Ethereum is exhibiting notable relative energy because it reclaims the $3,150 stage and makes an attempt to push greater, signaling early indicators of restoration after weeks dominated by heavy promoting stress, concern, and uncertainty. The broader market rebound has helped restore confidence, however ETH’s means to outperform key altcoins highlights rising demand and improved sentiment across the asset.

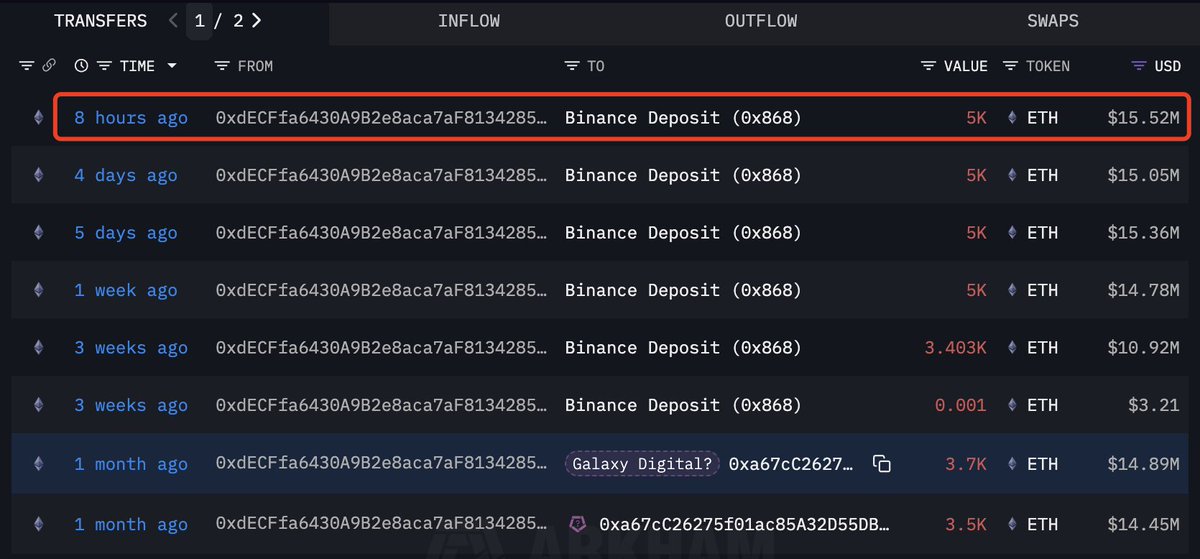

Including to the renewed optimism, recent on-chain information from Lookonchain reveals a big transfer from one of many market’s most acknowledged whales. In the course of the rebound, whale 0xdECF deposited one other 5,000 ETH—price roughly $15.52 million—into Binance.

This pockets has turn out to be well-known for sending massive batches of ETH to exchanges all through the latest downturn, typically coinciding with moments of heightened volatility and capitulation.

Its newest deposit means that the whale stays extremely energetic and aware of market situations. Whereas such actions can generally introduce uncertainty, additionally they spotlight growing liquidity and engagement from main holders. With worth reclaiming key ranges and whales repositioning, Ethereum enters a vital section the place sustained energy may affirm a broader shift in market construction.

Ethereum Whale Distribution Highlights Market Warning

In line with Lookonchain, whale 0xdECF has bought 25,603 ETH—valued at roughly $85.44 million—throughout Binance and Galaxy Digital since October 28. Regardless of this substantial distribution, the pockets nonetheless holds 5,000 ETH (round $15.52 million), suggesting that the whale has not totally exited its place however has considerably lowered publicity in the course of the latest market decline.

This sample of habits gives vital perception into sentiment amongst massive holders: whereas they don’t seem to be abandoning Ethereum solely, they’re actively managing threat and responding to volatility extra aggressively than typical.

Such persistent promoting stress from a big pockets typically acts as a drag on worth in periods of weak point, particularly when market liquidity is skinny. Nevertheless, the truth that the whale continues to retain a significant place signifies an expectation of potential restoration—or a minimum of a want to stay strategically uncovered to future upside.

Ethereum now finds itself in a vital section. The asset has reclaimed key ranges, however its mid-term construction stays extremely delicate to macro situations and whale habits. If promoting from main holders slows and accumulation begins to outpace distribution, the latest rebound may solidify right into a sustained development. In any other case, renewed promote flows may place Ethereum susceptible to revisiting decrease assist zones.

ETH Reclaims Quick-Time period Momentum however Faces Heavy Resistance

Ethereum’s every day chart reveals a transparent enchancment in momentum after reclaiming the $3,150–$3,200 area, however the broader construction stays fragile. The bounce from the $2,750–$2,850 assist zone marked a decisive shift in purchaser habits, with robust decrease wicks indicating aggressive demand. This rebound has pushed ETH again above key short-term ranges, but the asset nonetheless faces a difficult path ahead.

Value is now approaching the 50-day SMA, at the moment sloping downward simply above $3,250, which now acts as instant resistance. This transferring common has capped each rally since late October and stays the primary main barrier for bulls to reclaim. Past it, the 100-day SMA round $3,450 and the 200-day SMA close to $3,600 type a decent cluster of overhead resistance that defines the medium-term downtrend.

Quantity on the latest bounce is stronger than earlier makes an attempt, signaling that patrons are exhibiting extra conviction in comparison with the mid-November makes an attempt to recuperate. Nevertheless, the general development nonetheless leans bearish till ETH can break above the 50-day SMA and start closing every day candles over $3,300.

Ethereum sits in a vital inflection zone: holding above $3,100 strengthens the case for continued restoration, whereas rejection from the $3,250–$3,300 band may set off one other retest of the $2,800 area. The following few periods will decide whether or not this rebound evolves right into a deeper development reversal.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.