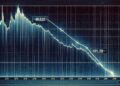

Whereas Bitcoin (BTC) continues to lose essential help ranges, an analyst has shared three potential situations for the flagship crypto’s upcoming efficiency, elevating the alarm about potential early indicators of a bear market.

Associated Studying

Bitcoin Value Correction Continues

On Monday, Bitcoin reached a brand new multi-month low after dropping beneath $93,000 for the primary time since Could. The cryptocurrency began the week dropping practically 5% from the $96,000 space and retesting the $91,000 degree as help.

Notably, BTC has seen a 16% correction from its November opening and has misplaced a number of essential ranges over the previous few weeks, together with the $100,000 psychological barrier and the 21-Week Exponential Shifting Common (EMA) as support.

Most lately, the flagship cryptocurrency closed the week beneath the 50-week EMA, which has raised the alarm for a number of market observers.

Analyst Rekt Capital noted that dropping this indicator is “not one thing we sometimes wish to see if bullish Market Construction is to stay intact,” including that “bear markets have a tendency to substantiate when worth loses the important thing bullish ranges which have supported upside momentum throughout the cycle.”

He defined that Bitcoin has shaped clusters of decrease lows on the 50-Week EMA throughout the cycle, which have “helped maintain a broader bullish technical uptrend.” Nevertheless, BTC is at the moment forming one other cluster below this indicator, as an alternative of approaching the potential macro decrease excessive growing above the 50-Week EMA.

In consequence, BTC’s current efficiency indicators step one of a possible breakdown, the analyst warned:

A full breakdown unfolds in three elements: first, a Weekly Shut beneath the important thing degree; second, a post-breakdown aid rally that turns that degree into new resistance; and third, draw back continuation that completes the bearish affirmation.

Early Indicators Of A Bearish Development?

Rekt Capital careworn that the 50-week EMA can be essential in figuring out whether or not BTC’s bullish pattern and tendency for “benign draw back deviations” nonetheless maintain.

He emphasised that if the flagship crypto fails to reclaim this indicator as help and it turns right into a resistance, it may very well be transitioning from its draw back deviation tendency to the early levels of a confirmed bearish pattern.

The analyst detailed that in the course of the early bear markets, “a Weekly Shut beneath the 50-Week EMA is adopted by a number of weeks of post-breakdown aid rallies into that transferring common, however these makes an attempt in the end fail, and the EMA merely acts as resistance till draw back acceleration unfolds.”

Based mostly on this, he shared three potential outlooks for BTC’s efficiency. The perfect-case state of affairs for Bitcoin could be reclaiming this indicator and efficiently ending this correction as a draw back deviation, as it might counsel that BTC stays in a bull market.

The second-best case scenario could be that Bitcoin sees a multi-week hesitation interval beneath the EMA because it enters the bear market, which may embrace a short overextension above this degree earlier than a clearer pattern decision to the draw back.

Associated Studying

In the meantime, the worst-case state of affairs would see the cryptocurrency’s worth unable to retest the 50-Week EMA, whilst resistance, and straight enter the draw back acceleration part.

Nonetheless, the analyst famous that, traditionally, the third state of affairs doesn’t seem as doubtless if we’ve already entered a bear market. As a substitute, he concluded that the recurring “relief-rally state of affairs” into the 50-week EMA earlier than draw back continuation appears extra doubtless.

Featured Picture from Unsplash.com, Chart from TradingView.com