- Ethereum hit 148.38M whole holders, the very best amongst all crypto property

- Regardless of current value dips, ETF inflows and on-chain exercise hinted at long-term optimism for ETH

Ethereum [ETH] is within the information at this time after it hit a serious adoption milestone by surpassing 148.38 million whole holders – The utmost on all crypto property.

The hike in pockets numbers is an indication of sustained curiosity within the second-largest cryptocurrency, regardless of bigger market fluctuations.

The milestone additionally represents Ethereum’s deep-rooted place within the digital asset house. As extra customers hold ETH, it fortifies the community’s rising utility and investor perspective.

Right here, it’s price noting that the information got here on the again of current upticks in different main on-chain metrics.

ETH staking units the very best month-to-month inflows

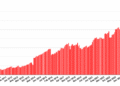

Along with the expansion in holders, Ethereum additionally recorded its largest month-to-month Staking Influx Complete thus far, based on CryptoQuant. The spike steered that long-term holders are locking of their positions, assured in ETH’s future efficiency.

Staking not solely reduces the circulating provide, but in addition instills confidence in community safety and stability.

Better staking participation has the potential to decrease promote stress within the brief run, aiding ETH’s value restoration on the charts.

ETF inflows add to constructive alerts

As talked about in AMBCrypto’s earlier analysis, whereas U.S-listed Ethereum ETFs attracted $11.26 million in inflows on 5 June (16 straight days of internet inflows), Bitcoin ETFs noticed $278.44 million in outflows on the identical day.

Institutional buyers’ urge for food for Ethereum ETFs bodes properly for extra confidence in ETH’s long-term future.

In reality, regardless of ETH’s 7% drop to round $2,400, indicators just like the Vendor Exhaustion Fixed underlined indicators of fading bearish stress.

Market sentiment continues to be cautious, however in restoration

That being mentioned, danger hasn’t vanished fully. Lengthy liquidations crossed $256 million just lately and Choices market demand tilted in the direction of places – An indication of sustained short-term warning.

Even so, analysts like Earnings Sharks imagine that ETH has proven energy on the $2,300-support stage. A return to $3,000 stays on the desk if these developments maintain themselves.

Lengthy-term prospects for ETH are higher!

Ethereum’s holders’ enlargement, rising staking inflows, and steady ETF inflows all contribute to a bullish long-term narrative.

Brief-term dangers could undoubtedly prevail, however these figures indicated that ETH could be positioning itself as probably the most bullish crypto asset in the long run.