Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

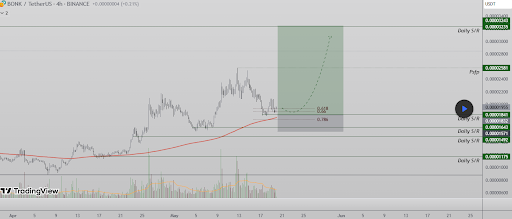

BONK’s value motion has been backwards and forwards in Could, and the cryptocurrency is now primarily again the place it began the month. Current value motion reveals that the token is trying to stabilize at across the 200 EMA after being rejected by the native excessive close to the 0.00002581 stage.

This rejection led to a measured pullback in direction of $0.00001820. Nonetheless, in keeping with a technical analysis on the TradingView platform, the retrace seems to be forming a bullish continuation setup with a 77% corrective transfer in view moderately than indicating a bearish reversal.

Bullish Market Construction Holds Agency For BONK

BONK’s value retracement has introduced it instantly right into a zone of heavy technical curiosity. On the coronary heart of this confluence lies the 200 EMA on the 4-hour timeframe, which may technically function the subsequent assist zone for the meme coin shifting ahead. As well as, the retracement aligns with the 0.618 Fibonacci stage, which is usually associated with bullish corrections. It additionally aligns with a every day assist zone round $0.00001832 to $0.00001841 and a resistance zone round $0.00002034.

Associated Studying

Apparently, this motion has led to a consolidation between these ranges since Could 15, and in keeping with the TradingView analyst, the worth construction suggests patrons are stepping in to defend the pattern. This, in flip, has led to the formation of a better low.

From a quantity standpoint, every upward impulse has proven rising quantity for the reason that first week of April. Nonetheless, the current decline occurred on diminishing quantity, hinting at exhaustion from sellers.

77% Upside Transfer If BONK Breaks Above Resistance

Even with the present vary, BONK is still within a bullish setup that may ship it in direction of a brand new 2025 excessive and presumably in direction of its present all-time excessive ranges. The essential stage to observe now could be the purpose of management (POC) resistance at roughly $0.00001955. This stage beforehand acted because the pivot level earlier than the pullback and now serves as the edge for bullish continuation.

Associated Studying

A confirmed shut above this area would doubtless set off a speedy growth transfer towards the subsequent resistance cluster round $0.00002581, earlier than ultimately reaching the expected value goal of $0.00003243, which might carry it near its January 2025 open of $0.000035. As such, the projected goal if this performs out will translate to a 77% rally. The value goal additionally aligns with a previous swing high on January 15 and January 18.

On the time of writing, BONK is buying and selling at $0.00001995, up by 1,6% prior to now 24 hours. Its response right here, simply above the POC resistance, can be an essential deciding issue. If patrons manage to maintain pressure and safe a decisive breakout, the stage might be set for a powerful rally into the higher resistance band and a retest of BONK’s 2025 swing excessive.

Featured picture from Shutterstock, chart from Tradingview.com