- Bitcoin capital outflows immediate market reassessment, signaling potential value shifts

- Bitcoin’s key help zones might decide future bullish or bearish momentum

Bitcoin’s [BTC] latest capital outflows have raised issues about future value actions. Traditionally, such actions have served as precursors to market shifts, prompting traders to reassess their methods. With market makers probably in search of new entry factors, the query stays – The place is Bitcoin heading?

Bitcoin capital outflows

Capital outflows in Bitcoin signify a redistribution of funds, typically reflecting modifications in market sentiment. When traders pull their belongings from BTC, it might point out profit-taking, fear-driven promoting, or shifts to different asset lessons. Market makers – who act as liquidity suppliers – reply by exploring decrease or greater value ranges to find out optimum re-entry zones.

Such outflows aren’t inherently bearish; they continuously function a recalibration part. For market individuals, monitoring these actions is vital.

Bullish development continuation?

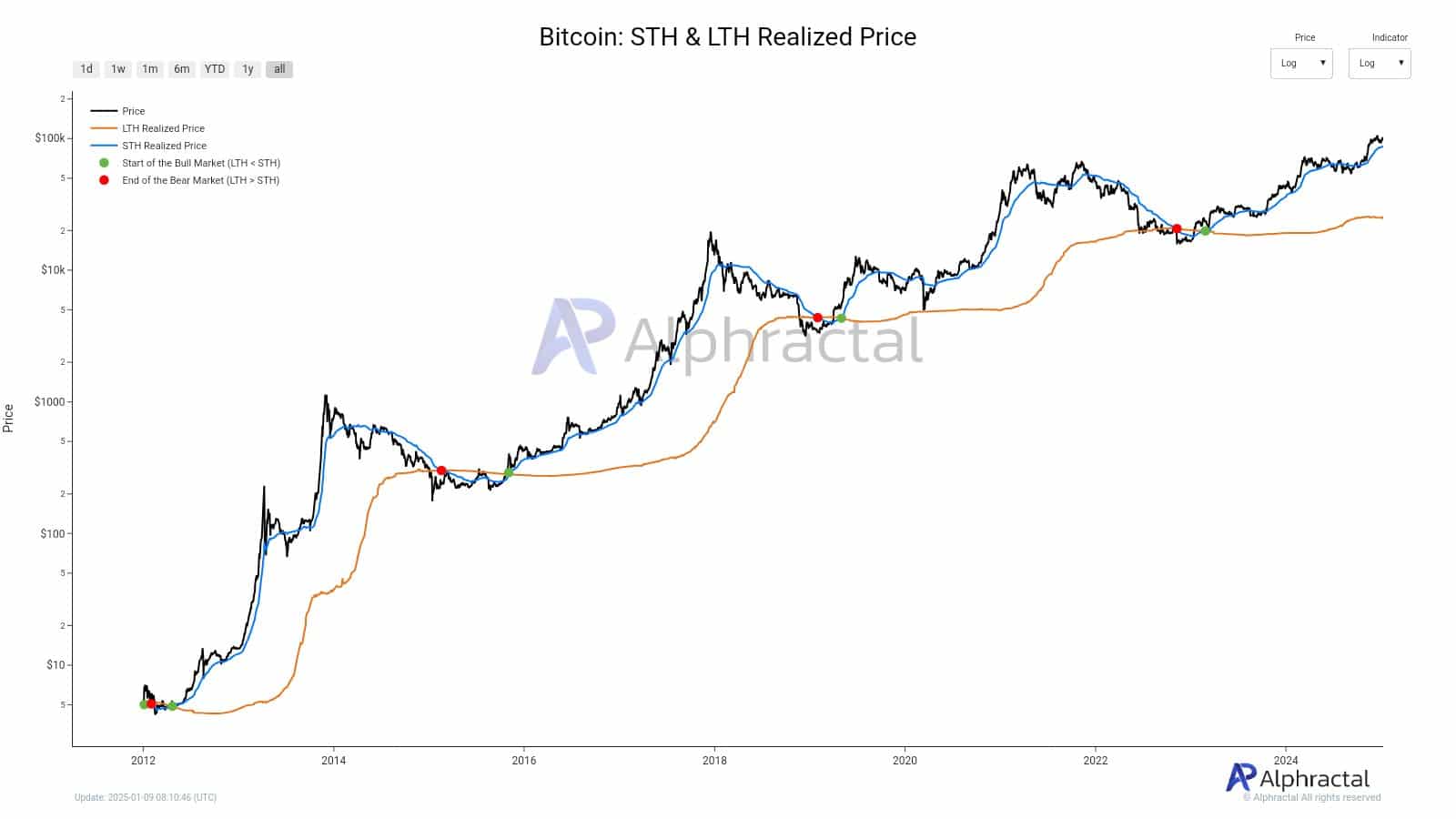

One bullish state of affairs hinges on Bitcoin reclaiming its STH Realized Worth, at present pegged at $86.2k. This metric, representing the typical value of cash held by short-term holders, typically serves as a psychological and technical help throughout bull markets. Its restoration has traditionally coincided with renewed investor confidence and bullish momentum.

The information highlighted how earlier bull runs revered the STH Realized Worth as a springboard for additional beneficial properties. If Bitcoin surpasses this stage, it might point out a resurgence in shopping for stress, signaling that market makers and retail traders alike are able to propel the worth greater.

This state of affairs suggests a possible upward continuation, with $86.2k performing as the primary checkpoint in Bitcoin’s rally.

Sentiment-based value motion

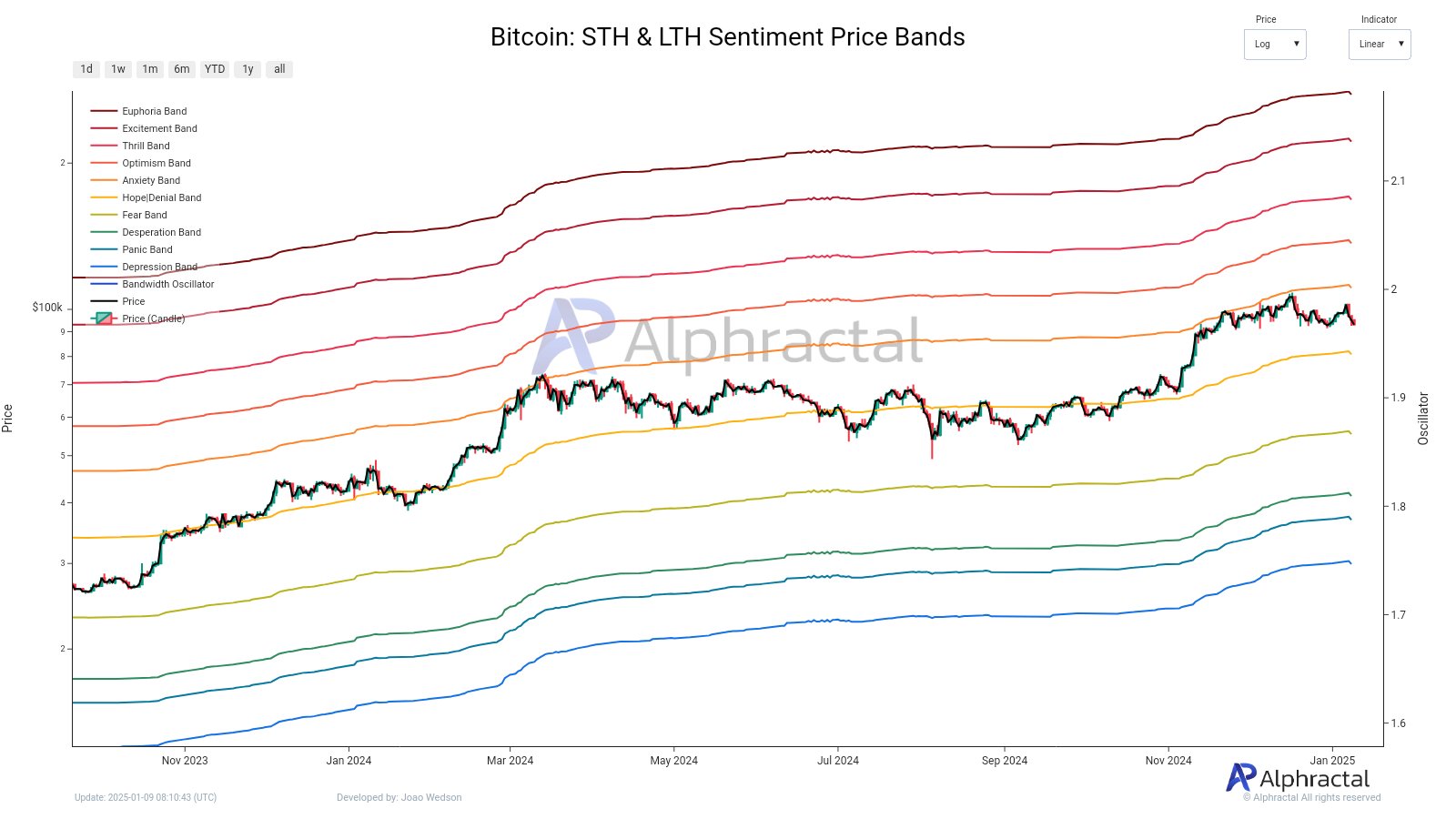

The Hope/Denial Band, at present positioned at $80.7k, serves as an important metric reflecting the sentiment steadiness between short-term holders and long-term holders. This band captures emotional shifts out there, oscillating between optimism and warning, and sometimes acts as a stabilizing power throughout bullish phases.

Traditionally, Bitcoin’s value has revered this vary, with sustained traits continuously rising from these ranges. For STHs, this zone symbolizes confidence, whereas LTHs view it as a possible validation of long-term funding methods.

As proven within the chart, prior interactions with the Hope/Denial Band coincided with upward value actions, reinforcing its position as a key reference level. A robust protection of $80.7k might sign resilience and bolster bullish momentum.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

A possible downturn

The chance of the newest Bitcoin value drop appeared to reflect occasions from Might 2021, when the market confronted a pointy correction following overheated sentiment and profit-taking. In that occasion, vital capital outflows drove Bitcoin to decrease help ranges, resetting market expectations.

Presently, related dynamics are in play. If bearish pressures prevail, Bitcoin might decline to the $66k–$60k vary. These ranges align with key metrics such because the Lively Realized Worth and True Market Imply Worth, which account for the community’s truthful worth excluding newly mined cash.

Such a downturn would take a look at investor confidence and problem each short- and long-term holders. Whereas this state of affairs indicators warning, it additionally gives a chance for market makers to discover sustainable re-entry factors.