XRP is displaying blended alerts throughout timeframes, leaving merchants on edge as the value approaches the important thing $2.35 degree. Whereas a latest breakout from a falling wedge on the 3-day chart suggests a bullish reversal, the 4-hour chart reveals indicators of slowing momentum and a doable rising wedge. With patrons and sellers locked in a battle, $2.35 may very well be the tipping level that decides whether or not XRP surges increased or slips right into a near-term correction.

XRP Breaks Out Of Falling Wedge On 3-Day Chart

In an X post, LSplayQ highlighted a key technical growth on the XRP 3-day value chart, pointing to a breakout from a falling wedge sample. Any such sample is often related to bullish reversals, signaling that market sentiment could also be shifting in favor of the bulls.

Following the breakout, XRP is at present buying and selling round $2.26, and in accordance with LSplayQ, the transfer means that patrons are stepping again in to reclaim management. The value motion marks a major shift after an prolonged interval of downward compression inside the wedge. If the bullish momentum continues, LSplayQ notes that XRP might goal a breakout degree close to $2.72, which represents an upside potential of roughly 20% from the present value.

That mentioned, LSplayQ additionally warns of the chance of a pullback if XRP fails to carry above the wedge breakout degree. In such a situation, the value might retest the $2.10 zone as a possible help. General, the technical outlook leans bullish, so long as XRP maintains its place above the breakout degree.

Rising Wedge Sample Alerts Warning Forward

In a post on X, The Crypto Bushman identified that XRP is pushing increased on the 4-hour chart, however warned that seasoned merchants are retaining an in depth eye on what lies beneath the floor.

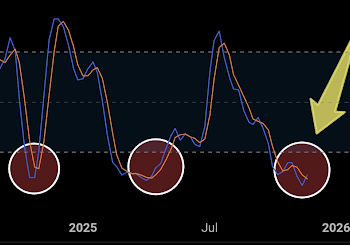

In accordance with the analyst, the value is at present buying and selling above each the 20- and 50-day EMAs, which generally alerts short-term power. Nevertheless, the general structure seems to be forming a rising wedge, a sample typically linked to potential reversals. On the similar time, momentum is starting to fade, with the MACD flattening and quantity really fizzling out, which Bushman describes as basic indicators of a possible entice transfer.

The Crypto Bushman emphasised {that a} failure to interrupt cleanly above $2.35 might result in the setup rolling over. In that case, the $2.25 zone turns into a essential degree to look at for a doable breakdown and shift in sentiment. On the flip facet, a powerful breakout backed by quantity might gasoline one other leg up towards $2.50 if shopping for stress returns decisively.