Bitcoin dropped to $96,000 on heavy promoting Friday, and falling danger urge for food, leaving merchants and analysts parsing whether or not that is regular profit-taking or a bigger turning level for the market.

Associated Studying

In accordance with on-chain and market experiences, the drop worn out greater than $700 million in lengthy positions and left November down by greater than 10%.

Whale Transfers Draw Focus

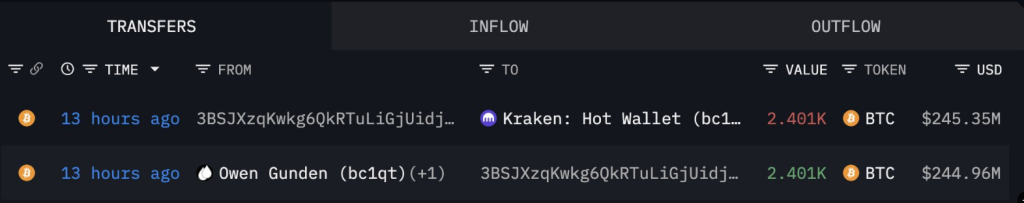

Experiences have disclosed {that a} pockets tied to dealer Owen Gunden moved 2,400 Bitcoin — about $237 million — onto the Kraken alternate, a switch tracked by blockchain watcher Arkham.

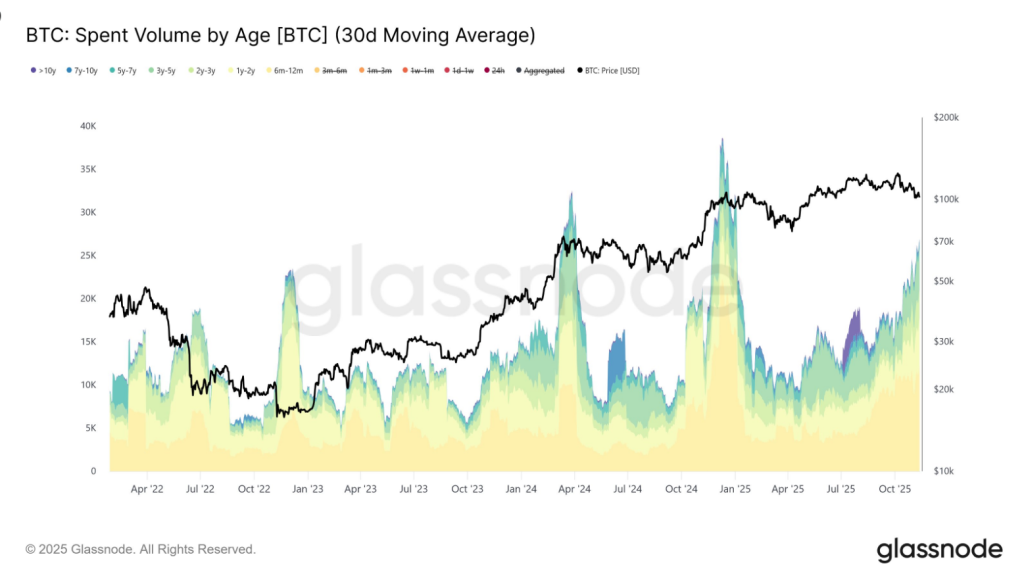

Based mostly on evaluation by Glassnode, long-term holders’ common day by day spending rose from over 12,000 BTC per day in early July to roughly 26,000 BTC per day as of this week.

OWEN GUNDEN JUST SOLD ANOTHER $290M BTC

Owen Gunden simply moved the entire remaining BTC out of his accounts. He deposited over HALF of his holdings instantly into Kraken, depositing a complete of $290.7M of BTC into Kraken.

He now has solely $250M of Bitcoin remaining. pic.twitter.com/ZUB3aToAgH

— Arkham (@arkham) November 13, 2025

That sample, Glassnode analysts say, appears like orderly distribution by older holders relatively than a sudden mass exit. It’s being framed as late-cycle profit-taking: common, regular, and unfold out.

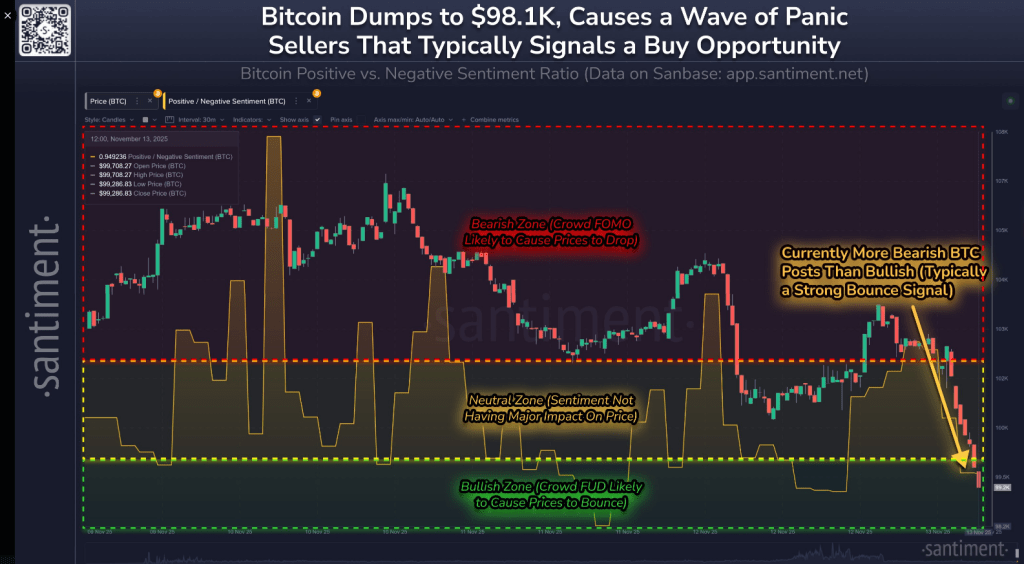

In accordance with Santiment, Bitcoin has fallen under $100K for the second time this month, triggering a burst of worry and anxious posts from retail merchants.

📉 Bitcoin has dumped under $100K for the second time this month. Predictably, this has induced a wave of FUD and anxious social media posts from retail merchants. As proven under:

🟥: Vital bullish/grasping bias (normally when markets are getting an excessive amount of FOMO, costs will go… pic.twitter.com/rowUv3xIMd

— Santiment (@santimentfeed) November 13, 2025

No Meltdown: Late-Cycle Indicators And On-Chain Readings

Vincent Liu, CIO at Kronos Analysis, disclosed that structured promoting and regular rotation of features typically present up in late-cycle phases.

He cautioned that this section doesn’t robotically sign a ultimate peak, offered there are nonetheless consumers prepared to absorb the additional provide.

Being in a late cycle doesn’t imply the market has hit a ceiling, he identified. It simply reveals momentum has eased, and larger forces like macro tendencies and liquidity at the moment are in management, he mentioned.

“Fee-cut doubts and up to date market weak point have slowed the climb, not ended it,” Liu mentioned. In different phrases, there’s no meltdown or something prefer it.

On-chain indicators are being watched intently; Bitcoin’s web unrealized revenue ratio stood close to 0.476, a stage some merchants interpret as hinting at short-term lows forming.

That studying is just one of a number of alerts, Liu added, and should be tracked alongside liquidity and macro situations.

A more in-depth take a look at the month-to-month common spending by long-term holders reveals a transparent development: outflows have climbed from roughly 12.5k BTC/day in early July to 26.5k BTC/day at this time (30D-SMA).

This regular rise displays rising distribution stress from older investor cohorts — a… pic.twitter.com/wECe58CV66— glassnode (@glassnode) November 13, 2025

Market Ache Got here From Shares And Charges

The cryptocurrency sell-off got here as crypto-related shares plunged. Broader markets had been weak as nicely, with the Nasdaq down 2% and the S&P 500 off 1.3%.

Cipher Mining fell 14%, Riot Platforms and Hut 8 dropped 13%, whereas MARA Holdings and Bitmine Immersion slid over 10%. Coinbase and Technique had been down about 7%.

Based mostly on experiences, giant institutional flows have pressured costs. Companies together with BlackRock, Binance and Wintermute reportedly bought greater than $1 billion in Bitcoin, a wave of promoting that produced a fast 5% drop inside minutes.

In the meantime, social sentiment turned sharply unfavourable, and the Crypto Concern & Greed Index hit 15, reflecting “extreme fear” amongst merchants.

Featured picture from Unsplash, chart from TradingView