Key Notes

- Ethereum ETFs recorded $728.3 million in internet outflows this week as market sentiment deteriorated sharply.

- BitMine, the world’s largest ETH treasury holder, appointed Chi Tsang as CEO alongside three new unbiased administrators.

- Technical indicators present ETH faces steep resistance, with reclaiming the 50-day transferring common turning into more and more unlikely within the close to time period.

BitMine Immersion Applied sciences, the world’s largest Ethereum treasury firm controlling greater than 2.9% of the community’s provide, introduced new management on Friday.

The corporate appointed Chi Tsang as its new Chief Government Officer, succeeding Jonathan Bates, whereas concurrently including three unbiased administrators, Robert Sechan, Olivia Howe, and Jason Edgeworth, to its board.

🧵

BitMine is happy to announce administration and Board appointments:– new CEO, Chi Tsang

3 unbiased board members:

– Rob Sechan @RobSechan , CEO of @NewEdgeWealth

– Jason Edgeworth, CIO of JPD Holdings

– Olivia Howe, Chief Authorized Officer of RigUpCollectively, these additions…

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 14, 2025

The reshuffle marks one in all BitMine’s most vital updates since its NYSE itemizing and comes because the agency pushes towards its strategic goal of acquiring 5% of the overall ETH provide.

In its official announcement on Friday, BitMine emphasised that the brand new government staff brings a mixed depth of expertise throughout know-how, DeFi, banking, and authorized experience. Chairman Tom Lee stated the transition was important to place BitMine because the institutional bridge between Ethereum and conventional capital markets, likening the continued crypto increase to the telecom and web revolution of the Nineteen Nineties.

New CEO Chi Tsang echoed this sentiment, calling the funding technique a generational alternative.

Outgoing CEO Jonathan Bates additionally lauded the corporate’s rise from a small startup to the world’s largest company holder of ETH, expressing confidence within the incoming staff’s skill to scale BitMine’s imaginative and prescient.

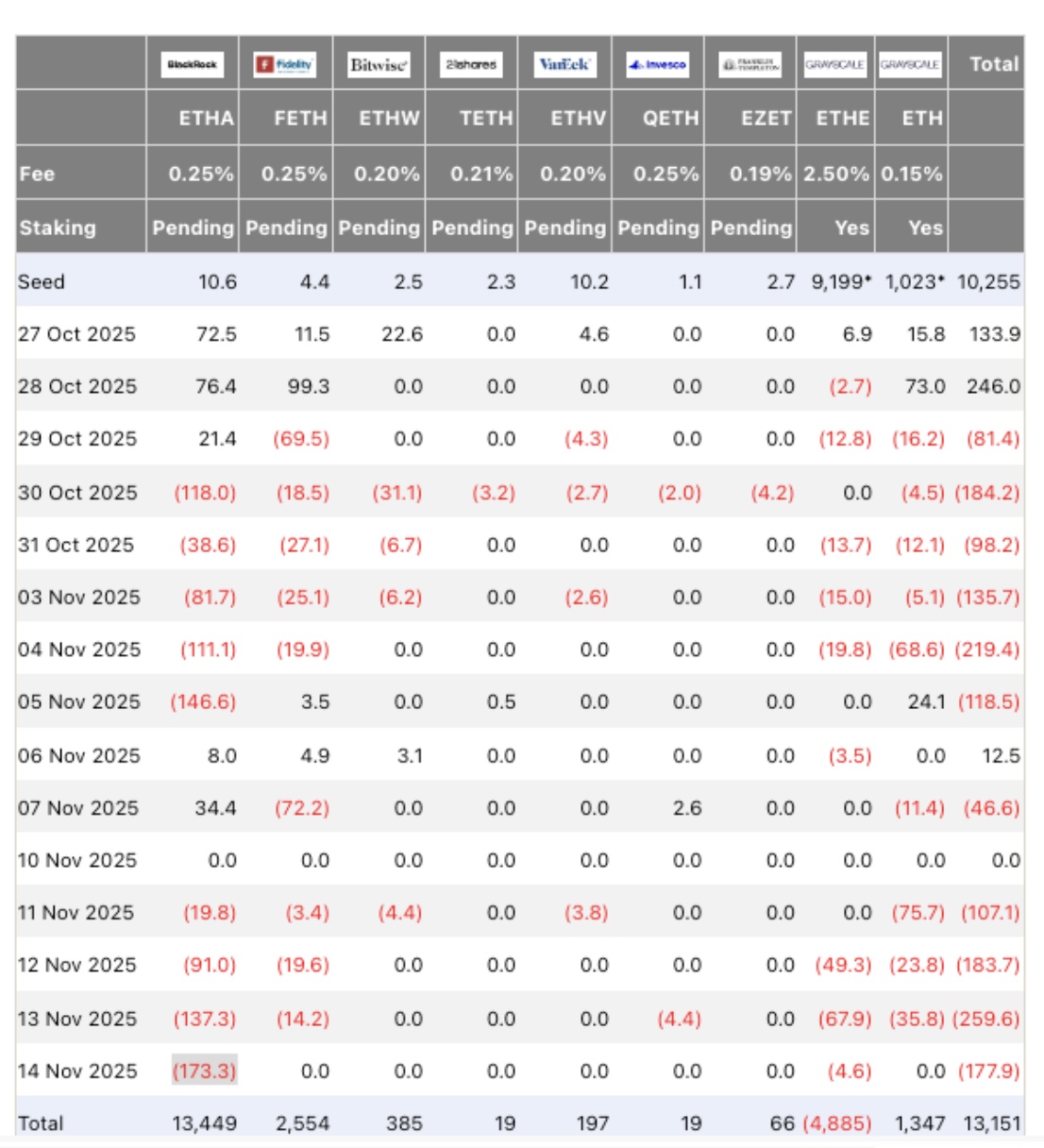

Ethereum ETF Flows, Saturday, Nov 15, 2025 | Supply: FarsideInvestors

The appointments arrive after a bruising week for ETH-linked funds. FarsideInvestors information exhibits U.S. Ethereum ETFs posted $728.3 million in internet outflows over 4 buying and selling days following the Monday market vacation. BlackRock’s Ethereum ETF registered a single-day withdrawal of $173.3 million on Friday, the most important for the month.

ETH fell 5% intraday, hovering simply above $3,200 as merchants reacted to a different session of heavy ETF withdrawals flooding the market. Bitmine’s current 3,505,723 ETH haul, now accounts for two.9% of whole circulation provide and is valued at $11.2 billion at present costs.

Ethereum Worth Forecast: Can ETH Maintain $3,200 as Momentum Weakens Into December?

Ethereum’s worth motion has deteriorated as ETF outflows coincided with technical rejection close to key transferring averages. On the day by day chart, ETH worth has plunged beneath the 50-day and 100-day transferring averages, and is now making an attempt to stabilize alongside the 200-day line close to $3,200.

Persistent ETF sell-offs after the failure to reclaim the 50-day common close to $3,912 earlier within the month have weakened Ethereum rebound prospects.

Ethereum (ETH) Worth Forecast | TradingView

The Breakout likelihood ratio exhibits successive days of heavy sell-offs flooding the market up to now week. ETH worth now has a 29% of reclaiming the $3,250 mark, favoring a 54% likelihood of a retrace to $3,000. The gap from present costs to the 50-day MA implies that patrons would wish a robust catalyst and quantity surge to provoke a clear breakout.

In the meantime, Ethereum’s RSI stays depressed at 36, hovering simply above oversold circumstances with no clear bullish divergence. The RSI’s failure to rise sustainably above 40 suggests weak demand and ongoing vulnerability to additional retracement. In the meantime, the BBP indicator exhibits persistent adverse readings, reflecting contracting buy-side strain and subdued volatility growth that often accompanies development reversals.

A breakdown beneath the 200-day common may expose ETH to $3,050 and probably $2,850, ranges the place stronger historic bid clusters exist.

Conversely, if ETF outflows stabilize and ETH holds the $3,200 assist convincingly, a restoration towards $3,450 is feasible; nonetheless, reclaiming the 50-day MA stays a low-probability end result except institutional flows shift optimistic.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.