In keeping with an analyst, Bitcoin sits in a liquidity set-up that has proven up earlier than large rallies. Costs aren’t taking pictures larger but. At press time Bitcoin trades round $104,500, down 0.5% over the previous day.

Associated Studying

Merchants watched a decline of about 1.8% earlier that pushed the worth close to $103,400 and it briefly touched $102,850 throughout the transfer.

Stablecoin Sign Factors Towards Accumulation

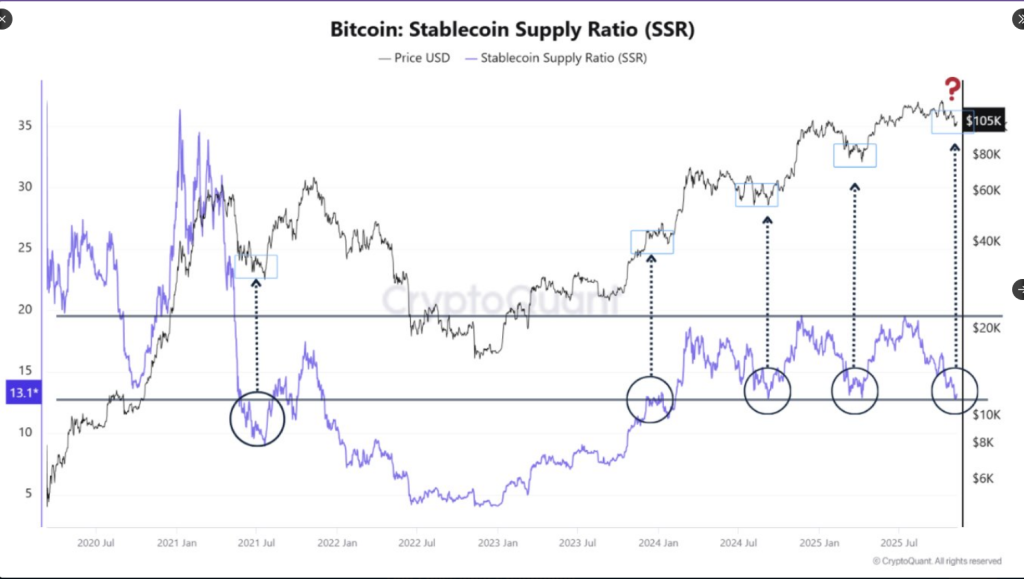

CryptoQuant analyst Moreno factors to the Stablecoin Supply Ratio, or SSR, as the primary clear indicator. The SSR compares Bitcoin’s market cap to the entire market cap of stablecoins. It has dropped again into the 13 vary.

Primarily based on historic readings, that 13 space has lined up with market lows in mid-2021 and at a number of moments throughout 2024. Stories present that when SSR fell to related ranges, liquidity quietly constructed up and shopping for adopted after a interval of low volatility.

Liquidity Sample Has Appeared Earlier than Each Bitcoin Surge — And It’s Again

“We’re witnessing a liquidity configuration that has solely appeared a handful of occasions since 2020, and every occasion marked a pivotal second for Bitcoin’s trajectory.” – By @MorenoDV_ pic.twitter.com/vWKcCkyn55

— CryptoQuant.com (@cryptoquant_com) November 11, 2025

Binance Reserve Traits Add A Second Layer

The second metric Moreno highlights comes from Binance. On that change, stablecoin balances are rising whereas Bitcoin reserves are shrinking. In plain phrases: extra cash-like tokens sit on the change and fewer cash are being held there.

That sample has appeared solely a handful of occasions since 2020, in line with the info he referenced. Every time, the motion advised capital ready on the sidelines and holders shifting cash off exchanges into longer-term storage.

Market Calm Can Disguise Massive Strikes

The present buying and selling backdrop is cautious. Many traders anticipated a lift after information that the US Congress accepted short-term federal funding via January 30, but crypto didn’t rally with different danger belongings.

Some capital rotated again to shares. On the identical time, massive holders took earnings after current highs, and momentum cooled. That blend reveals how macro occasions can shift flows with out instantly turning into crypto shopping for.

Threat Nonetheless Exists — Construction May Break

Moreno warns this liquidity zone acts like a remaining structural help. If the metrics break down decisively, it might sign a deeper reset earlier than any sustained restoration.

In that state of affairs, shopping for would probably be delayed and volatility would rise. This isn’t a assured consequence, however it’s a clear danger that merchants watch intently.

Outlook: Restricted Draw back, Rising Upside

Primarily based on experiences and on-chain indicators, Moreno believes the risk-to-reward favors consumers at these ranges. He factors to the built-up stablecoin provide and falling change BTC reserves as causes for that view.

Associated Studying

Historic patterns recommend the final three months of the yr usually convey good points for Bitcoin, however previous conduct doesn’t promise future returns.

For now, the indications present capital parked in stablecoins and fewer cash out there on main exchanges. That creates a setup the place recent shopping for might push the market larger rapidly if sentiment turns.

But the alternative is feasible: a break under these ranges would reshape the cycle and pressure many contributors to rethink positions. Markets will determine which path comes subsequent.

Featured picture from Gemini, chart from TradingView