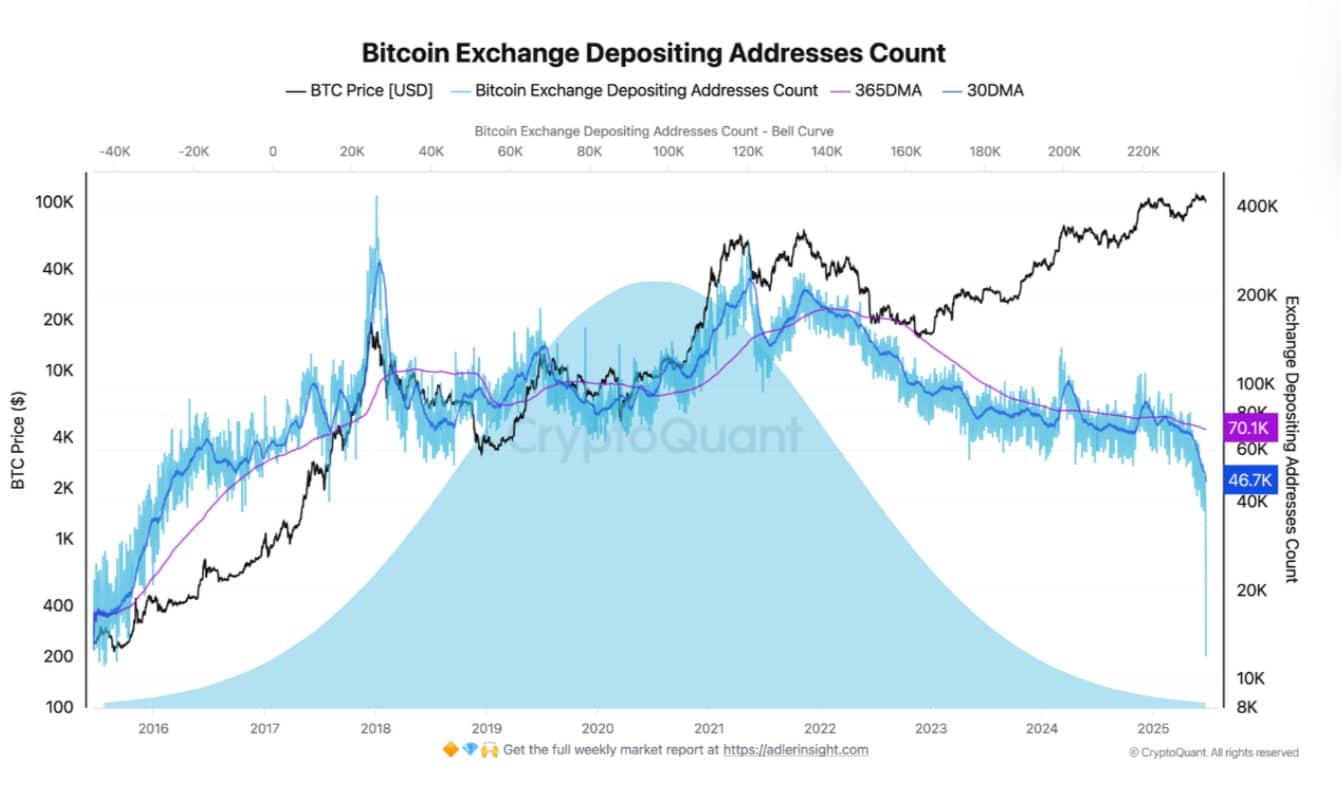

- Bitcoin’s 30-day common for trade depositing addresses dropped to 48K, with the day by day rely falling to simply 37K.

- Spot ETF adoption and declining retail exercise contributed to decreased BTC motion and fewer lively deposit addresses.

Bitcoin [BTC] is not behaving like the identical asset it was a couple of years in the past.

In truth, a elementary shift in investor habits is unfolding—one which’s regularly pulling BTC out of speculative circulation and into long-term custody.

Bitcoin trade deposits hit historic low

In response to CryptoQuant, the variety of addresses depositing to exchanges has considerably decreased.

The 30-day shifting common stood at simply 48,000. In the meantime, the day by day rely dropped to round 37,000. To place this into perspective, between 2015 and 2021, the yearly common hovered close to 180,000.

Naturally, this isn’t only a blip.

The longer-term 365-day shifting common has additionally dropped to 70,100, whereas the 10-year imply nonetheless sits greater at 90,000. These information factors affirm a sustained decline, not simply cyclical noise.

As these addresses decline, so has the variety of depositing transactions.

Bitcoin’s Alternate Depositing Transactions hit a 12,000 low lately, marking the weakest stage since mid-2023. Even now, the metric struggles to regain altitude, sitting close to 13,000.

What does this imply? Briefly, much less BTC is shifting to exchanges, and that’s a serious inform.

Shortage meets conviction

Bitcoin’s shortage is at an all-time excessive because the Inventory to Circulation Ratio surges to 59.4k. When shortage surges to such excessive ranges, it alerts rising BTC accumulation.

Importantly, this spike in shortage has occurred whilst BTC continues to commerce above $100K, exhibiting that holders are unfazed by the worth and probably ready for extra.

With these modifications out there, the query is, what’s behind it?

Elements behind declining trade deposits

One clear catalyst is the rise of Bitcoin spot ETFs. These devices enable traders to achieve publicity with out shifting BTC on-chain, lowering the necessity for direct trade deposits.

Furthermore, retail merchants have been much less lively on this cycle. Thus, traders at the moment are selecting to carry Bitcoin as financial savings or treasury reserves quite than actively buying and selling it.