Bitcoin edged larger on Sunday as indicators of easing US-China commerce tensions lifted danger belongings, whereas Technique’s founder hinted the corporate stored including to its Bitcoin holdings.

Associated Studying

Technique Retains Shopping for

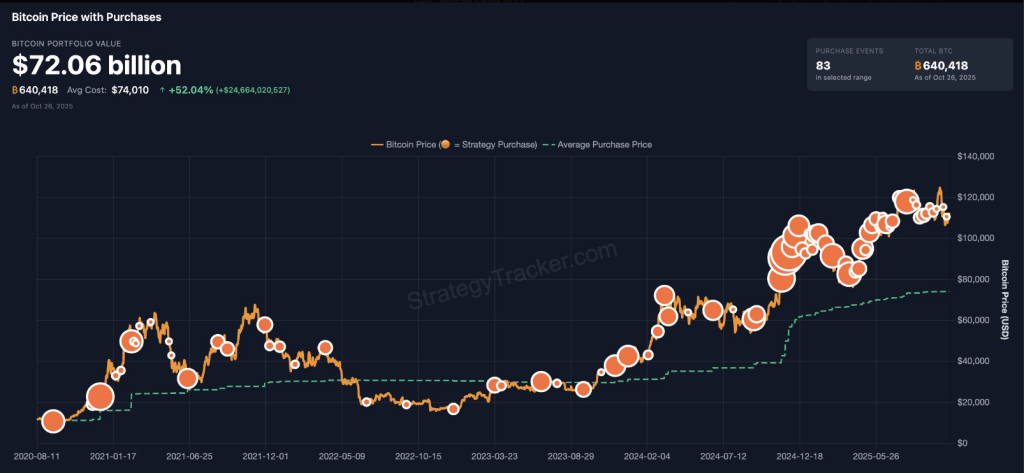

Michael Saylor posted a chart on October 26 that makes use of orange dots to mark latest purchases. The visible cue has turn into his shorthand for brand spanking new buys.

Primarily based on experiences, Technique added 387 BTC between October 13 and October 20, bringing its whole to 640,418 BTC. That quantity is placing by itself. It exhibits a gentle, deliberate strategy to purchasing even when costs are unstable.

Technique’s disclosed common price for its Bitcoin stands at $74,010. The corporate’s strikes these days have been small in contrast with September, when it took in additional than 7,000 BTC throughout a number of massive transactions. The scale of any contemporary purchases this week has not been publicly revealed.

On the identical time, Bitcoin’s market strikes have been influenced by broader information. The worth of Bitcoin rose about 1.6% on Sunday, whereas Ethereum gained roughly 2.8%. Quick-term swings seem pushed extra by headlines than by a single firm’s actions.

It’s Orange Dot Day. pic.twitter.com/5FSGmxwoNS

— Michael Saylor (@saylor) October 26, 2025

Holdings, Valuation And Observe File

Primarily based on experiences, at costs just a little over $115,000 per BTC, Technique’s Bitcoin stash is valued at round $72 billion. That valuation implies a paper acquire of greater than $25 billion over a complete price foundation of about $47.4 billion for the reason that program started in 2020.

Experiences have logged 83 separate buy occasions in that point, a sample that has left buyers with a transparent view of the agency’s playbook: purchase repeatedly and report afterward.

Among the shopping for was concentrated in September, when the agency added hundreds of cash in just a few massive strikes. Lately, nonetheless, allocations have regarded smaller and extra frequent. That shift suggests a choice for regular accumulation moderately than single large bets.

Shopping for Habits And Market Response

Technique shares have been buying and selling above the corporate’s internet asset worth. That reality suggests buyers are snug proudly owning MSTR as a approach to acquire Bitcoin publicity with out shopping for the token straight. The corporate’s technique — announce purchases after the actual fact and let the market mirror the holdings — has been constant and predictable.

Associated Studying

Geopolitical Headlines Drive Volatility

In the meantime, officers from the US and China signaled progress in trade talks, and that helped calm some buyers. In accordance with experiences, Scott Bessent advised CBS Information he anticipated the specter of 100% tariffs and a direct export management regime to have receded.

Earlier in October, China introduced tighter limits on uncommon earth exports utilized in chip manufacturing. On October 11, US President Donald Trump stated he would impose a further 100% tariff on Chinese language items and deliberate export controls on sure software program to take impact on November 1.

These days of sharp rhetoric brought on heavy losses throughout markets and triggered one of many largest liquidation occasions in crypto this 12 months.

Featured picture from Gemini, chart from TradingView