Key Takeaways

Why is Ethereum displaying resilience this quarter?

Ethereum short-term holders stay in a excessive revenue zone, and good cash is shopping for the dip, giving ETH a conviction-driven benefit.

How does Bitcoin’s weak spot have an effect on Ethereum?

BTC’s rising capitulation threat is popping right into a relative energy for ETH, positioning it as a safer asset amid broader market weak spot.

Zooming out, Ethereum [ETH] is struggling greater than Bitcoin [BTC] this month. With a 17.8% drop in November, ETH is posting a -23% This autumn ROI (virtually 1.5× behind Bitcoin), repeating a Q1-style divergence.

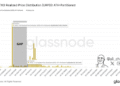

Trying on the larger image, ETH HODLers are taking heavier losses, with 40% of supply presently underwater. However zooming in tells a unique story. On the 14th of November, BTC fell to early-Could ranges with a 5.6% dip.

In the meantime, Ethereum stays almost 73% above its $1,793 value foundation from Could. Put merely, whereas BTC HODLers are displaying indicators of weak spot, ETH short-term holders (STHs) are nonetheless sitting on a wholesome revenue buffer.

In a risk-off market, this divergence marks a key inflection level.

In contrast with Bitcoin, Ethereum is displaying a stronger incentive to HODL, which suggests its capitulation threat is decrease. In reality, only a 0.25% transfer from ETH’s $3,160 spot worth would push a key cohort again into profitability.

For context, 4.09% of ETH’s provide has a realized worth of $3,168. Reclaiming this stage would put roughly 3 million ETH again within the cash. In brief, might STH conviction in ETH change into a key catalyst this cycle?

Ethereum holds robust as Bitcoin capitulation looms

Bitcoin is displaying clear capitulation alerts.

With a 5.2% dip to $94k, BTC’s Net Realized Profit/Loss flipped to pink, highlighting $1.3 billion in web losses (its largest loss-led realized worth since April). In the meantime, ETH managed to restrict its losses to $325 million.

Merely put, Bitcoin is dealing with considerably greater promoting strain, whereas Ethereum stays comparatively resilient, with STHs (holding >155 days) holding onto income, giving ETH a conviction-based benefit.

In brief, BTC’s capitulation threat is popping into ETH’s main benefit.

Furthermore, this isn’t only a rundown. Tom Lee is actively shopping for the “dip.” Arkham Intelligence just lately flagged a pockets withdrawing $29.7 million ETH, which matches prior acquisition patterns seen from Bitmine.

All in all, Ethereum’s This autumn tailwind hasn’t flipped bearish but.

On condition that ETH STHs are sitting in a “comparatively” excessive revenue zone, and with good cash shopping for the dip, Ethereum might certainly place itself as a conviction-driven haven amid broader Bitcoin weak spot.