In keeping with a brand new technical evaluation, Bitcoin (BTC) and the broader crypto market could possibly be mirroring historical post-halving cycle patterns. Whereas the market has beforehand rallied by way of July and August, historic fractals level to a possible crash in September, adopted by a push right into a cycle peak later within the 12 months.

Associated Studying

September Proves Dangerous For Bitcoin And Crypto Market

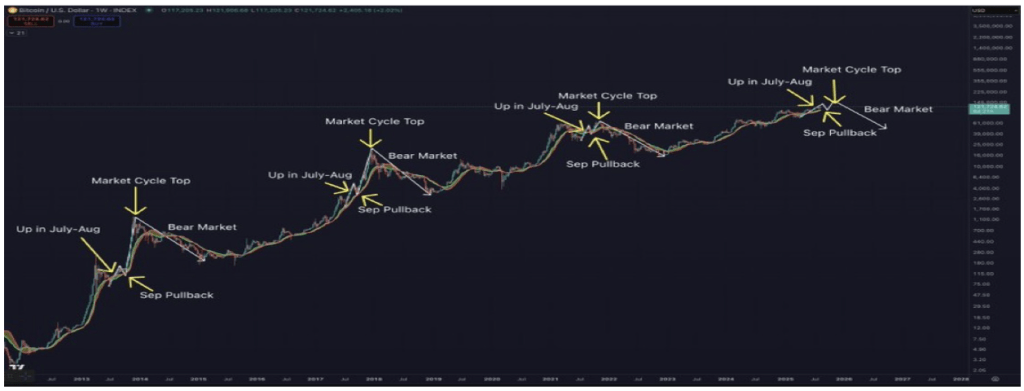

A current X social media post by crypto analyst Benjamin Cowen has highlighted a recurring sample in Bitcoin’s price action that might have vital implications for the market over the approaching months. His evaluation reveals that Bitcoin has persistently adopted a post-halving cycle that displays distinct seasonal price movements, significantly round July, August, and September.

The chart shared by Cowen illustrates that in earlier cycles, Bitcoin has typically rallied in July and August, fueling optimism and powerful market sentiment. Nevertheless, every time this has been adopted by a September crash, resulting in a reset earlier than the ultimate push towards the cycle prime, which often arrives within the last quarter of the year.

In keeping with the evaluation, this repeating construction just isn’t distinctive to a single cycle however has appeared throughout a number of previous cycles, giving weight to the skilled’s argument that historical past could possibly be repeating. In 2013, 2017, and 2021, Bitcoin’s value conduct adopted this sample virtually identically, displaying power in mid-summer and weak point in September.

After a remaining rally to a peak, every of those cycles was finally adopted by an extended bear market phase, throughout which valuations corrected sharply from their highs. Based mostly on Cowen’s report, the present cycle seems to be unfolding the identical approach, as Bitcoin already displayed power in July and August this 12 months, sparking concerns {that a} September pullback could possibly be approaching.

BTC Cycles Recommend Market Nonetheless Has Room To Develop

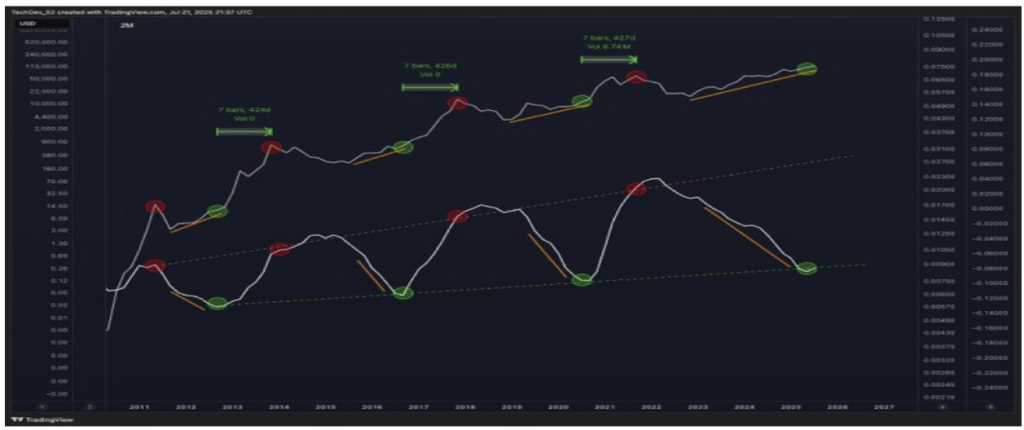

A brand new technical evaluation by crypto market skilled TechDev additionally reveals a recurring sample in Bitcoin’s long-term value cycles, arguing that, opposite to well-liked perception, the present market should still be far from its peak. The evaluation, supported by a historic chart of BTC’s efficiency, reveals that each market prime has persistently occurred round 14 months after a particular cyclical sign.

The chart outlines a number of Bitcoin cycles courting again to 2011, with tops and bottoms clearly marked with inexperienced and pink indicators. Every upward run is adopted by a major correction after which a restoration accumulation section. The info additionally revealed that every cycle prime typically aligned with a measured timeframe of roughly 420 days.

Associated Studying

Based mostly on this mannequin, present projections present that Bitcoin still has room to run. The newest inexperienced marker on the chart indicators that the market might already be transitioning out of its corrective section. If historic patterns maintain, this might imply the market is getting into a protracted progress window somewhat than nearing exhaustion.

Featured picture from Unsplash, chart from TradingView