Bitcoin’s current wobble has break up analysts. Some warn of a deep pullback whereas onchain trackers level to a light correction that might already be ending.

Associated Studying

Conventional Evaluation Exhibits Danger

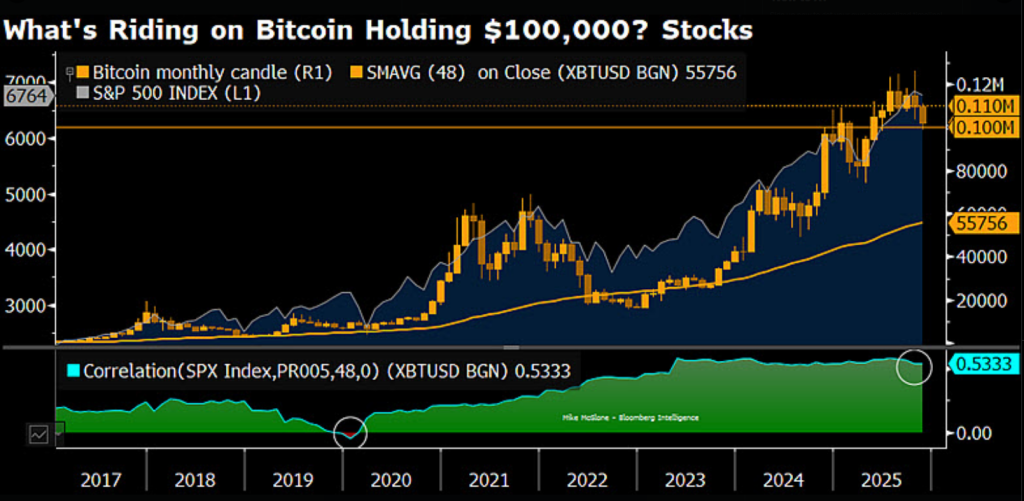

In response to Bloomberg analyst Mike McGlone’s publish on X, the transfer beneath $100,000 might not be completed. He referred to as a fall from current highs a doable “Speed Bump Towards $56,000,” and mentioned that previous rallies usually reverted towards the 48-month shifting common, now close to $56,000.

That view implies the potential for a pointy drop — nearly 50% from current peaks — if the present downtrend retains going. Quick, stark statements from established market commentators have pushed concern amongst some buyers.

Onchain Alerts Level To A Milder Decline

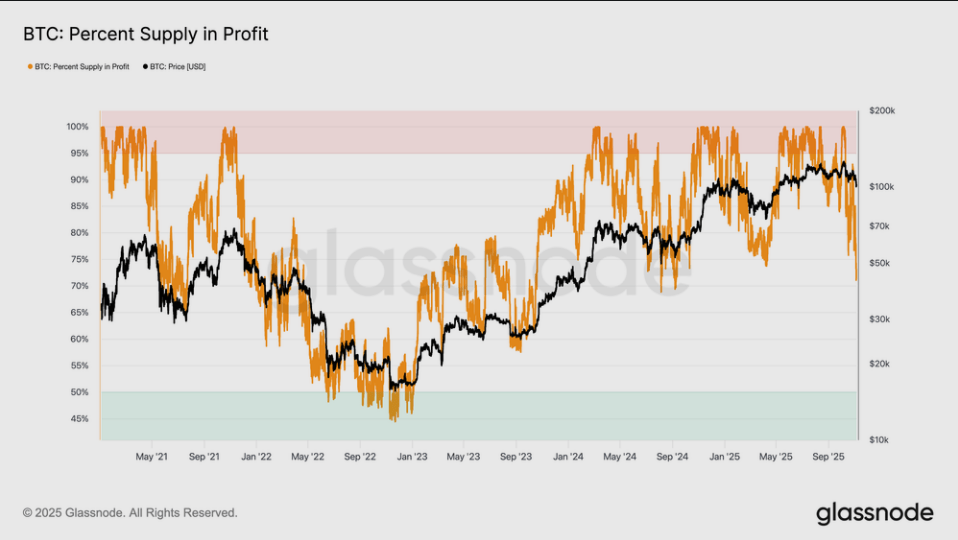

Studies have disclosed knowledge from Glassnode and XWIN Analysis Japan that paint a unique image. Bitcoin slipped to $99,000 on Nov. 4, the primary time in over 4 months it fell beneath the $100,000 mark, but it surely later recovered to round $101,500, based on Coingecko.

$100,000 Bitcoin – a Velocity Bump Towards $56,000?

“Have a look at the chart” has been a mantra from Bitcoin bulls, however the market gods can refresh humility when costs stretch too far. Synonymous with humility is imply reversion, and my have a look at the chart exhibits how regular it’s been for the… pic.twitter.com/ijzJ8L4SjT— Mike McGlone (@mikemcglone11) November 6, 2025

Onchain measures such because the Market Worth to Realized Worth, or MVRV, have dropped to ranges that previously marked native lows. Glassnode highlighted the Relative Unrealized Loss metric, which at the moment sits at 3.1%.

Readings at this degree have traditionally matched mid-cycle corrections reasonably than full-blown bear markets. The agency famous losses beneath a 5% threshold have tended to be orderly revaluations, not panic-driven sell-offs.

Bitcoin: Lengthy-Time period Forecasts Are Being Recalibrated

Based mostly on experiences from ARK Make investments, Cathie Wooden trimmed her long-term Bitcoin projection by $300,000. She had earlier predicted a $1.5 million high by 2030; the lower implies a brand new peak goal round $1.2 million.

Wooden mentioned competitors from stablecoins in rising markets is lowering some demand for Bitcoin as a retailer of worth. The transfer exhibits that even long-term bulls are adjusting assumptions because the market shifts.

Associated Studying

Market sentiment is being examined by numbers and by narrative. Quick-term worth swings have been giant, however some key onchain indicators stay inside ranges that haven’t signaled excessive stress.

On the similar time, notable analysts and enterprise leaders proceed to warn of a lot deeper retracements. Buyers are left to weigh technical patterns, blockchain metrics, and evolving views on demand drivers like stablecoins.

Featured picture from Gemini, chart from TradingView