Key Takeaways

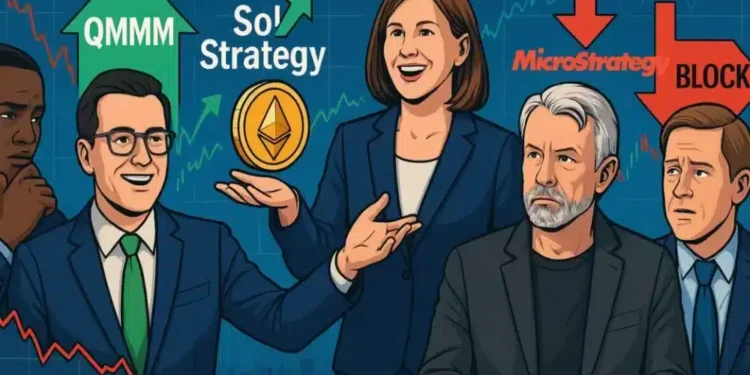

Hong Kong-based QMMM Holdings sparked a 1,700% inventory surge after saying a $100 million crypto treasury plan. The hype round company crypto treasuries continues to develop.

Crypto adoption isn’t simply reshaping monetary markets; it’s additionally rewriting the playbook for company progress.

For some corporations, constructing a crypto treasury is proving to be greater than only a diversification technique; it’s turning into a robust catalyst for inventory efficiency.

QMMM Holdings surges on crypto

The newest instance comes from Hong Kong-based QMMM Holdings, whose announcement of a $100 million crypto treasury despatched its shares skyrocketing over 1,700% in a single day.

This adopted the agency’s announcement concerning plans to combine synthetic intelligence with blockchain, aiming to create a platform that mixes crypto analytics with a Web3 autonomous ecosystem.

As a part of that imaginative and prescient, the corporate revealed plans to determine a diversified crypto treasury, with Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] at its core.

In line with QMMM, the treasury is predicted to launch with an preliminary worth of $100 million.

Nevertheless, the main points round financing stay unclear.

A January SEC submitting reveals that the corporate concluded its final fiscal 12 months on the thirtieth of September 2024, with roughly $500,000 in money and equivalents, alongside a internet lack of $1.58 million.

This hole between ambition and obtainable assets has raised questions on how the agency will execute such an aggressive plan.

Nonetheless, QMMM insists the treasury is simply the start.

The corporate says it intends to develop into high-quality crypto belongings with long-term upside, Web3 infrastructure tasks, and even world premium fairness belongings that align with its broader strategic imaginative and prescient.

However whereas QMMM’s inventory skyrocketed on the information, not each crypto treasury play is having fun with the identical trajectory.

Different crypto treasury corporations and their efficiency

Canadian agency Sol Methods, which manages a Solana treasury and staking operations, noticed its Nasdaq-listed shares tumble 42% on ninth September.

Its itemizing on the Canadian Securities Trade fared solely barely higher, sliding 16.34% to 10.60 CAD.

Earlier this week, Eightco Holdings additionally made headlines after announcing plans to construct a Worldcoin [WLD] treasury.

The transfer initially despatched its inventory hovering, however by press time, shares had slipped greater than 10% to $40.17.

Nevertheless, regardless of combined outcomes, crypto treasury methods are clearly gaining traction, with corporations giant and small making an attempt to copy Michael Saylor’s high-risk, high-reward playbook.

In opposition to this backdrop, Lion Group Holding Ltd. (LGHL) additionally announced plans to alternate its Solana and SUI [SUI] holdings for Hyperliquid [HYPE].

With this, the agency aimed to realize publicity to the venture’s Layer-1 chain and on-chain perpetual alternate.

This coincided with the worldwide crypto market cap slipping to $3.89 trillion, down 0.73% previously 24 hours.

Corporations proceed to actively add and reshuffle their crypto portfolios to align with rising ecosystems, at the same time as total market sentiment stays cautious.