Key Notes

- Sharplink Gaming’s institutional backing validates Ethereum as a most well-liked company reserve asset for treasury diversification methods.

- ETH’s technical breakout above Bollinger higher band suggests continued momentum towards the $4,100-$4,350 resistance zone forward.

- Rising institutional adoption creates favorable circumstances for sustained value appreciation regardless of RSI approaching overbought ranges.

Ethereum shattered the $4,050 resistance stage on August 8, marking its highest value level since December 2024 because the digital asset posted a stable 6% every day rally.

The ETH value rally was initially triggered on August 7 by a big announcement from strategic treasury investor Sharplink Gaming, confirming a $200 million direct providing backed by world institutional buyers. The corporate revealed that proceeds can be used to expand its Ethereum treasury to over $2 billion, reinforcing its dedication to ETH as a core reserve asset.

“SharpLink is proud to be joined by globally-recognized institutional buyers, augmenting our sturdy current investor base and additional validating our mission to be the world’s main ETH treasury,” said Joseph Chalom, SharpLink’s Co-Chief Government Officer.

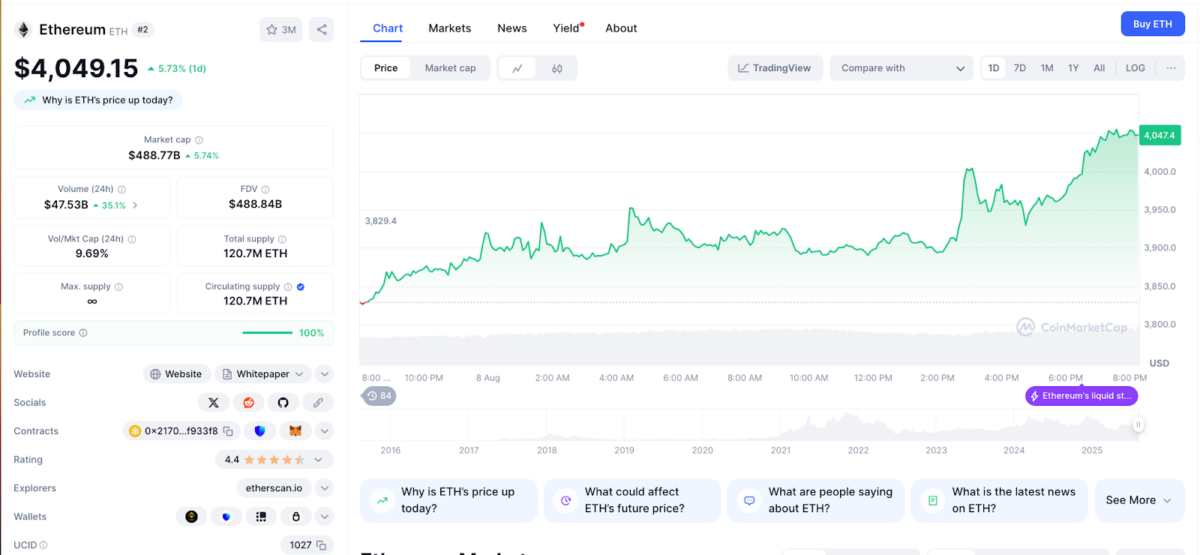

Ethereum value motion | CoinMarketCap Aug. 8, 2025

Ethereum markets reacted positively. According to CoinMarketCap, Ethereum traded between a low of $3,864 and a excessive of $4,065, with every day volumes rising 35% to hit $47.1 billion at press time.

As Ethereum’s institutional adoption grows, particularly amongst US-based corporate investors, short-term merchants might proceed to put upside bets, anticipating imminent capital inflows.

Ethereum Value Prediction: Bulls Eye $4,350 Breakout as RSI Strengthens

Ethereum closed the August 8 session at $4,045, printing a clear bullish engulfing candle that pierced above the Bollinger Band’s higher band at $4,000. This marks ETH’s first decisive shut above the higher band since late July, suggesting rising volatility and momentum in favor of the bulls. Notably, ETH reclaimed the midline help on the 20-day common earlier this week at $3,719, which may function a gentle consolidation base as merchants place for additional features.

ETH is now buying and selling within the higher volatility vary between $4,009 and $4,350, with the RSI climbing to 68.99. The Bollinger Bands have began increasing once more, indicating renewed directional momentum. With ETH firmly positioned above each the midline and the higher band, value motion suggests continuation slightly than exhaustion, but RSI nearing 70 requires warning.

If ETH confirms a every day shut above $4,100, it will mark a technical breakout from the two-week consolidation vary. With minimal resistance between $4,100 and $4,350, Ethereum may rapidly speed up towards all-time highs. The RSI would possible enter overbought territory, however this may occasionally not deter bullish momentum if quantity rises concurrently.

Ethereum value forecast

On the flip facet, failure to keep up a every day shut above $4,000 would possible see ETH revisit the $3,695 to $3,719 help zone, with Bollinger’s midline and former resistance flipping again to help. A breakdown beneath $3,695 would expose ETH to the $3,600 and $3,500 vary, the place the decrease Bollinger band at present offers rapid help. A detailed beneath that may shift the development again to impartial.

Finest Pockets Presale Positive factors Momentum as Ethereum Attracts Institutional Demand

Whereas Ethereum strengthens its place because the institutional favourite for crypto treasuries, Best Wallet is rising as a presale alternative aligning itself with Ethereum’s increasing on-chain economic system.

Finest Pockets Token Presale

With over $14 million raised, the BEST presale affords buyers precedence entry to future venture listings, decreased transaction charges, and staking rewards with excessive APY. The venture is positioning itself as a DeFi-native pockets for brand new market entrants seeking to profit from Ethereum’s anticipated breakout part amid rising institutional inflows.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.