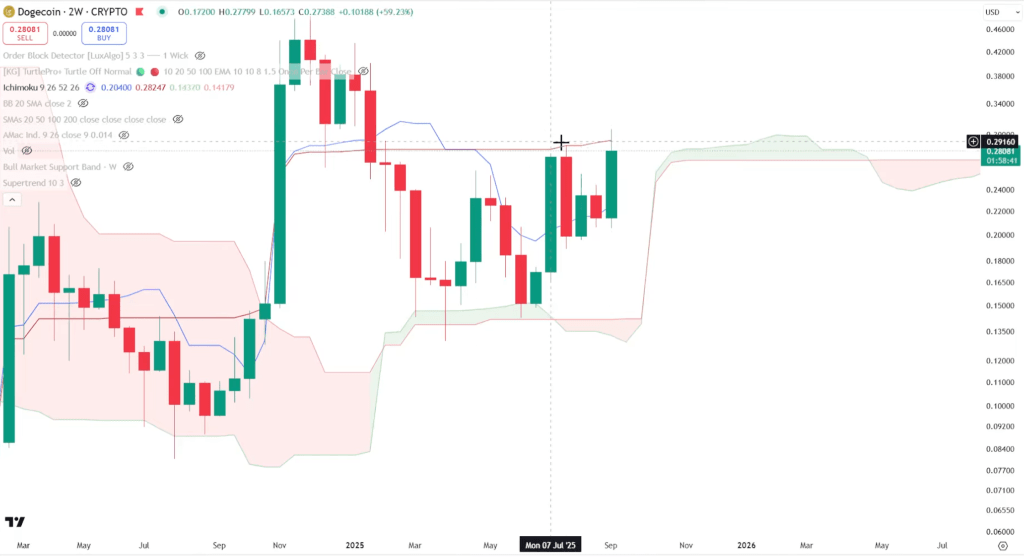

Dogecoin sits at a technically pivotal juncture, in line with crypto analyst CantoneseCat (@cantonmeow), who argues that the subsequent decisive inflection arrives at $0.54—“the ultimate boss”—if the coin can translate an more and more constructive multi-timeframe construction into weekly acceptance above the Ichimoku cloud.

Recording simply hours forward of the weekly shut on September 14, he framed DOGE’s backdrop as a gentle, methodical rebuild powered by higher-timeframe assist retention fairly than headline-driven spikes. “I’m bullish on Dogecoin,” he mentioned. “There’s nothing that I’m actually too bearish about right here.”

Dogecoin Cost Stalls At Ichimoku Wall

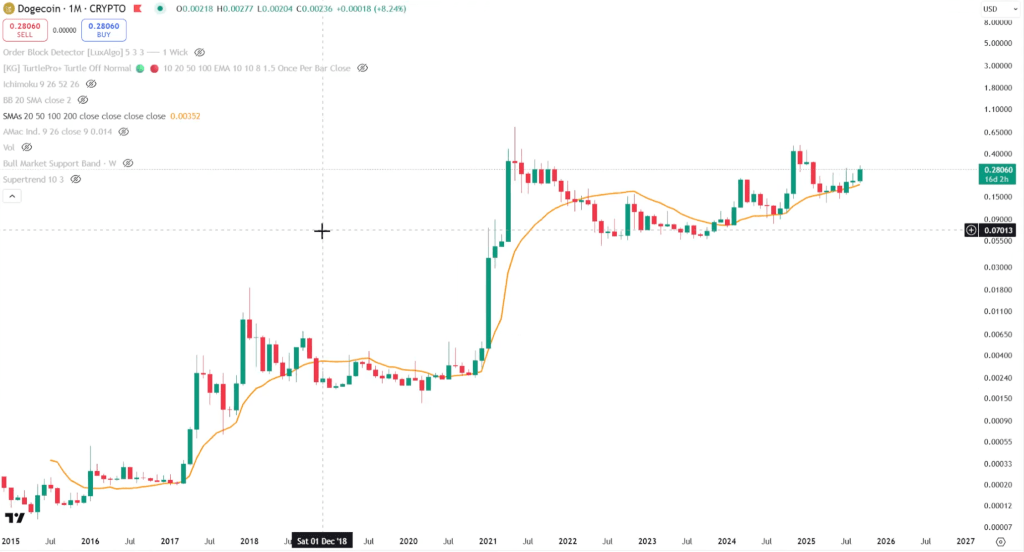

The crux of his view is that Dogecoin has reclaimed and maintained the important thing foundations that traditionally precede its enlargement phases. On the month-to-month chart, value has pushed into the Ichimoku cloud and continues to respect the 20-month shifting common as positively sloping assist.

Associated Studying

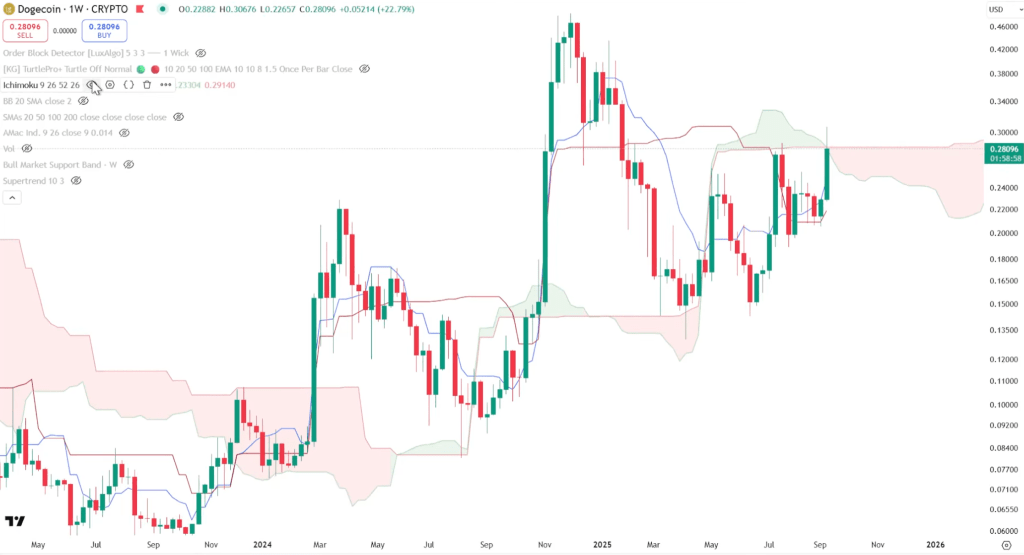

He emphasised how that shifting common has repeatedly served because the trampoline for prior advances: “Each single time at any time when it served as assist, it’ll push up larger.” In parallel, DOGE has re-engaged the higher Bollinger Band on the weekly timeframe whereas staying above the 20-week shifting common—a configuration that, in his learn, indicators persistent underlying demand, even when the primary contact with overhead resistance produces hesitation.

The weekly and two-week Ichimoku constructions dominate his near-term roadmap. On the two-week chart, he described “a V-shaped restoration pretty much as good because it’s going to get,” with the Kijun performing because the quick ceiling.

On the weekly, he anticipated the shut to find out whether or not the coin might transition from probing resistance to establishing development continuation. If the primary try failed, he mentioned, the setup would stay intact supplied the 20-week shifting common continued to rise and DOGE preserved its higher-lows construction contained in the cloud. The trail ahead, in his phrases, stays “one degree at a time.”

Fibonacci confluence is the second pillar. CantoneseCat locations robust weight on the 0.618 logarithmic retracement because the “gatekeeper” for DOGE’s next leg. A confirmed weekly and month-to-month maintain above that line, he contends, would elevate the likelihood of a measured run into clustered resistance close to $0.33 and $0.41, culminating in a check of $0.54.

He repeatedly characterised $0.54 because the breakpoint that will flip the narrative from range-bound to trending. “If we shut the week above the 0.618, then it does improve the opportunity of difficult a few of these larger ranges at 33 cents, 41 cents after which 54 cents—going to be the ultimate boss,” he mentioned. Clearing that last boss, he added, would put “all-time highs” again on the desk with out asserting a timeline.

The analyst additionally acknowledged that broader beta nonetheless issues on the margin. Bitcoin’s weekly posture round its 20-week Bollinger midline and Tenkan line, he mentioned, usually determines whether or not crypto spends weeks grinding larger or sliding into lower-band purgatory. Into the weekend, he thought BTC was “reclaiming the 20-week,” with a Bollinger squeeze that “anticipate[s] an even bigger transfer to return.”

Associated Studying

That issues for DOGE primarily insofar as a constructive BTC backdrop tends to loosen up threat constraints and permit altcoin momentum to precise. However the Dogecoin name stands by itself technical legs: month-to-month cloud engagement, two-week V-recovery, a positively sloped 20-week common, repeated upper-band faucets, and—crucially—the 0.618 maintain.

CantoneseCat additionally cautioned in opposition to over-interpreting the necessity for good retests. On Bitcoin he famous that markets typically “manufacture some sort of information” to justify a sweep, a dynamic that may simply as simply play out on DOGE throughout liquidity hunts. For Dogecoin, meaning permitting for shallow backfills towards dynamic helps with out declaring the construction damaged. His emphasis was on continuation patterns—notably flags—forming above reclaimed ranges fairly than on deep resets.

Targets stay crisp and conditional. The primary goal is to take care of acceptance above the 0.618 log Fib on weekly and month-to-month closes. From there, he expects a stair-step sequence by roughly $0.33 and $0.41 earlier than any credible assault on $0.54. He was specific that $0.54 is the battlefield that will resolve whether or not Dogecoin can transition from a constructive restoration to a development acceleration part. Solely a weekly breakout and subsequent conversion of the cloud into assist would validate that shift.

Dogecoin Weekly Shut Is Combined

After the weekly candle printed, CantoneseCat confirmed the combined—however nonetheless constructive—outcome. “DOGE weekly candle closed beneath the Ichimoku cloud, however a newly forming weekly candle is now contained in the Ichimoku cloud to start out the week,” he wrote. In a second be aware he added: “$DOGE closed the week above 0.618 log fib.”

Virtually, that consequence preserves the bullish scaffolding whereas suspending a definitive cloud break by a minimum of one other bar. The maintain above the 0.618 retains the $0.33 and $0.41 magnets lively; the early push again into the cloud suggests momentum is trying to re-assert. The thesis stays unchanged: so long as Dogecoin defends the 0.618 and the 20-week shifting common continues to slope larger, the market will hold steering towards a confrontation with the $0.54 “last boss.”

At press time, DOGE traded at $0.2629.

Featured picture created with DALL.E, chart from TradingView.com