TL;DR: Ethereum will use a minimum of ~99.95% much less power put up merge.

Ethereum shall be finishing the transition to Proof-of-Stake within the upcoming months, which brings a myriad of enhancements which were theorized for years. However now that the Beacon chain has been working for a couple of months, we are able to truly dig into the numbers. One space that we’re excited to discover includes new energy-use estimates, as we finish the method of expending a rustic’s value of power on consensus.

There are no concrete statistics on power consumption (and even what {hardware} is used) as of but, so what follows is a ball-park estimation of the power consumption of the way forward for Ethereum.

As many individuals are working a number of validators, I’ve determined to make use of the variety of distinctive addresses that made deposits as a proxy for what number of servers are on the market at the moment. Many stakers might have used a number of eth1 addresses, however this largely cancels out towards these with redundant setups.

On the time of writing, there are 140,592 validators from 16,405 distinctive addresses. Clearly that is closely skewed by exchanges and staking providers, so eradicating them leaves 87,897 validators assumed to be staking from residence. As a sanity examine, this suggests that the common home-staker runs 5.4 validators which looks as if an affordable estimate to me.

Energy Necessities

How a lot energy does it take to run a beacon node (BN), 5.4 validator purchasers (VC), and an eth1 full-node? Utilizing my private setup as a base, it is round 15 watt. Joe Clapis (a Rocket Pool dev) not too long ago ran 10 VCs, a Nimbus BN, and a Geth full node off of a 10Ah USB battery financial institution for 10 hours, which means that this setup averaged 5W. It’s unlikely that the common staker is working such an optimised setup, so let’s name it 100W all in.

Multiplying this with the 87k validators from earlier than implies that home-stakers devour ~1.64 megawatt. Estimating the facility consumed by custodial stakers is a bit tougher, they run tens of hundreds of validator purchasers with redundancy and backups.

To make life straightforward, let’s additionally simply assume that they use 100W per 5.5 validators. Based mostly off of the staking infrustructure groups I’ve spoken to, this can be a gross over-estimate. The true reply is one thing like 50x much less (And if you’re a custodial staking crew consuming greater than 5W/ validator hit me up, I am certain I may help you out).

In complete, a Proof-of-Stake Ethereum subsequently consumes one thing on the order of two.62 megawatt. This isn’t on the size of nations, provinces, and even cities, however that of a small city (round 2100 American properties).

For reference, Proof-of-Work (PoW) consensus on Ethereum at the moment consumes the power equal of a medium-sized nation, however that is truly essential to preserve a PoW chain protected. Because the title suggests, PoW reaches consensus based mostly off of which fork has probably the most “work” performed on it. There are two methods to extend the speed of “work” being performed, enhance the effectivity of mining {hardware} and utilizing extra {hardware} on the identical time. To stop a sequence from being efficiently attacked, miners should be doing “work” at a fee higher than an attacker might. As an attacker is prone to have comparable {hardware}, miners should preserve giant quantities of environment friendly {hardware} working to stop an attacker from out-mining them and all this {hardware} makes use of a variety of energy.

Beneath PoW, as the worth of ETH and the hashrate are positively correlated. Subsequently, as as the worth will increase, in equilibrium so too does the facility consumed by the community. Beneath Proof-of-Stake, when the worth of ETH will increase, the safety of the community does too (the worth of the ETH at-stake is value extra), however the power necessities stay unchanged.

Some comparisons

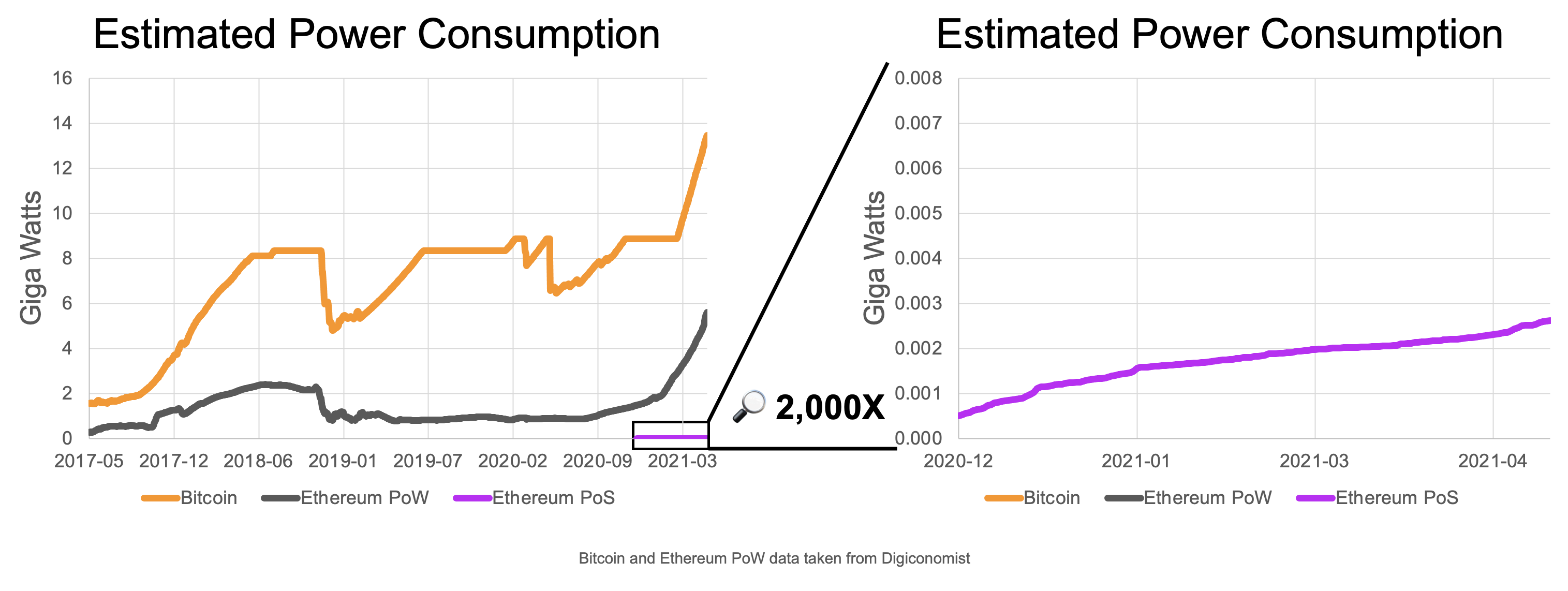

Digiconomist estimates that Ethereum miners at the moment devour 44.49 TWh per yr which works out to five.13 gigawatt on a seamless foundation. Which means that PoS is ~2000x extra power environment friendly based mostly on the conservative estimates above, which displays a discount of a minimum of 99.95% in complete power use.

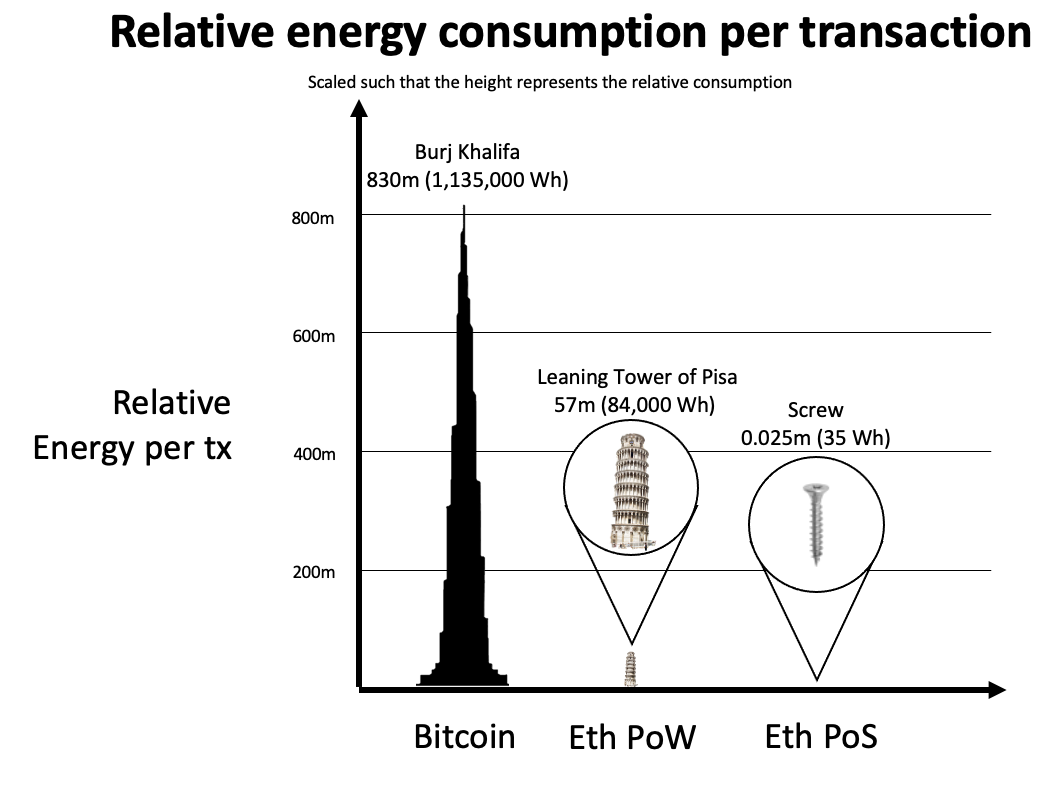

If power consumption per-transaction is extra your pace, that is ~35Wh/tx (avg ~60K gasoline/tx) or about 20 minutes of TV. In contrast, Ethereum PoW makes use of the equal power of a home for two.8 days per transaction and Bitcoin consumes 38 house-days value.

Trying Ahead

Whereas Ethereum continues to make use of PoW for now, that will not be the case for for much longer. Previously few weeks, we have seen the emergence of the primary testnets for The Merge, the title given to the second Ethereum switches to from PoW to PoS. A number of groups of engineers are working time beyond regulation to make sure that The Merge arrives as quickly as potential, and with out compromising on security.

Scaling options (resembling rollups and sharding) will assist additional lower the power consumed per-transaction by leveraging economies of scale.

Ethereum’s power-hungry days are numbered, and I hope that is true for the remainder of the trade too.

Because of Joseph Schweitzer, Danny Ryan, Sacha Yves Saint-Leger, Dankrad Feist, and @phil_eth for his or her enter.