Key Notes

- Bitcoin Money (BCH) gained 10% over seven days, consolidating above $602 as high 20’s finest performer.

- Bitcoin’s retrace from $124,500 to $108,300 fueled demand for adjoining bets like Bitcoin Money.

- Ethereum and Chainlink led weekly losers, dropping 4.1% and 5.8% amid profit-taking and regulatory issues.

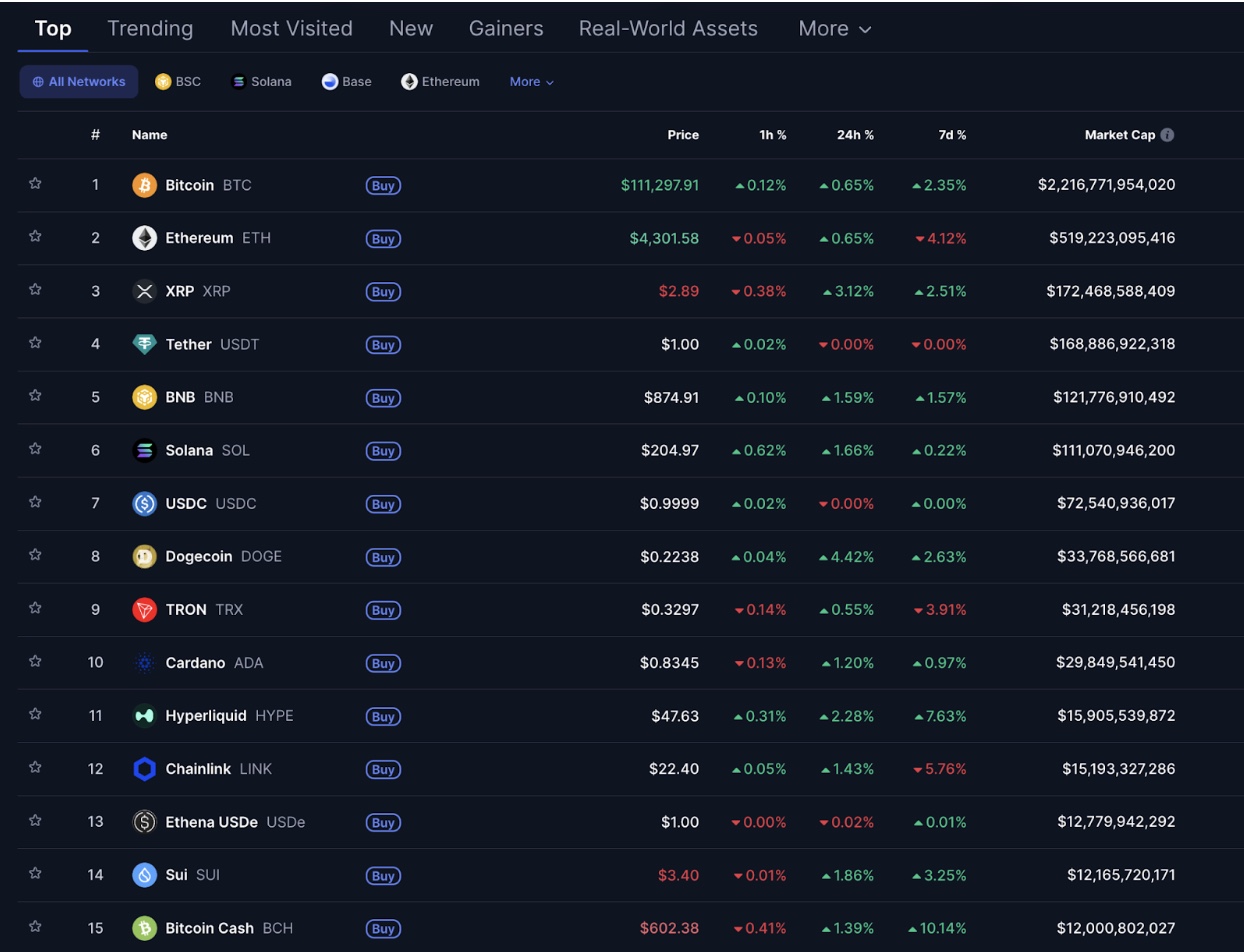

Bitcoin Money (BCH) value consolidated above $602 on Sunday, September 7, posting 10% positive factors on the weekly vary and rising because the best-performing high 20 cryptocurrency, based on CoinMarketCap information.

With 10% positive factors, Bitcoin Money (BCH) leads weekly high 20 Cryptocurrency market efficiency, as of September 7, 2025 | CoinMarketCap

The rally displays merchants looking for Bitcoin-adjacent upside as BTC value motion stalled beneath file highs. Bitcoin reached an all-time high of $124,500 on August 14 however ended the month at $108,300, down 6%. Makes an attempt to retest $120,000 in early September have failed, leaving BTC consolidating close to $111,000 at press time, with a light 2% uptick on the seven-day candle.

This efficiency hole has directed speculative flows into property like Bitcoin Money, the place merchants anticipate correlated upside with out the heavy resistance ranges limiting Bitcoin itself. BCH market cap now sits close to $11.98 billion, supported by $326 million in 24-hour quantity.

If Bitcoin stays range-bound, BCH may proceed to draw capital rotation as buyers diversify whereas sustaining publicity to constructive narratives surrounding the worldwide Bitcoin ecosystem.

Ethereum and Chainlink Emerge High Losers as Merchants E book Earnings

Whereas Bitcoin Money value rose 10% over the previous week, Ethereum (ETH) and Chainlink (LINK) led the losers amongst high 20 property. ETH slipped 4.1% over seven days to commerce at $4,288, whereas LINK fell 5.8% to $22.30 at time of publication.

Ethereum value declines to $4290, down 7% over the previous week. | CoinMarketCap, September 7, 2025.

Ethereum confronted promoting strain after studies {that a} new Nasdaq ruling tightened restrictions on corporate fundraising for cryptocurrency purchases. This dampened sentiment round institutional ETH ETF inflows, and strategic reserve accumulations final week, weighing on buying and selling volumes, which dipped at 4.4% previously week, corresponding with the ETH value decline.

Regardless of sustaining a $517 billion market cap, ETH’s failure to construct momentum has left it lagging friends like Solana and XRP on the weekly time vary.

Chainlink’s decline follows profit-taking after final week’s surge, which was fueled by US government macroeconomic data being relayed via Chainlink’s oracle infrastructure, in partnership with Pyth Network.

The preliminary rally drove LINK value to multi-month peaks above $25, however because the catalyst light, merchants locked in positive factors over the previous week, driving costs down 6% to hit $22.2 on lowered each day quantity of $509 million.

Bitcoin Money’ double-digit rally, amid energetic market dips in giant markets like ETH and LINK spotlight how fading catalysts and regulatory indicators are driving short-term market rotation as broader crypto sentiment stays cautiously bullish.

Maxi Doge Presale Positive factors Momentum as Bitcoin Money Outperforms

With Bitcoin Money rising because the week’s strongest top-20 performer, buyers are additionally trying towards speculative initiatives like Maxi Doge (MAXIDOGE). The newly launched meme-drive token is gaining traction as merchants discover high-risk, high-reward community-driven utilities with no stop-losses.

At the moment priced at $0.00025, the Maxi Doge presale has already raised greater than $1.9 million of its $2.2 million goal. Potential contributors can nonetheless safe MAXIDOGE tokens by means of the official Maxi Doge site earlier than the presale strikes into its subsequent stage.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.