Ethereum has formally damaged beneath key help ranges, and market sentiment is quickly deteriorating as main property throughout the crypto panorama proceed to slip. Analysts are more and more calling for the arrival of a brand new bear market, noting that each Bitcoin and the main altcoins have misplaced important technical zones that beforehand held the broader construction collectively. ETH, now buying and selling at multi-month lows, is feeling the total weight of cascading liquidations, robust sell-side quantity, and evaporating investor confidence.

Associated Studying

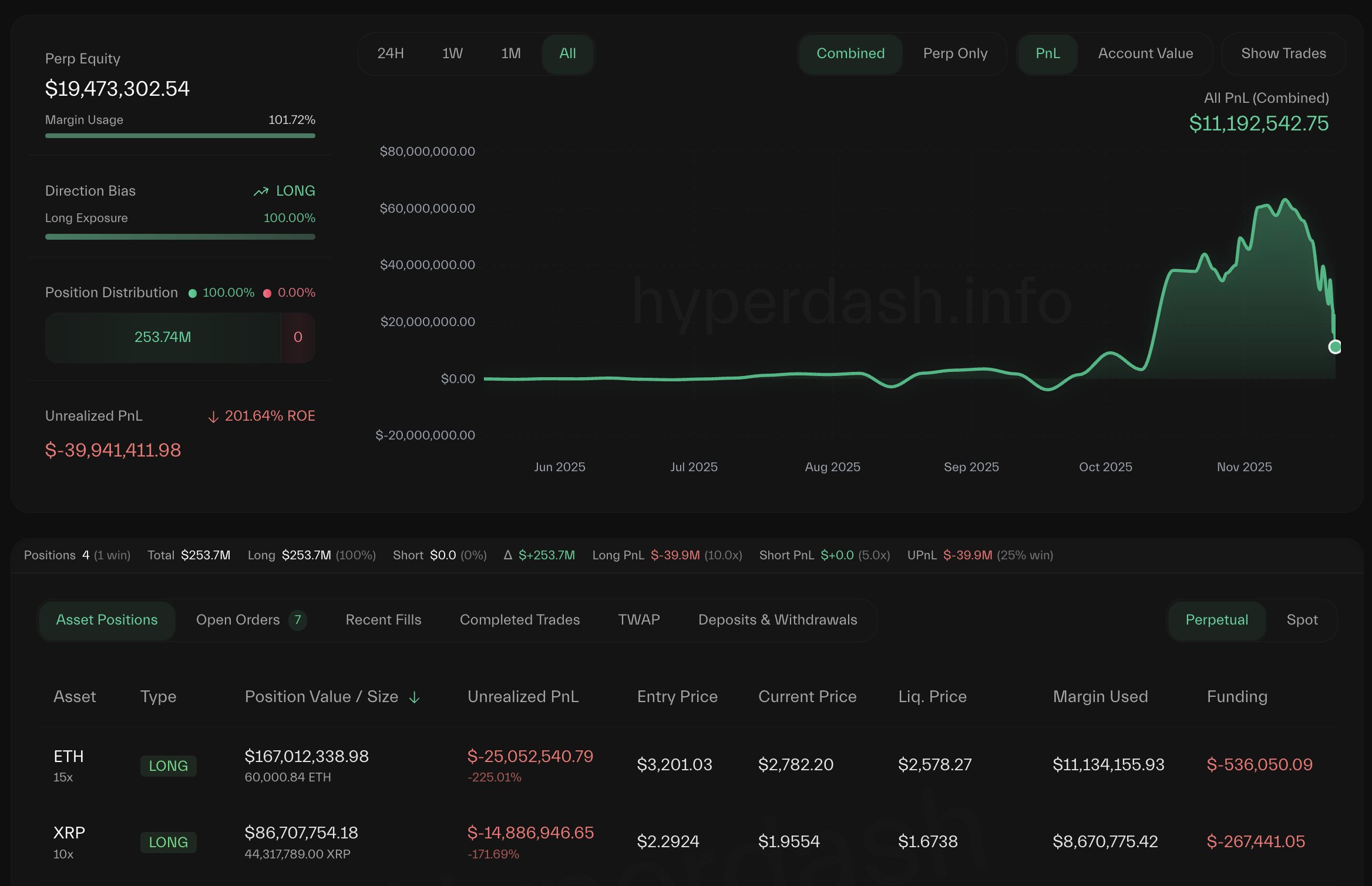

Including to the rising uncertainty, Lookonchain experiences a putting improvement: in simply 10 days, greater than $61 million in revenue has disappeared for a widely known market participant sometimes called the Anti-CZ Whale.

This dealer beforehand gained consideration for aggressively opening shorts instantly after CZ bought ASTER — a transfer that paid off handsomely till the latest violent downturn reversed his fortunes.

The Anti-CZ Whale’s Unrealized Revenue Collapse Provides Strain

In line with Lookonchain, the dealer referred to as the Anti-CZ Whale has taken an enormous hit in the course of the newest market downturn — and Ethereum sits on the middle of the injury. Simply 10 days in the past, this whale had accumulated practically $100 million in whole revenue on Hyperliquid, largely fueled by aggressive positions constructed in periods of excessive volatility.

Nonetheless, because the crypto market sharply corrected, his outsized ETH and XRP longs turned towards him. The end result has been a brutal drawdown: his whole revenue has now fallen to simply $38.4 million, wiping out greater than 60% of beneficial properties in lower than two weeks.

This dramatic reversal displays a couple of dealer’s misfortune — it alerts the extent of the stress weighing on Ethereum. As ETH continues to say no and investor sentiment deteriorates, even probably the most seasoned actors are struggling to navigate the volatility. The whale’s speedy revenue erosion highlights how shortly bullish conviction can shift when key help ranges fail.

For Ethereum, holding the present zone is essential. Worth motion has already inflicted vital ache throughout longs, short-term holders, and leveraged gamers. If ETH loses this help decisively, the following wave of pressured promoting may deepen losses and speed up the broader market capitulation.

Associated Studying

ETH Worth Evaluation: Testing a Main Weekly Help Zone

Ethereum has entered a important part on the weekly timeframe, with value pulling again sharply towards the $2,680 area — a stage that now acts because the final significant help earlier than a deeper market breakdown. The chart reveals a powerful rejection from the $4,500 zone earlier this quarter, adopted by a sustained collection of decrease highs and decrease lows, confirming a medium-term downtrend.

The 50-week shifting common has been misplaced decisively, and ETH is now sitting instantly on prime of the 100-week MA, a stage that has traditionally acted as a key pivot throughout main market corrections.

Quantity has expanded in the course of the latest drop, highlighting an setting pushed by concern and compelled promoting quite than managed profit-taking. This aligns with broader market situations, the place liquidity is skinny and volatility stays elevated throughout majors. A clear break beneath $2,650 would open the door for a retest of the $2,300–$2,400 zone, which served as robust accumulation throughout earlier cycles.

Associated Studying

Nonetheless, the weekly chart additionally reveals that ETH is coming into a traditionally oversold space, just like mid-2022 and late-2023, the place reversals finally fashioned after weeks of compression. For now, Ethereum should maintain above this weekly help to keep away from a deeper retrace and protect the construction wanted for a possible restoration.

Featured picture from ChatGPT, chart from TradingView.com