Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

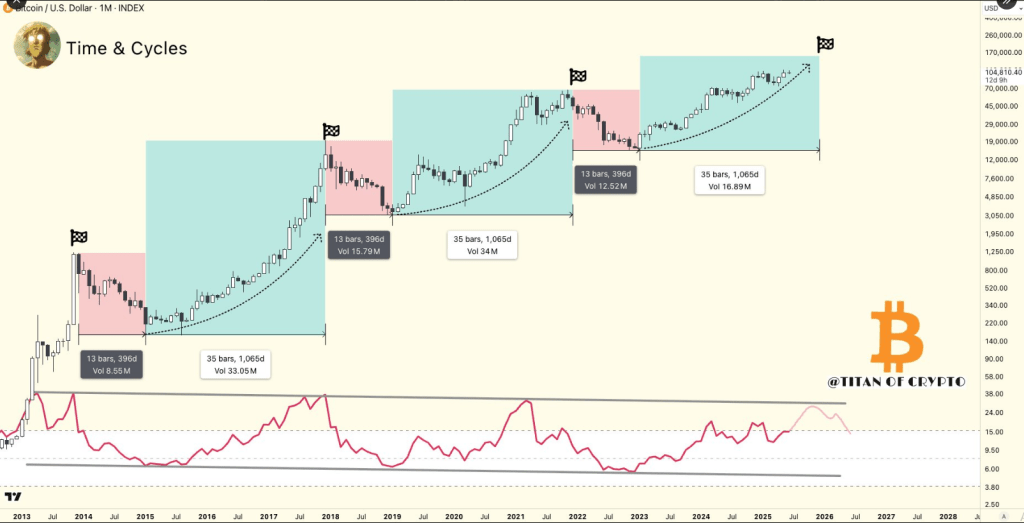

Bitcoin’s latest pullback has sparked recent debate over whether or not the rally has run its course. Based on market watcher Titan of Crypto, the story isn’t over but.

Associated Studying

Bitcoin slipped simply 6% from its all‑time excessive of $112,000, however some analysts pointed to a cooling relative energy index (RSI) and warned of a high. Titan’s take flips that view on its head, arguing that we’re nonetheless deep within the meat of the bull cycle.

Fractal Cycles Hold Operating

Titan pointed to a transparent sample in Bitcoin’s final two cycles. Every cycle started with roughly 13 month-to-month bars—about 396 days—of steep decline. In 2014–15, Bitcoin fell from $1,240 to $161 over that span.

Costs then rallied for 35 bars (1,065 days) to hit $19,800 in December 2017. The identical 13‑bar slide adopted by 35 bars of good points performed out once more after 2018, ending at $69,000 in 2021.

#Bitcoin Bull Market Getting into Closing Section 🏁

As in earlier cycles: ~1 12 months of bear market, adopted by ~3 years of growth.$BTC seems to be to be within the last leg however not finished but. pic.twitter.com/MGre5ahz3P

— Titan of Crypto (@Washigorira) June 18, 2025

Momentum And RSI In Focus

Some analysts flagged a weakening RSI as an indication that Bitcoin has peaked. That metric can’t be ignored—when momentum wanes, worth usually takes a breather. Titan’s chart lays down the time‑primarily based sample, however RSI, buying and selling quantity, and on‑chain knowledge give a dwell learn on demand.

Bull Run Nonetheless Has Room

Primarily based on stories, the present cycle’s bullish section kicked off in January 2023 and sits within the twenty ninth bar this month. Bitcoin has climbed 530% because the begin of that run.

If historical past holds, we’ve received at the least 5 extra month-to-month bars of uptrend earlier than the rally tops out round November. Earlier research even level to a wedge breakout that would ship worth to about $137,000 earlier than any critical pullback.

Large Names See Larger Peaks

Samson Mow, the CEO of Jan3, foresees Bitcoin tearing previous the $1 million mark in a fierce upswing, powered by authorities rollouts, sovereign bond issuances, and an pressing surge in ‘hyperbitcoinization’ earlier than seeing any actual correction.

Raoul Pal (Actual Imaginative and prescient), the previous Goldman Sachs government, shares a well-recognized bullish view. He has laid out situations the place Bitcoin hits $1 million by 2030, primarily based on financial stimulus and restricted provide.

Associated Studying

Technique’s Michael Saylor has additionally stated Bitcoin might skyrocket to between $500,000 and $1 million earlier than seeing any actual correction.

These large names within the crypto business spotlight rising institutional inflows and a looming provide squeeze after the following halving as gas for a fair greater peak.

This rally isn’t only a rerun of what we noticed in 2017 or 2021. Bitcoin at this time strikes with ETFs, large‑ticket company buys, and extra merchants watching on‑chain alerts than ever earlier than.

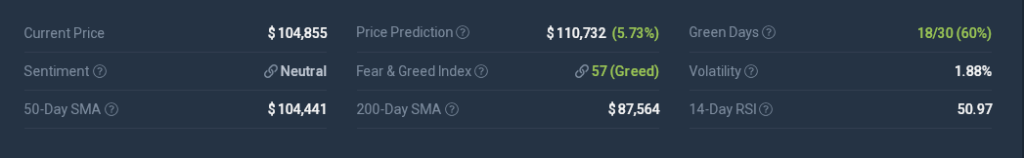

In the meantime, the most recent outlook by CoinCodex sees Bitcoin climbing 5.73% to hit roughly $110,732 by July 19, 2025. Proper now, technical alerts level to a Impartial temper, whereas the Worry & Greed Index sits at 57—squarely in Greed territory.

Featured picture from Pexels, chart from TradingView