Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is presently hovering in a tightly compressed price vary after failing a number of instances to interrupt above $110,000 earlier this month. The previous few days have been characterised by the main cryptocurrency buying and selling round $105,000, with neither bulls nor bears taking management. Regardless of the general consolidation, a subtle yet significant signal is beginning to flash beneath the floor, notably on the 4-hour chart, that may ship Bitcoin to a brand new all-time excessive quickly.

Return Of Uncommon Divergence Sample On Bitcoin’s 4H Chart

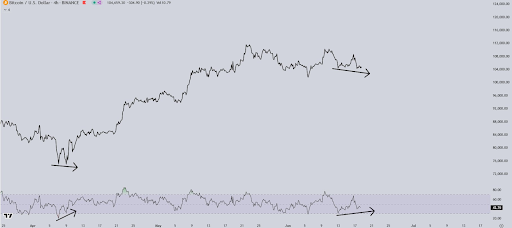

Crypto analyst Luca (@CrypticTrades_) took to social media platform X to share a chart that highlights an essential technical growth on Bitcoin’s 4-hour timeframe: the return of a bullish divergence. This sign, which beforehand appeared in early April, preceded the large rally that catapulted Bitcoin to its Might 22 all-time excessive of $111,800. The identical divergence is forming as soon as once more and one other Bitcoin worth breakout may be very close.

Associated Studying

As proven within the 4-hour candlestick timeframe chart under, the divergence is clearly illustrated between worth motion and the Relative Energy Index (RSI). Worth has been forming decrease lows, whereas the RSI has been printing increased lows. This mismatch serves as an early indicator that promoting momentum is fading, and a reversal to the upside may observe. The earlier occasion of this sample instantly preceded a pointy transfer from a $74,000 low in early April to above $111,000 in just some weeks.

What Does This Divergence Imply For Bitcoin’s Worth?

Bullish divergences on mid-timeframe charts just like the 4-hour have a status for being the primary reversal indicators when supported by rising quantity. In Bitcoin’s present case, the looks of this sample once more may imply that the current retracement from $111,800 has run its course. With RSI now trending upward at the same time as worth presses barely decrease, Bitcoin could also be witnessing one other hidden accumulation section earlier than its subsequent leg increased.

Associated Studying

If the sample holds true to its earlier efficiency in April, the main cryptocurrency might be organising for an additional push towards new all-time excessive ranges. Bitcoin is presently not far off from a brand new all-time excessive, as it is just about 5.5% away from its worth peak. Based mostly on this, one other robust breakout may simply purpose past the earlier $111,800 excessive.

Though Bitcoin’s worth is comparatively stagnant for now, the presence of this bullish divergence is a reminder of how shortly issues can change. The earlier bullish divergence ended up with a 50% worth surge. An identical efficiency from the present worth stage would translate to another target above $160,000.

On the time of writing, Bitcoin is buying and selling at $105,700, up by 1.4% previously 24 hours, already displaying indicators of the bullish divergence sign coming into motion.

Featured picture from Getty Photos, chart from Tradingview.com