Bitcoin’s worth motion this month has left merchants watching intently as massive gamers double down on bullish calls. In line with VanEck’s research, the funding agency has reaffirmed a $180,000 year-end goal even after Bitcoin slid from a current excessive, an indication that some institutional consumers usually are not backing away regardless of a pullback.

Associated Studying

Institutional Shopping for Stays Heavy

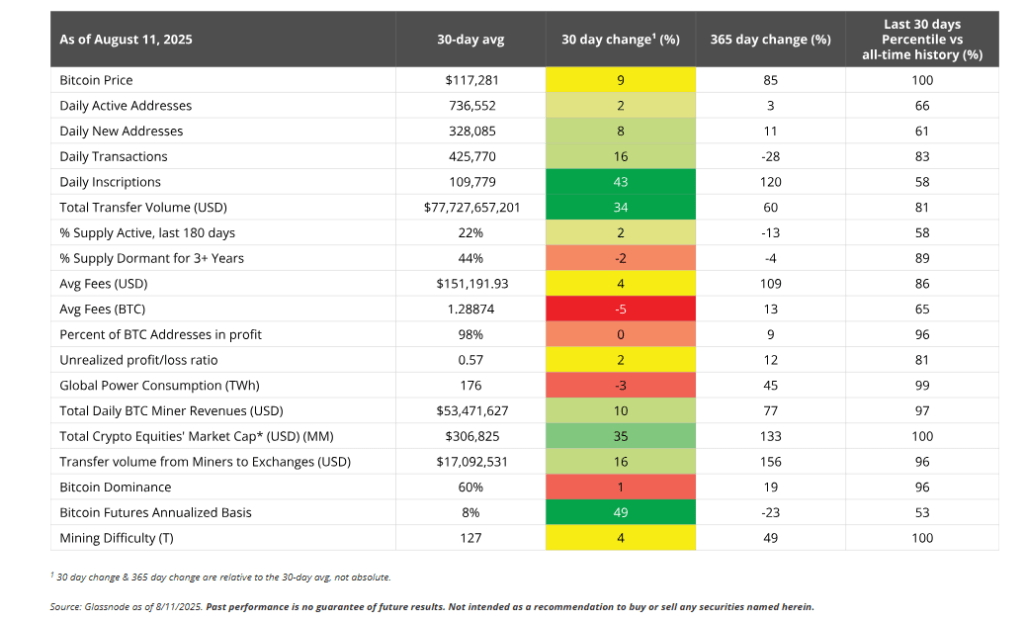

Experiences have disclosed heavy accumulation in July. Alternate-traded merchandise purchased 54,000 BTC whereas Digital Asset Treasuries added 72,000 BTC, giving clear proof that enormous holders proceed to pile in.

VanEck first laid out its bullish view in November 2024 when Bitcoin traded round $88,000. On the identical time, US-listed miners now account for 31% of world Bitcoin hashrate, up from roughly 30% earlier this yr, whilst fairness index fell 4% when excluding Utilized Digital’s 50% soar.

Worth Strikes Present Volatility And Fast Restoration

Bitcoin slid to $112,000 in early August earlier than leaping again to $124,000 on August 13. That transfer set a brand new all-time excessive above July’s $123,838.

On the time of writing, Bitcoin trades near $115K, roughly 8% beneath that current peak. Merchants describe the pullback as a repositioning after a run-up, not an apparent breakdown.

Supply: VanEck

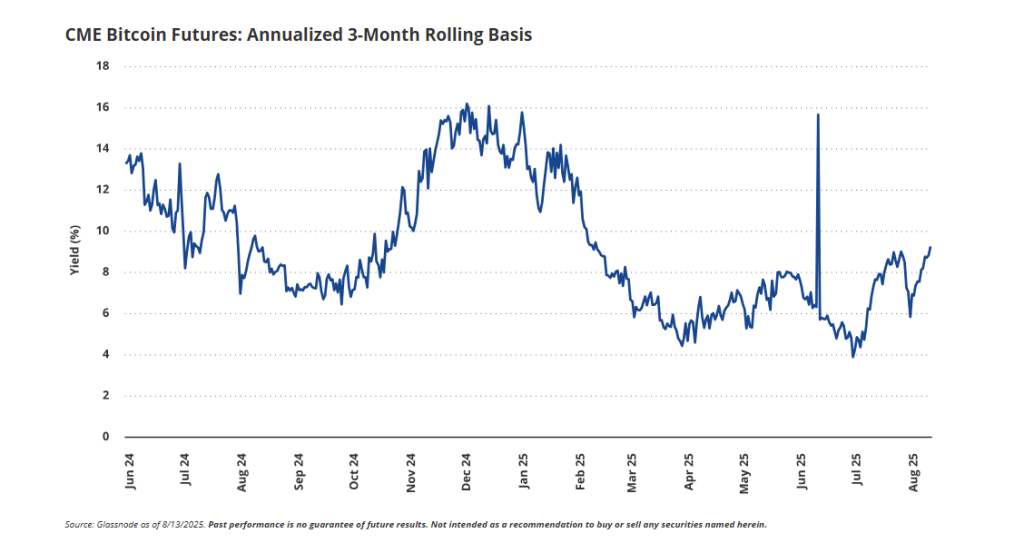

Derivatives metrics again the image of rising speculative curiosity. CME foundation funding charges have surged to 10%, the very best stage since February 2025.

Choices markets present name/put ratios hitting 3.21x, the strongest since June 2024, with traders spending $792 million on name premiums.

But implied volatility has compressed to 32%, effectively underneath the one-year common of fifty%, which makes choices cheaper for consumers.

Alternatively, futures open curiosity sits over $6 billion, although a $2.3 billion unwind in open curiosity throughout current corrections ranks among the many bigger single-session strikes.

Supply: VanEck

Voices Break up On How Excessive Bitcoin May Go

Executives and analysts disagree on the tempo and peak of the rally. Coinbase CEO Brian Armstrong joined figures reminiscent of Jack Dorsey and Cathie Wooden in suggesting Bitcoin may attain $1 million by 2030, citing clearer guidelines and wider institutional adoption.

Galaxy Digital’s Mike Novogratz warned {that a} million-dollar stage would extra doubtless replicate extreme US financial stress than regular market energy.

Preston Pysh flagged considerations about how Wall Avenue’s rising position may change Bitcoin’s use and tradition.

Associated Studying

Help Ranges And Technical

Technically, many market watchers view the $100,000-$110,000 vary as key help. A decisive break beneath $112,000 may push costs towards $110,000 and, in a deeper transfer, $105,000.

For now, the story is blended. Institutional demand and speculative derivatives flows are pushing worth strain greater, whereas low cost choices and compressed volatility make bullish bets less expensive.

Whether or not that mixture lifts Bitcoin to VanEck’s $180,000 goal will depend upon continued inflows and whether or not key help holds.

Featured picture from Meta, chart from TradingView