The crypto market is buzzing after the launch of the primary U.S. spot XRP ETFs, a improvement that has injected recent institutional power into the asset.

Associated Studying: Famous Trader Bets $27 Million That The XRP Price Will Crash

With a number of high-performing corporations getting into the race, together with Canary Capital, Franklin Templeton, and Grayscale, a daring query is resurfacing throughout the business: Can XRP realistically problem Ethereum for the No. 2 spot within the international cryptocurrency rankings?

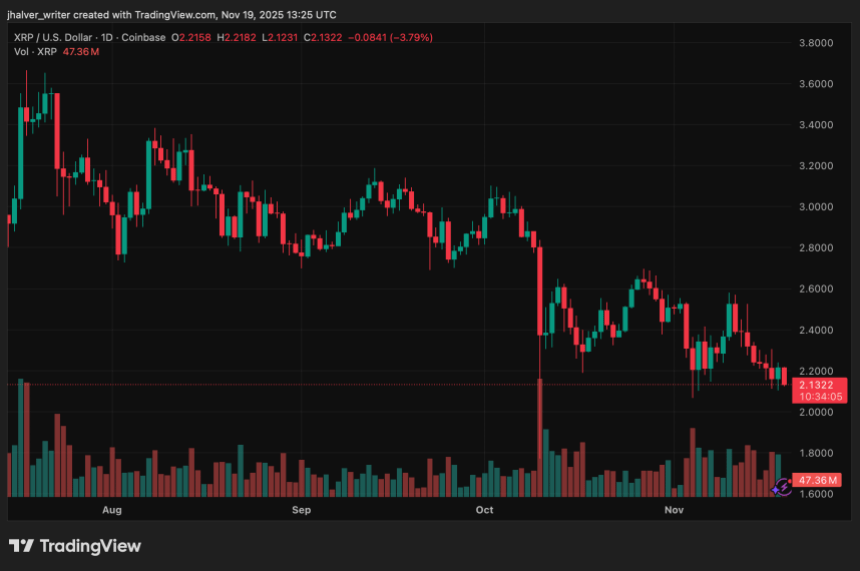

XRP's value traits to the draw back on the every day chart. Supply: XRPUSD on Tradingview

XRP ETFs Ignite Institutional Momentum

The launch of XRP ETFs in November 2025 marked a historic second for the asset. Canary Capital’s XRPC debuted with over $58 million in first-day quantity, the strongest ETF opening amongst lots of launched this 12 months.

Franklin Templeton has now filed its Kind 8-A to checklist the Franklin XRP ETF on NYSE Arca, signaling that one other main participant is simply days away from going stay.

This inflow of institutional curiosity mirrors the early phases of Bitcoin and Ethereum ETF rollouts, characterised by short-term volatility adopted by broader adoption.

Although XRP’s value consolidated across the $2.12–$2.17 zone after the preliminary spike, analysts argue that ETF inflows function with settlement lags by means of OTC desks. In different phrases, the precise impression on market value might not be realized till later.

Can XRP Really Compete With Ethereum’s Dominance?

Regardless of XRP’s explosive 12 months, marked by document utility, rising XRPL adoption, and Ripple’s $500 million strategic funding, the asset nonetheless faces a steep climb if it hopes to overhaul Ethereum.

Ethereum stays firmly in second place with a $373 billion market cap, supported by an enormous ecosystem of decentralized purposes, good contracts, and tokenized property. XRP, at present round $129 billion, operates on a community optimized for funds moderately than programmable purposes.

Analysts word that whereas XRP’s institutional use circumstances are deepening, notably in cross-border settlement, tokenization, and banking infrastructure, the shortage of a local smart-contract layer limits its means to reflect Ethereum’s developer-driven demand.

For now, consultants say that overtaking Ethereum is unlikely within the quick to medium time period. However with increasing utility, ETF-driven accumulation, and rising adoption in Japan, the U.S., and international banks, XRP’s market cap may nonetheless climb considerably.

Worth Outlook: Volatility Now, Greater Strikes Later

From a technical standpoint, XRP is sitting at a important assist zone close to $2.12, repeatedly testing the 0.382 Fibonacci stage. Promoting stress stays current, with capital outflows and decrease highs on the chart. But open curiosity has surged from $1 billion to over $6 billion since October, signaling sturdy dealer engagement.

Associated Studying: Analyst Says You’re Looking At XRP The Wrong Way, Here’s What It Actually Does

Lengthy-term forecasts from analysts stay optimistic, with some projecting attainable runs towards $6–$25 if ETF inflows intensify and liquidity tightens. As November and December usher in a number of ETF listings, XRP’s subsequent main transfer will doubtless be formed by how rapidly institutional allocations scale.

Cowl picture from ChatGPT, XRPUSD chart from Tradingview