On-chain knowledge exhibits Ethereum buyers with a holding time better than three years have ramped up their promoting to ranges not seen since 2021.

Seasoned Ethereum Holders Are Growing Their Distribution

As defined by on-chain analytics agency Glassnode in a brand new post on X, the three to 10 years previous Ethereum holders have notably raised their spending not too long ago. These buyers belong to a broader group generally known as the long-term holder (LTH) cohort, which has a holding time cutoff of 155 days.

Statistically, the longer an investor holds onto their cash, the much less doubtless they turn into to promote them at any level. As such, the LTHs as a complete might be thought of diamond arms.

Because the 3 to 10 years previous ETH buyers can be previous even by the usual of the LTHs, they might be assumed to incorporate essentially the most stalwart of HODLers. Given this stature of the cohort, the habits of its buyers could also be value maintaining a tally of, for promoting from them might be an indication that market circumstances have compelled even essentially the most seasoned arms into exiting.

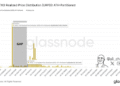

One solution to monitor the habits of the group is thru the Spent Quantity by Age indicator, which tracks the transactions that the assorted investor age bands are making on the blockchain. Under is the chart for the metric shared by Glassnode that exhibits the pattern in its 90-day shifting common (MA) for Ethereum over the previous couple of years.

The worth of the metric seems to have shot up in latest months | Supply: Glassnode on X

As displayed within the graph, the Spent Quantity by Age has shot up for the buyers belonging within the 3 to 10 years holding time bracket since late-August. At current, the 90-day MA is sitting above 45,000 ETH, which means the veterans of the market are promoting tokens value $139 million day-after-day.

“This marks the best spending degree by seasoned buyers since Feb 2021,” famous the analytics agency. In addition to the selloff in February, this group additionally participated in nearly the identical degree of distribution alongside the bull run high within the second half of that yr.

As the newest wave of promoting has arrived, Ethereum has witnessed bearish momentum. It solely stays to be seen whether or not this decline within the value would lead into one other bear market like in late 2021, or if the bull run will regain its footing as in February 2021.

LTH promoting isn’t the one bearish issue that ETH has needed to take care of not too long ago. Because the chart shared by CryptoQuant group analyst Maartunn exhibits, the Ethereum spot exchange-traded funds (ETFs) have witnessed important outflows over the previous month.

The pattern within the spot ETF netflows for Ethereum and Bitcoin | Supply: @JA_Maartun on X

From the above chart, it’s obvious that Ethereum spot ETFs are seeing a damaging 30-day netflow of $1.21 billion, whereas Bitcoin has had it even worse with $2.80 billion in internet outflows.

ETH Worth

On the time of writing, Ethereum is buying and selling round $3,100, down over 4% within the final week.

Appears to be like like the worth of the coin has plunged throughout the previous day | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.