Key Notes

- The brand new Gemini XRP bank card offers tiered rewards from 1-4% cashback with service provider promotions reaching as much as 10%.

- Gemini expanded RLUSD integration as a base foreign money throughout all spot pairs to streamline buying and selling for US prospects.

- The alternate secured a $75 million credit score line from Ripple whereas making ready for public itemizing regardless of current losses.

Cameron Winklevoss, co-founder of Gemini, confirmed the launch of the XRP version of the Gemini Credit score Card, a transfer that strengthens each the alternate’s product choices and Ripple’s ecosystem.

According to Gemini, the brand new card permits prospects to earn as much as 4% again in

XRP

$2.89

24h volatility:

4.3%

Market cap:

$171.75 B

Vol. 24h:

$6.68 B

, immediately deposited into their Gemini accounts.

Behold, the XRP version of the @Gemini Credit score Card! Earn as much as 4% again in XRP each time you swipe. It is that simple. Superb awaits https://t.co/yxURzST3hN

— Cameron Winklevoss (@cameron) August 25, 2025

The rewards program spans a number of classes: 4% on fuel, EV charging, and rideshares; 3% on eating; 2% on groceries; and 1% on common purchases. Gemini has additionally launched merchant-specific promotions that enhance cashback to as a lot as 10% in XRP.

Co-founder Tyler Winklevoss additionally chimed in on the launch, calling it a win for the “XRP Army,” providing recent methods for customers to earn and have interaction with the Ripple-issued token. This aligns with Gemini’s broader aim of deepening crypto adoption in each day transactions.

Calling on the XRP Military. This Credit score Card 💳 was made for you. Earn as much as 4% again in XRP each time you swipe. Onward! 🚀 https://t.co/oeC2Qg1mSG

— Tyler Winklevoss (@tyler) August 25, 2025

Furthermore, Gemini introduced expanded help for Ripple’s RLUSD after initially listing the stablecoin in May. US customers will now be capable to use RLUSD as a base foreign money throughout all Gemini spot pairs, streamlining buying and selling and lowering the necessity for a number of conversions. Ripple CEO Brad Garlinghouse described this integration as a milestone for mainstream adoption, connecting secure funds with broader asset utility.

Gemini Eyes IPO Amid Strengthened Ripple Ties

The XRP bank card launch and RLUSD integration come at a pivotal time for Gemini, which is positioning itself for a public itemizing in the USA. The agency lately revealed a $75 million credit score line from Ripple in its official IPO filings with the US Securities and Change Fee (SEC), deepening the partnership between the 2 firms.

Regardless of posting a $282 million web loss within the first half of the 12 months, Gemini’s newest bank card partnership with Ripple alerts its intention to press ahead with its world growth ambitions. Just lately, the firm secured a MiCA license in Malta to function within the EU and launched tokenized US shares, signaling diversification past pure crypto buying and selling.

By tying buyer rewards and alternate liquidity extra intently to Ripple’s ecosystem, Gemini is betting that these improvements is not going to solely yield passive revenue for XRP holders but additionally show retail demand to potential buyers because it edges in direction of its public market debut.

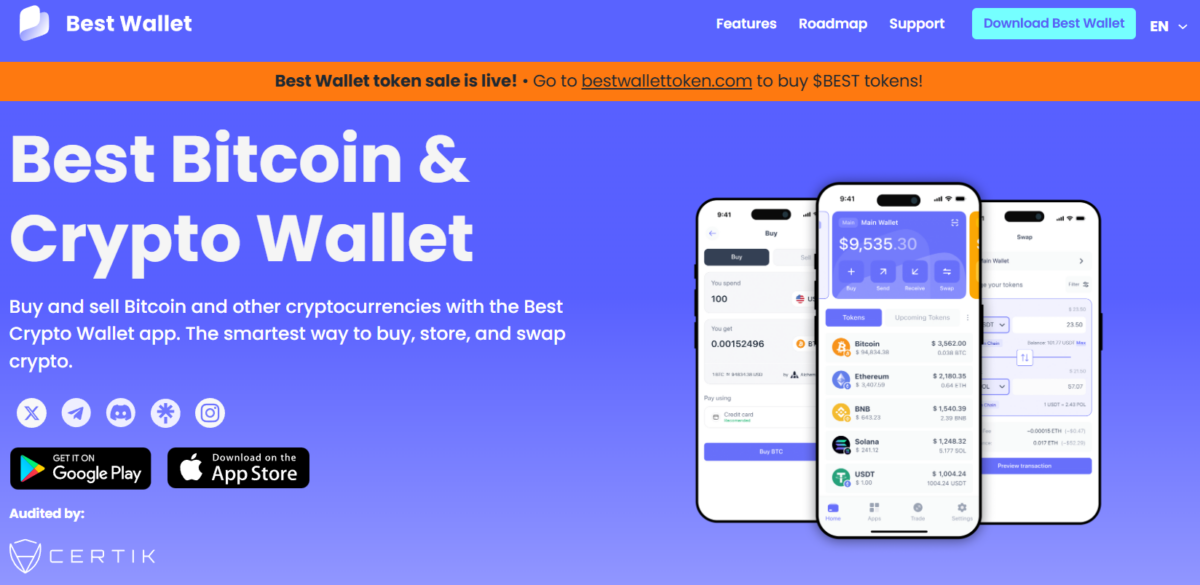

Greatest Pockets Presale Positive factors Momentum Amid Gemini’s XRP Credit score Card Launch

Gemini’s rollout of an XRP cashback bank card has additionally amplified investor curiosity in safe multi-chain wallets similar to Greatest Pockets (BEST).

Greatest Pockets Presale

The venture has already raised over $15 million in its presale, providing customers low transaction charges, enticing staking yields, and precedence entry to decentralized purposes. Designed with multi-chain compatibility, Greatest Pockets is rising as a most popular selection for merchants managing belongings throughout ecosystems like Ripple, Solana, and Ethereum.

The presale’s sturdy momentum alerts rising demand from buyers looking for each safety and yield. With entry tiers nonetheless open, early contributors have a possibility to safe BEST tokens at discounted costs via the official Best Wallet site.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.